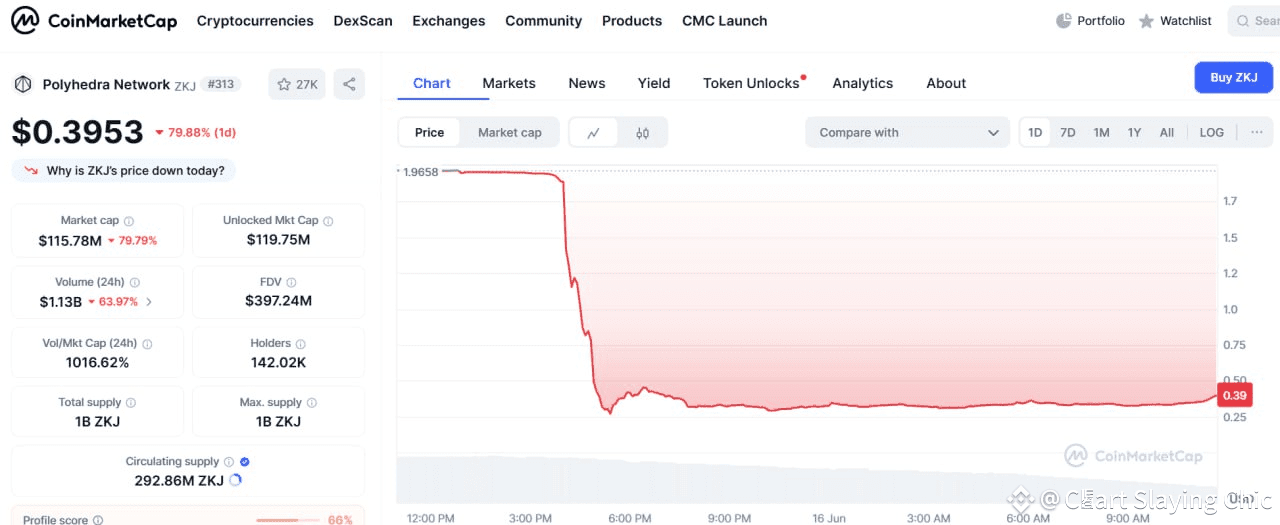

In just two hours, $ZKJ — the token powering Polyhedra’s ecosystem — plummeted over 80% in value, dropping from $1.75 to $0.35. It wasn't just a price correction; it was a calculated, high-impact event that sent shockwaves through the crypto space.

So what exactly happened? Here’s a breakdown of the chaos, who triggered it, and what it means moving forward.

The Spark: Coordinated Whale Activity

The collapse began with six whale wallets making strategic moves in the ZKJ/KOGE liquidity pools. These wallets:

Pulled liquidity from ZKJ/KOGE pairs

Swapped KOGE (48 Club DAO’s governance token) into ZKJ

Dumped 5.23 million ZKJ, worth approximately $9.66 million

This maneuver drained liquidity from both tokens — especially from the KOGE/USDT pool — triggering a steep and sudden decline in price.

The Domino Effect: $100M in Liquidations

The whale dump wasn’t the end.

As ZKJ’s price spiraled, leveraged long positions started to get liquidated. Within four hours, nearly $100 million was wiped from the market — accounting for a staggering 81.3% of all crypto liquidations in that timeframe.

Retail traders were caught completely off-guard. Those using leverage stood no chance as the liquidations snowballed.

A Perfect Storm: Unlock, Sentiment & Liquidity

Looking deeper, it becomes clear this wasn’t purely organic.

A scheduled unlock of 15.53M ZKJ (worth ~$32M before the crash) was approaching.

Whales likely front-ran the unlock, anticipating sell pressure.

The broader market was already shaky — Nasdaq was down 1.5%.

ZKJ pools had low liquidity, making it easy for large sells to crash the price.

This convergence of timing and vulnerability turned a routine unlock into a catastrophic event.

The Fallout: Damage Control and Distrust

In the aftermath:

Polyhedra blamed the collapse on “abnormal on-chain activity”

Binance removed ZKJ/KOGE from its Alpha Points rewards program, effective June 17

The crypto community on X erupted with accusations of a “rug pull”, targeting both Polyhedra and 48 Club DAO

Trust in the project — and in its governance mechanisms — has taken a severe hit.

The Road Ahead: Can ZKJ Recover?

Technically, ZKJ appears oversold, with its RSI sitting between 23.9–28 — a zone that could signal a bounce.

But recovery isn’t just about charts.

A second unlock is scheduled for June 19, and unless transparency improves and liquidity returns, ZKJ could stagnate between $0.25 and $0.40 in the short term.

Key Takeaways: A Cautionary Tale

This event highlights a critical formula in crypto risk:

> 🚫 Low liquidity + upcoming unlocks + whale control = extreme vulnerability

Retail investors bore the brunt of this collapse. And without clear communication and action from the project team, trust — once lost — may take far longer to return than the price ever will.