1. Identify the trend

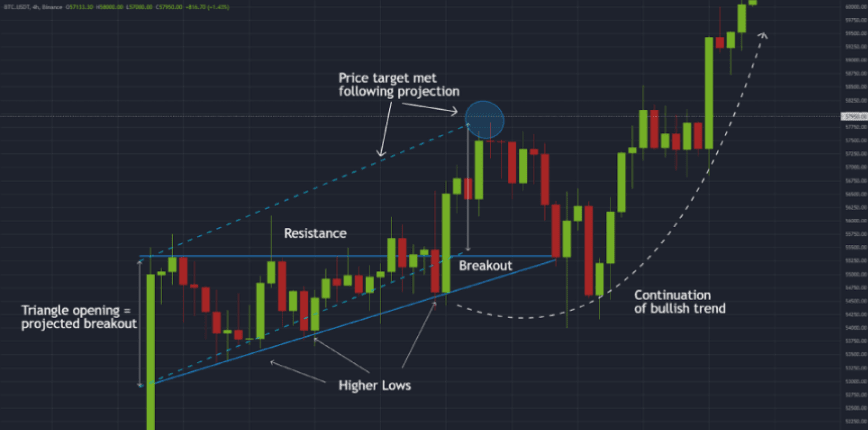

Use trend lines: connect at least two rising lows for an uptrend or two descending highs for a downtrend.

#Confirm with moving averages: for example, when the EMA 50 crosses above the EMA 200 in a 1-hour chart and the ADX is above 30, it indicates a strong upward trend.

2. **Wait for a pullback**

In an uptrend: when the price retraces to the trend line or moving average, it is the ideal time to enter long.

In a downtrend: look for bounces towards the line/EMA to enter short positions.

3. Risk management

Place the stop‑loss just below the last low (in an uptrend) or above the last high (in a downtrend).

Use trailing stops to secure profits as the trend advances.

4. **Define your take-profit (TP)**

Set the TP at previous resistance levels or let the position run using a trailing stop.

5. Use additional confirmations

RSI: avoid buying in overbought zone (+70) or selling in oversold zone (−30).

MACD and volume can help you catch the strength of the movement.

🧩 Practical example with Binance

1. Open the BTC/USDT chart in the Binance interface (using TradingView).

2. Add two EMAs: 50 and 200 periods.

3. Observe a golden cross: EMA 50 over EM

To 200 + ADX >30 → bullish signal.

To 200 + ADX >30 → bullish signal.

4. Wait for the price to retrace towards these EMAs or the trend line, buy at that point.

5. Place the stop-loss below the last low.

6. Define the exit with a TP in the next resistance or use trailing.

7. Confirm the movement with RSI (not overbought) and increasing volume.

🎯 Template for your task

Section Key content

Identification Trend + confirmations

Entry Pullback to lines/EMA

Stop‑loss Previous swing low/high

Target Next resistance or trailing

Extra indicators RSI, MACD, volume

✅ Conclusion

Trend Trading is effective because it follows the market instead of anticipating it. It requires discipline: wait for clear signals, manage risk and confirm with indicators. In Binance, you have all the integrated tools to implement it step by step with your own charts.