Ethereum $ETH has had very poor performance recently, with its price currently at $3,164.02, marking a -7.18% decrease over the past year.

Even when Bitcoin (BTC) hit new all-time highs, Ethereum continued to lag behind comparatively. As global markets have crashed throughout Q1 2025, Ethereum has been one of the worst large-cap coins affected, suffering hugely.

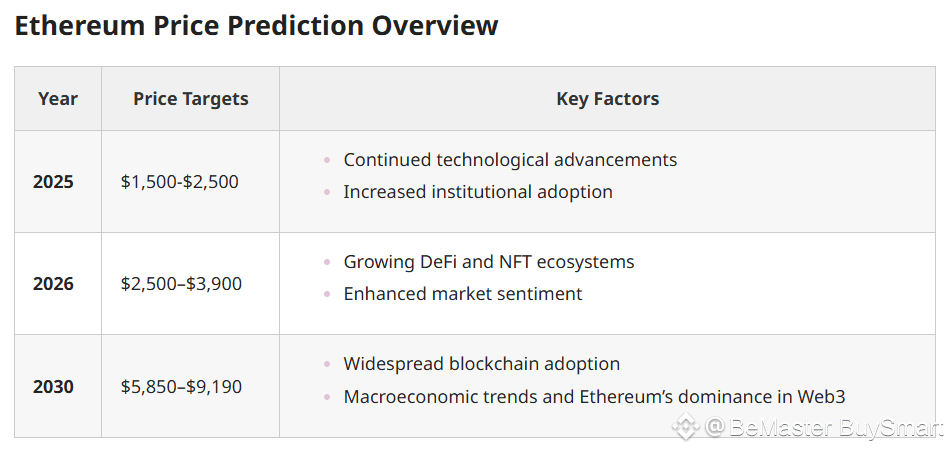

So, what is the Ethereum price prediction for 2025 and beyond? Analysts expect the ETH price to fluctuate between $1,500 and $2,500 in 2025, depending on macroeconomic factors and whether we can see another bull run this year.

This Ethereum price forecast provides a detailed ETH $ETH price analysis, experts’ outlook, and future projections.

Recent Events Affecting ETH Price

In 2024, Ethereum has seen key developments that significantly impacted its ecosystem and its role in institutional finance. A major highlight was the approval of the first spot Ethereum ETFs by the US Securities and Exchange Commission (SEC) in May, with trading starting in July.

These spot ETFs directly track Ethereum’s price, offering investors a simpler way to gain exposure to the asset, which is expected to attract significant institutional inflows. The best Ethereum ETFs include the Greyscale Ethereum Mini Trust (ETH), Fidelity Ethereum Fund (FETH), and the Bitwise Ethereum ETF (ETHW).

Moreover, the Dencun upgrade was set to enhance scalability and lower transaction costs on the Ethereum network. This upgrade, particularly through Proto-Danksharding (EIP-4844), reduced gas fees for Layer 2 rollups, making Ethereum more efficient and competitive. However, Solana’s recent outperformance in daily active users and transaction volume has shown growing competition. These metrics underscore the need for Ethereum to continue innovating to maintain its market dominance.

According to the Ethereum Foundation, the next-in-line Prague-Electra (Pectra) upgrade is expected to be launched on April 30, 2025. The upgrade will address some of the issues and introduce new updates, including increasing the staking amount per validator from exactly 32 ETH to anywhere between 32 ETH and 2048 ETH.

It’s also important to note the events from late January 2025, when numerous influential Ethereum supporters called out the Ethereum Foundation for falling behind the competition despite its burn rate. While the organization operated with $800 million, it burned through $240 million combined in 2022 and 2023 alone.

Current State of Ethereum

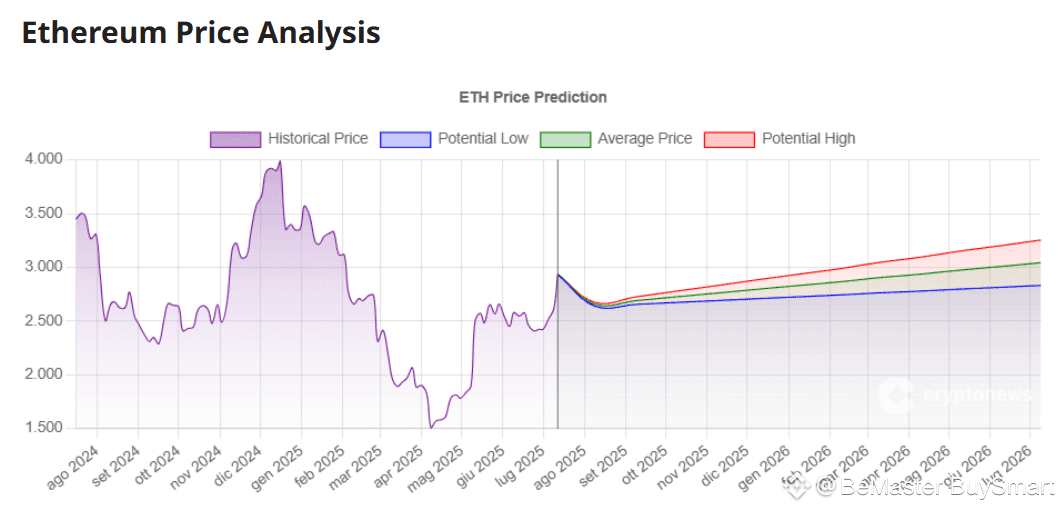

Ethereum experienced a wild ride in 2024, fluctuating from a low of $2,113.93 on January 3, 2024, to a high of $4,093.17 on December 6, 2024. Although it’s lost 9% from its latest peak price, currently at $3,164.02, the short-term Ethereum outlook remains positive.

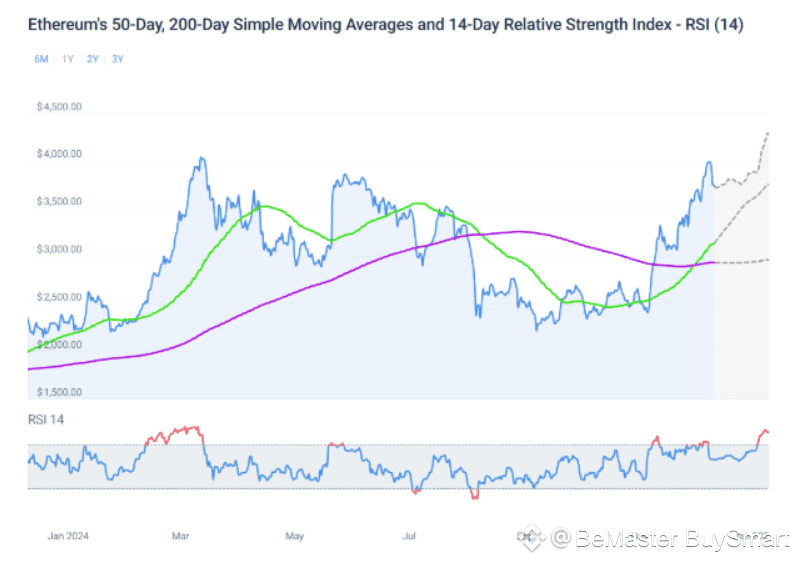

Ethereum technical analysis from CoinCodex showed a bullish sentiment for ETH price, as of December 10, 2024.

The important support levels to watch were $3,551.26 and $3,387.16, with the strongest level at $3,162.40. Resistance was expected at $3,940.12, $4,164.88, and $ 3,286.07.

Technical indicators suggested that ETH’s 200-day SMA could rise in the next month and reach $2,966.88 by January 09, 2025. Ethereum’s short-term 50-day SMA was expected to hit $3,757.45 simultaneously.

Meanwhile, the Relative Strength Index (RSI), which signals whether a cryptocurrency is overbought (above 70) or oversold (below 30), was at 58.81 at the time of writing, which indicated that Ethereum was in a neutral position.

According to CoinCodex’s short-term Ethereum price projection, the price of Ether could grow by 14.57% and hit $4,280.21 by the beginning of January 2025.

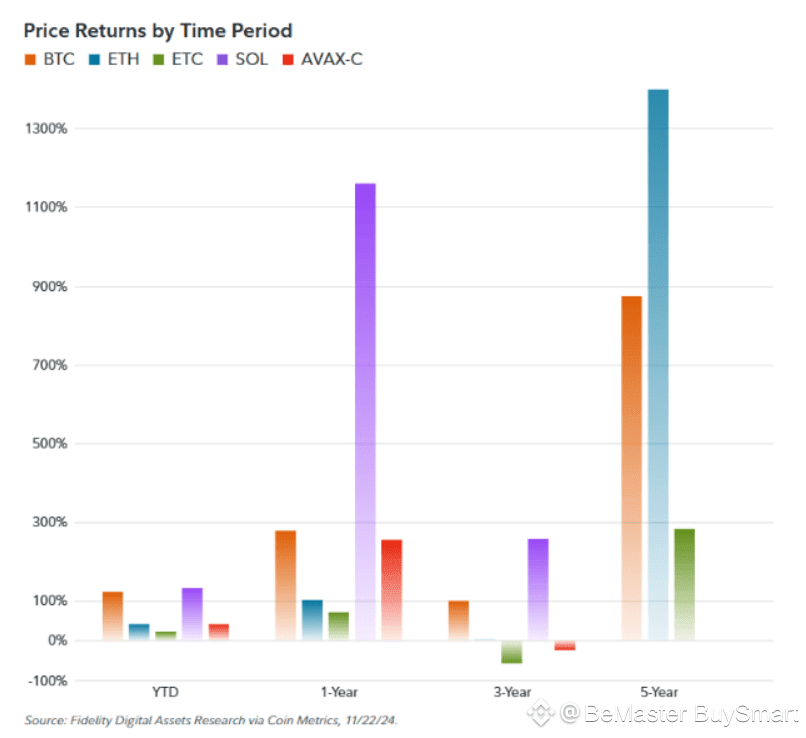

When looking at price performance over the past five-year period, Ether has outperformed its competition.

However, Solana (SOL), Avalanche (AVAX-C), and Bitcoin (BTC) have led over the past three-year, one-year, and year-to-date periods.

According to the Fidelity Digital Assets Research via Coin Metrics, as of November 11, 2024:

“It is possible that Ether may have just been overextended and needed a repricing relative to its competitors, but it could also be showing a shift in overall market preference.”

ETH Price Prediction for 2026

Price outlook: Expected range for 2026 is $4,350 (low) to $9,900 (high), with consolidation around $7,125.

Potential upside: Broader adoption in DeFi, NFTs, and Web3 could drive substantial growth.

Driving factors: Blockchain integration into global finance, sectoral adoption, geopolitical developments, regulatory clarity, and macroeconomic stability.

By 2026, Ethereum could see significant growth as blockchain technology becomes more integrated into global finance and decentralized applications (dApps). The adoption of Ethereum in sectors like DeFi, NFTs, and Web3 will likely fuel demand.

Rob Viglione, Co-Founder of Horizen Labs told Cryptonews:

“Despite Ethereum’s dominance trending downward since summer 2024, the asset will likely show incredible buoyancy in 2025. With Ethereum’s unmatched ecosystem controlling over half of DeFi’s total value locked and its expanding layer-2 networks, the foundation remains strong.”

“The potential approval of staking in ETH ETFs, increased institutional adoption under a crypto-friendly SEC in 2025, and growing tokenization efforts from major players like BlackRock could provide significant tailwinds. Combined with Ethereum’s technical maturity and network effects, these factors suggest strong upside potential despite recent underperformance.”

Geopolitical factors and regulatory clarity in key regions, such as the US and Europe, will also play pivotal roles in determining price action. If macroeconomic conditions, such as inflation and interest rates, stabilize, Ethereum may experience a steady upward trend.

However, economic instability or geopolitical tensions could lead to increased volatility across crypto markets.

Based on current technical indicators, in 2026, Ethereum is likely to consolidate around $7,125, with strong support near $4,350, while facing resistance around $9,900.

Meanwhile, Geoff Kendrick, analyst and Head of Crypto Research at the Standard Chartered Bank, predicted that Ethereum could hit $8,000 by 2026.

He labeled this as only a “stepping stone” on the way to a larger valuation of $26,000–$25,000, with no timeframe given for this larger valuation.

bitsCrunch’s Maharajan believes that by 2026, Ethereum’s position as the backbone of Web3 could push its price even higher, “potentially in the range of $15,000, as Layer 2 solutions further mature and institutional interest in Ethereum ETFs strengthens.”

Lian echoes this forecast, suggesting that “Ethereum may benefit from Layer 2 scaling solutions, potentially reaching $8,000–$15,000.”

However, Plena Finance’s Sparsh Jhamb is less optimistic. He said:

“By 2026, we’ll probably be entering the next bear market—something that usually happens after a big bull run. But this time, things might not be as dramatic. With institutions and even governments starting to adopt Bitcoin and Ethereum, we could see a more stable market compared to previous cycles.”

ETH Price Prediction for 2030

Price outlook: Expected range for 2030 is $9,850 (low) to $79,600 (high), with an average price around $12,000.

Potential upside: Ethereum could achieve new highs driven by mainstream blockchain adoption, scalability improvements, and institutional participation.

Driving factors: DeFi and enterprise adoption, post-halving market dynamics, enhanced scalability, regulatory clarity, market volatility, and geopolitical stability.

Outlining the Ethereum price prediction for 2030, we might expect ETH’s price to be significantly higher, driven by widespread adoption in DeFi and enterprise solutions. Historically, post-halving cycles have triggered bullish runs across crypto markets, and Ethereum is likely to follow this pattern.

Given its previous cycles, Ethereum could experience a similar surge in 2030, much like after the 2021 bull run. With blockchain adoption becoming mainstream by then, Ethereum’s price could average $12,000, testing resistance near $20,000.

Factors like improved scalability and institutional adoption will play crucial roles in sustaining this momentum. Broader geopolitical stability and regulatory clarity in key markets will further support Ethereum’s growth.

If these trends hold, Ethereum could see unprecedented highs, making it a central asset in the global digital economy—if not, it could face lows of $4,600.

According to VanEck’s long-term ETH price prediction:

“Ethereum may emerge as a powerhouse among digital assets, with a predicted token price of $11.8k by 2030. Ethereum’s unique approach combines a globally distributed infrastructure, smart contract capabilities, and a digital commerce model that enables trustless transactions.”

Finder’s panelists support VanEck’s bullish stance on Ethereum, expecting ETH to hit $12,059 by 2030.

Looking further into Ethereum’s future, Sparsh Jhamb said:

“If Ethereum captures about 30% of Bitcoin’s market cap, it would have a market cap of $3 trillion to $4.5 trillion. With an estimated 120 million ETH in circulation, Ethereum’s price would range from $25,000 to $37,500, reflecting its continued strength as a foundational blockchain for decentralized applications and smart contracts.”

“These projections may sound ambitious, but with Ethereum’s rapid adoption and immense potential, they’re entirely achievable.”

According to Vijay Pravin Maharajan, “Ethereum’s price could climb to $20,000 or more, but intense competition from other blockchains and periods of market volatility present omnipresent challenges.”

Anndy Lian maintains a similar view, saying that “Ethereum, as the backbone of Web3, might exceed $20,000 by 2030.”

Denis Vasin, Co-Founder of Storm Trade, told Cryptonews without giving exact price targets:

“If we look years ahead, the growth of Ethereum’s potential at the expense of L2 will be reflected in its value. As a result, we may see a steady growth not due to instant speculation but to fundamental changes in the economics of using this platform.”

Will Ethereum’s Protocol Upgrades Affect the ETH Price?

Ethereum’s upcoming protocol upgrades, notably the Pectra upgrade, aim to enhance network efficiency and user experience.

Pectra combines the Prague and Electra upgrades, introducing features like EIP-3074, which integrates traditional wallets with smart contracts through account abstraction. This integration simplifies transactions and reduces gas fees, potentially increasing user adoption.

Historically, such enhancements have positively influenced Ethereum’s price by attracting more users and developers. For instance, the Dencun upgrade in March 2024 improved scalability, leading to a price surge.

Commenting on Pectra’s impact on Ethereum’s future, Vijay Pravin Maharajan told Cryptonews:

“The Ethereum network is gearing up for its most impactful update since The Merge with the upcoming Pectra upgrade, which could be a transformative milestone for the Ethereum ecosystem. Set for early 2025, Pectra is geared towards improving scalability and accessibility. The completion of Ethereum’s scalability upgrades will be critical to enhancing transaction throughput and reducing costs, attracting more developers and users to the ecosystem.”

However, Christine Kim, a Vice President of the Research team at Galaxy Digital, does not expect the Pectra upgrade to have a significant influence on Ethereum’s value. She said:

“As with any network-wide upgrade on Ethereum, there will likely be heightened volatility in ETH around the time of Pectra and the potential for negative swings in price should there be any unexpected bugs or failures related to the upgrade.”

Still, she believes that the likelihood of an unsuccessful Pectra upgrade is slim as the code changes undergo extensive battle testing before activation on the mainnet, and Ethereum protocol developers have vast experience.

“Therefore, barring temporary volatility in ETH leading up to and shortly following the upgrade, the code changes in Pectra related to fixing various parts of the protocol are not anticipated to have a prolonged positive or negative impact on ETH value.”

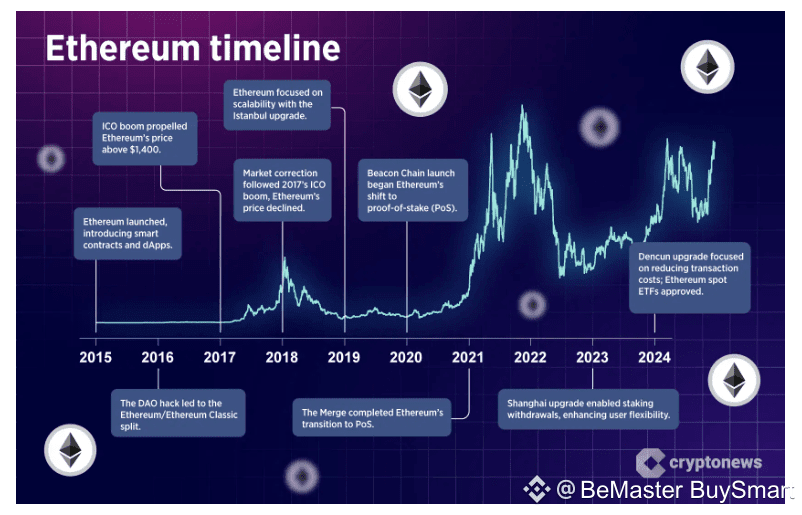

Ethereum History: Key Milestones

2015: Ethereum launched, introducing smart contracts and dApps.

2016: The DAO hack led to the Ethereum/Ethereum Classic split.

2017: ICO boom propelled Ethereum’s price above $1,400.

2018: Market correction followed 2017’s ICO boom, Ethereum’s price declined.

2019: Ethereum focused on scalability with the Istanbul upgrade.

2020: Beacon Chain launch began Ethereum’s shift to proof-of-stake (PoS).

2021: The Merge completed Ethereum’s transition to PoS.

2023: Shanghai upgrade enabled staking withdrawals, enhancing user flexibility.

2024: Dencun upgrade focused on reducing transaction costs; Ethereum spot ETFs approved. ATH of $ 4,878.

What’s Next for Ethereum?

Ethereum’s value in the coming years will be influenced by several key factors, including its dominance in dApps, the adoption of L2 scaling solutions, and macroeconomic conditions.

According to a consensus analysts’ outlook compiled in this article, Ethereum could continue its upward trend in the long term. Ethereum price projections range from around $5,000 in 2025 to exceeding $20,000 by 2030. This long-term ETH price forecast foresees an integration with Web3 ecosystems and a continued increase in on-chain activity.

Meanwhile, potential risks for the future of Ethereum include regulatory challenges, increased competition, or setbacks in scalability. How the network adapts to ever-changing market demand and developer requirements remains to be seen.

FOLLOW BE_MASTER BUY_SMART 💰💰💰 Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩