##上市公司山寨币财库 Even brokerages have started to get into crypto, is the next wave of skyrocketing in the Hong Kong stock market coming?

Guotai Junan International, this veteran brokerage, skyrocketed 80% at the start of trading, peaked at over 190% during the day, catching everyone off guard

Many people ask: what's going on? Can brokerages still become 'monster stocks'?

There is only one truth: it has entered the crypto space

It's not a concept, it's solid evidence!

On that day, Guotai Junan International officially announced - it has received formal approval from the Hong Kong Securities and Futures Commission to upgrade to a full-function virtual asset trading license

Becoming the first Chinese-funded brokerage to directly provide trading for BTC, ETH, USDT and other virtual assets

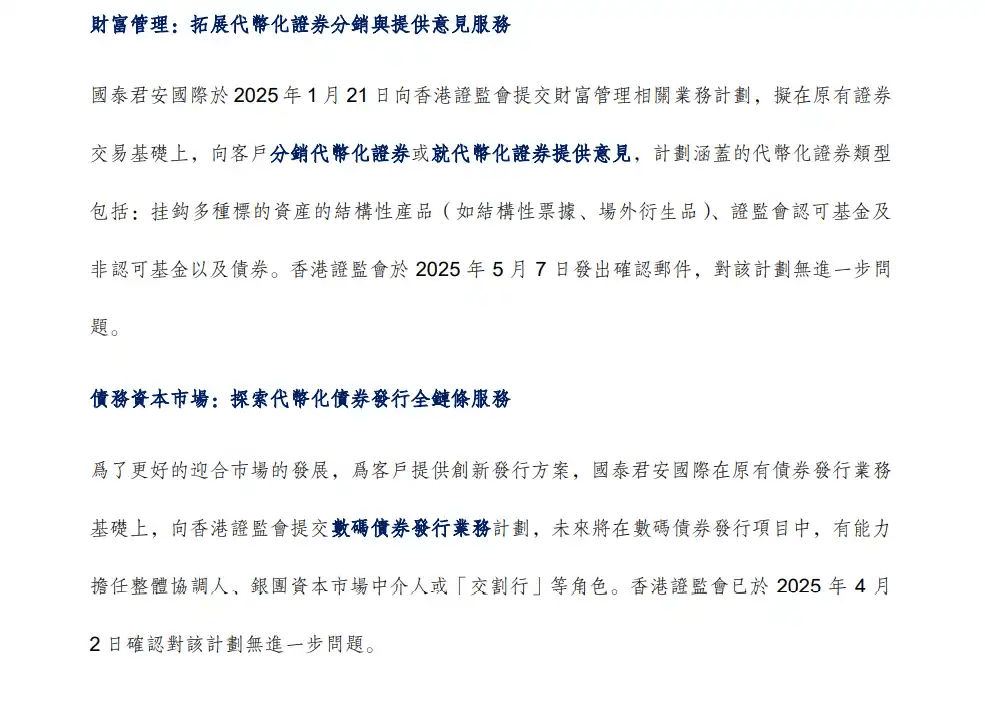

Not just trading, but also tokenized bonds, structured notes, and on-chain funds can be issued!

Traditional brokerages transforming into Web3 investment banks, directly opening their doors to welcome customers, treating crypto as assets, and engaging in on-chain finance

The 'Hong Kong version of the crypto-stock craze' is really about to begin

Let's take a look at the recent Hong Kong stock market, is there a familiar taste:

Boyah Interactive: 3351 BTC + 297 ETH, the king of holding stocks in Hong Kong, stock price doubled

Blue Hong Kong Interactive / Guofu Innovation / OKCloud Chain: Heavily invested in BTC / ETH or engaging in on-chain infrastructure

New Fire Technology / OSL: Focused on digital asset custody + trading platform, skyrocketed in May

Outside, US stocks are engaging in 'micro-strategy replication trend', DFDV buys SOL, SBET buys ETH, Nano Labs issues bonds to reserve BNB - surges of dozens of times are common

Now, funds in the Hong Kong stock market are starting to understand: it's not necessarily about trading crypto, but definitely about trading holdings

In the next round of the market, retail investors are still not awake, but brokerages have already planted mines on-chain

This surge of Guojun International is actually a strong signal released by the Hong Kong stock market:

It's not about who lays out the crypto first

But who first integrates compliance + financial systems + on-chain transactions

You think they are here to help you trade crypto, but they are actually here to build the 'on-chain financial infrastructure'

This is not just about riding the wave, but the starting point for traditional brokerages to officially go on-chain

How to play this round of 'crypto-stock trend'?

Retail investors chase concepts, while the main players focus on the path

What you see now is the rise, what smart money sees is:

Which holding companies have quietly increased their positions?

Which brokerages are queuing up after getting their licenses?

Which platforms are secretly working on stablecoin deposit channels?

I am Xiao Peng, an experienced trader, also doing research on crypto macro strategies

Recently focusing on the research of 'Hong Kong stocks x Web3 x macro linkage logic', follow me for daily tracking of integrated crypto-stock opportunities ##香港加密概念股