"Trading coins for small profits, positioning in stablecoins for big profits."

Today's seemingly calm meeting may quietly open the next round of global financial power shifts.

🌐【1. What does today's meeting mean?】

According to multiple media reports, the Shanghai state-owned assets system held a special meeting today on digital currency and RMB stablecoin, focusing on discussing:

• The technical path of the RMB stablecoin;

• The dual currency collaborative mechanism with the Hong Kong dollar stablecoin;

• Can state-owned enterprises participate in cross-border on-chain settlement pilot projects?

This is not an ordinary discussion meeting; it has released an extremely strong signal:

👉 "China is about to take action, and it’s not Bitcoin, but on-chain currency sovereignty."

🧠【The RMB stablecoin will open the on-chain 'foreign exchange rights' competition】

Most people seeing this news will only say: "Ah, China is finally considering stablecoins."

But what I see is: the sovereign war of on-chain finance has officially begun.

• You think stablecoins are just USDT? In fact, they are the borderless colonial tool of the US dollar.

• The Hong Kong dollar version of the Stablecoin has already opened for pilot, if the RMB stablecoin really lands—

It has become the 'on-chain weapon' for the RMB to go global.

This is not an internal competition in the crypto circle, but rather: the on-chain foreign exchange hedging system is being restructured!

🚀【And the crypto circle's reaction has already quietly begun】

You may not have noticed:

• TRON chain stablecoin trading volume surged 18% this week, USDD activity is heating up;

• Huobi (HTX) local capital inflow is evident, HT has risen over 26%, this is not speculation, but rather 'returning to roots' capital positioning;

• CKB, CFX and other 'domestic chains' have started to move; even assets like WLD that are linked to compliance have been pre-pumped.

These are not coincidences, but rather funds are positioning in advance:

👉 Once the Hong Kong dollar + RMB stablecoin system is implemented, whoever holds a 'infrastructure-level' position will have the future discourse power.

📉【You thought you missed Bitcoin, but what you actually missed is a new round of restructuring】

Today BTC broke 118K, many are cheering, but I want to say:

"How much BTC rises has no impact on the on-chain sovereign game."

Real opportunities have never been in the price itself, but in the migration path of value anchors.

In this bull market, you might make a few points of difference;

But the moment the next round of on-chain stablecoins opens up cross-border payments, the participants are the ones restructuring the financial order.

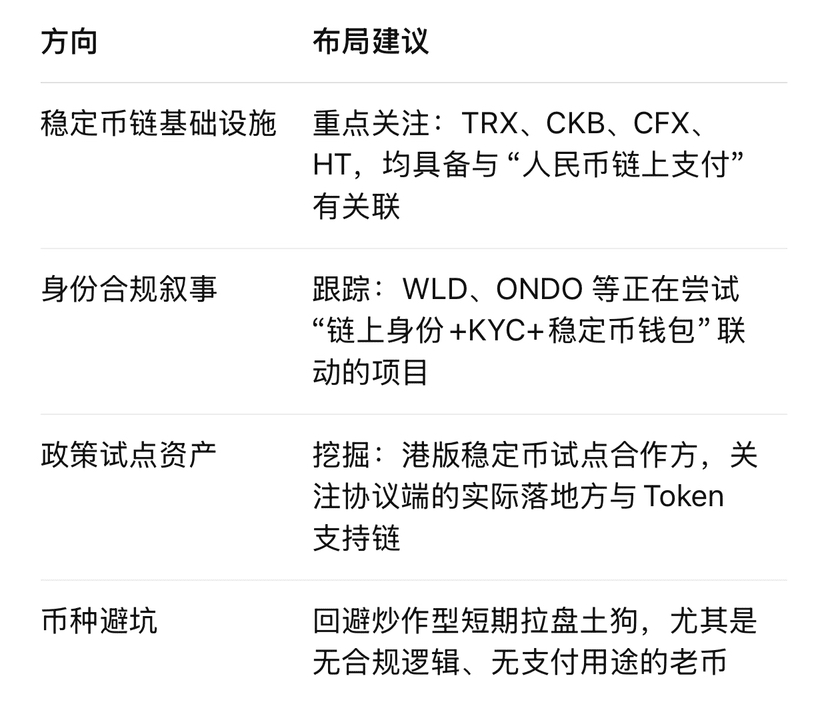

✅【My practical advice】

🎯Conclusion: Stablecoins are the next super narrative, but it's not about 'getting free benefits', it's about 'seizing power'.

You might look down on stablecoins, thinking they can't appreciate;

But you forgot, the Federal Reserve can't control USDT, but it can control the flow of your assets through it.

📌 Now, China is ready to play the RMB stablecoin card—

👉 The question is: will you continue to trade coins, or will you follow the pattern and position in advance?

💬 Do you think the Hong Kong dollar + RMB dual stablecoin will impact USDT's position? Which domestic chains are worth you positioning in advance?

Welcome to share your views; let's find the positioning opportunities before the 'on-chain central bank' is implemented together!