Hey Binance Square fam! Let’s dive into the action on AIN/USDT—AI Network’s breakout is catching serious attention. We’ll unpack what’s fueling the move, key levels, and how to play it smart 💡

---

🔥 Why AIN Is Popping Off

Fresh Perpetual Futures Launch: Binance rolled out AIN/USDT perpetuals at up to 50× leverage on July 11—this typically supercharges volatility and liquidity as traders chase momentum .

Massive One-Day Pump: AIN just surged ~40% in a single day, blasting toward new all-time highs—momentum is firmly in bullish territory .

---

📊 Real-Time Market Snapshot

Price & Volume: AIN is hovering near $0.14, with 24‑hour volume around $31M and market cap of about $26M—hinting at growing interest and healthy liquidity .

Technical Landscape: Investing.com technicals rate AIN a Strong Buy across hourly, daily, and weekly charts. Indicators like RSI (~74), MACD, and ADX show bullish alignment despite a hint of overbought on some scales .

---

🧭 What’s Fueling AIN’s Growth

1. Decentralized AI IDE Platform

AIN’s home platform offers a no‑code AI IDE and app store, enabling users to build DApps using natural language. This real‑world utility is gaining traction and differentiating AIN from other AI tokens .

2. Wider Exchange Listings

Soon after Binance launched futures, BitUnix also listed AIN/USDT in spot and futures—a sign of growing acceptance and global adoption .

3. On‑Chain Strength & Buzz

CoinGecko reports a 7‑day gain of around +18% and a bullish community sentiment—momentum is building across exchanges .

---

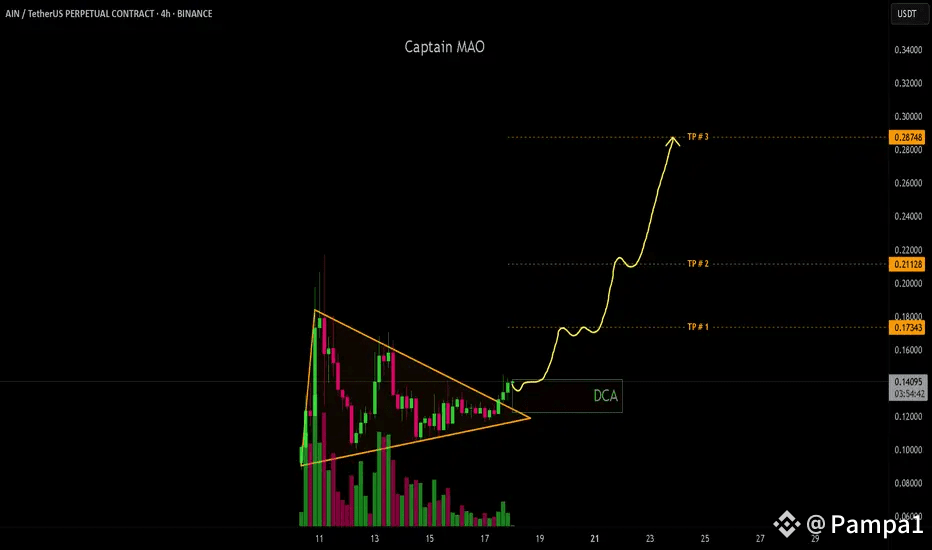

🎯 Key Levels & Trade Guide

Zone Why It Matters Trading Tip

$0.13–$0.135 Short-term dip/retouch zone after pump Strong entry point—watch for a bounce confirmation

$0.14–$0.145 Current breakout level If holds, set sights higher

$0.15–$0.16+ Next upside targets after breakout Book partial profits here if momentum continues

Below ~$0.125 Invalidates short-term bullish setup Consider stop-loss to protect capital

---

🛠 Smart Entry & Risk Plan

1. Confirm Support Test

Check for a bounce off $0.13–$0.135 with solid volume—this signals sustainable demand rather than a fakeout.

2. Scale In Layers

Add first chunk around $0.135

Add more if price revisits or breaks above $0.14

3. Take Profits Smartly

Exit part of your position near $0.15–$0.16

Trail your stop below recent swing lows or EMAs

4. Keep Stops Tight

Consider a stop-loss just below $0.125–$0.13, depending on your risk appetite

---

🧠 Broader Outlook

Short-Term: Pullback to retest levels could present ideal entries before continuation to $0.15+

Mid-Term: Continued news flow, DeFi integrations, and the futures market fueling participation could cap upside above $0.17–$0.18

Long-Term: If AIN’s agentic AI IDE gains traction and more spot/futures listings follow, $0.20+ becomes plausible—watch ecosystem news closely

---

✅ Final Take

AIN is flashing strong bullish vibes—big gains, futures-backed volume, and real-world utility driving the move. The current breakout zone around $0.13–$0.14 could be a sweet spot for entry. Just layer in carefully, protect your downside, and ride the wave if momentum holds 🌊

Want a deeper dive into AI tokens, futures setups, or altcoin picks? I’ve got more insights lined up—just give me a shout! 😊