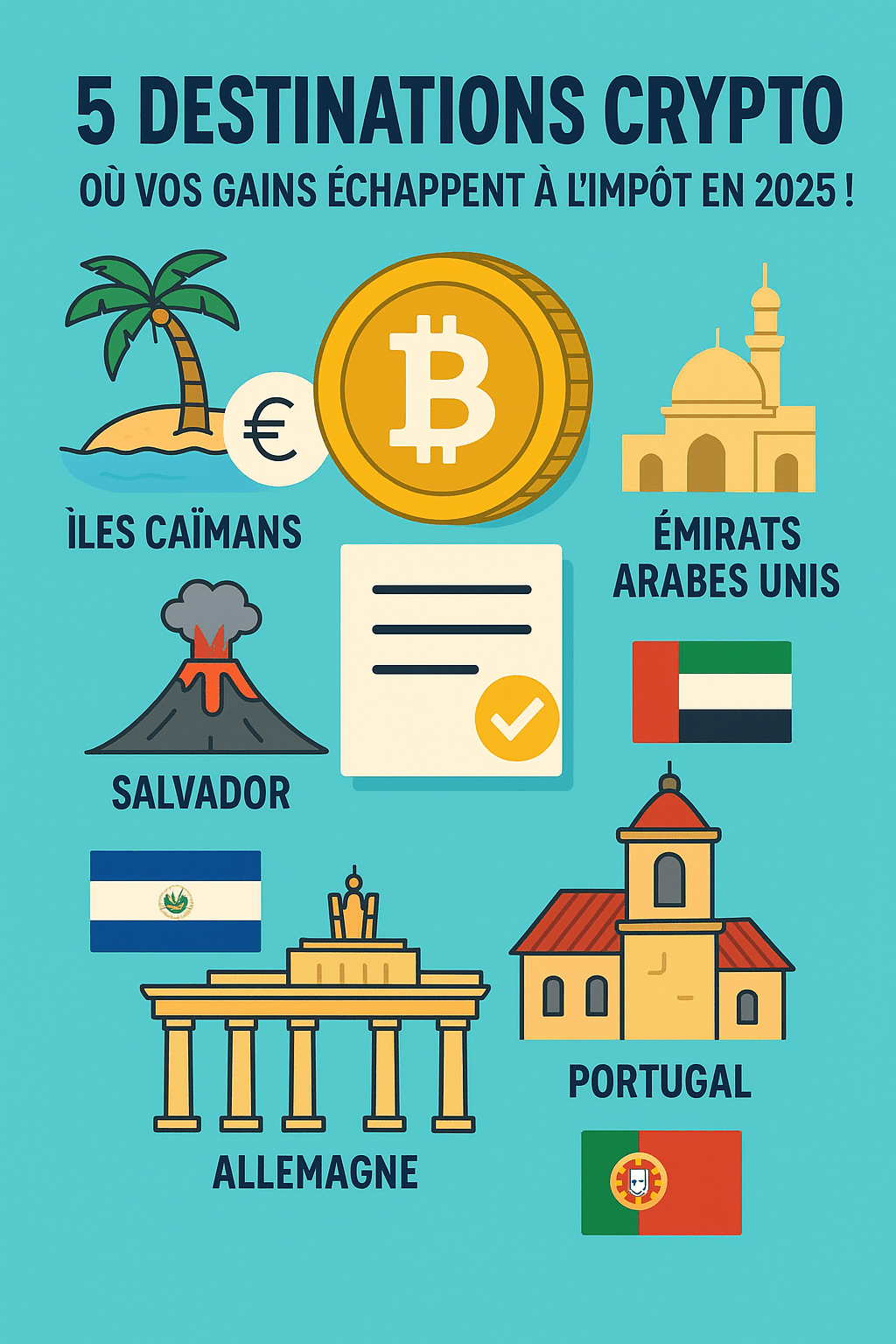

Too often overshadowed by heavy tax regimes, crypto benefits in some countries from privileged treatment... and this could well change your way of investing 💡.

🏝️ 1. Cayman Islands

A classic of offshore zones, where capital gains and crypto income are completely non-taxable. Since April 2025, a clear regulatory framework further enhances the appeal of this tax haven.

🕌 2. United Arab Emirates

Dubai and Abu Dhabi are betting everything on digital. Result: capital gains, staking, mining... everything is at zero tax, accompanied by a very structured blockchain environment.

🌋 3. El Salvador

The first country to adopt Bitcoin as legal tender, El Salvador eliminates all taxes on gains in BTC. With Bitcoin City, the aim is a tax-free city for miners and investors.

🇩🇪 4. Germany

A well-hidden advantage in the EU: if you hold your cryptos for more than 12 months, resale is completely exempt. And even intra-year gains up to €1,000 are tax-free.

🇵🇹 5. Portugal

This tax haven keeps a gentle hand: long-term gains (after 1 year of holding) are not taxable. Short-term profits are taxed (at 28%), but remain competitive for savvy investors.

📏 Perspective in Europe: the MiCA regulation

The EU clarifies the overall framework for platforms through MiCA, with licensing requirements and more transparency. But some major players, like Binance and Tether, are still awaiting approval.

Why does it matter?

A few countries are really playing the crypto tax haven card: clear regulation + tax benefits = attracting investors and projects. For the investor, it’s the perfect opportunity to escape capital gains constraints and boost their strategies (mining, staking, hold...) without the weight of tax.

✅ To remember

CountryMain ConditionTaxation

cryptoCaymans—Zero taxUAE—Zero tax

El SalvadorBTC legal tenderZero tax

GermanyHolding > 12 monthsTotal exemption

PortugalHolding > 12 monthsLong-term exemption

💡 In summary, if you are looking to optimize your crypto taxation while benefiting from a robust legal framework, these 5 countries should be considered from 2025. No need to be a resident: a digital nomad status or a targeted project is often enough.

Source: journalducoin.com