Here’s the blueprint to lock in profits.

🔑 Key Lessons from Past Cycles

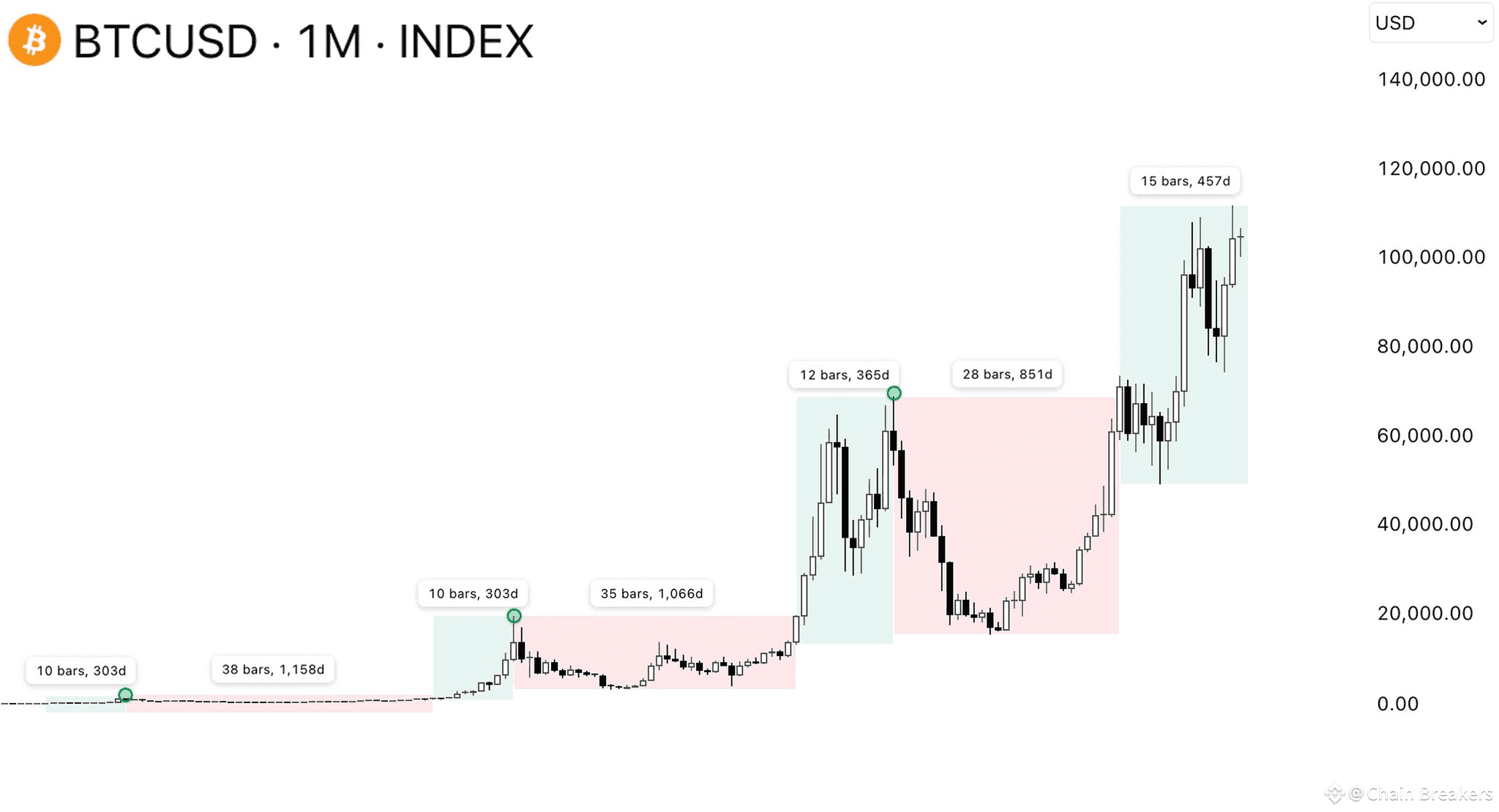

- 2013: Bull (9mo) → Bear (38mo)

- 2017: Bull (10mo) → Bear (33mo)

- 2021: Bull (12mo) → Bear (27mo)

- 2024: Bull (15mo and counting) → ATH likely Nov-Dec 2025 .

Patterns Emerge:

- Bulls last longer, bears shorten.

- Volatility compresses (BTC rises/falls slower but steadier).

- One constant: All peaks hit Nov-Dec (2013, 2017, 2021 → 2025 will repeat) .

💡 Why 99% Will Fail (And How to Win)

- Mistake I Made: Didn’t lock profits in 2013 ($130K → $8K).

- Human Psychology: Euphoria blinds traders to exit signals.

- Liquidity Crunch: Post-peak, 99% of tokens crash fast.

Solution: Sell Nov-Dec 2025—history’s clearest exit signal.

📉 Current Dip? Normal Bull Run Behavior

- Golden Cross Correction: Typical pullback before next leg up (e.g., 2024 saw 8% drop → 62% rally) .

- Macro Alignment: U.S. debt concerns, institutional adoption (ETFs, Trump policies) support long-term bullish targets ($150K–$200K BTC) .

✅ Action Plan

1. Track Golden Cross: Confirms bullish momentum (50-day SMA > 200-day SMA) .

2. Watch Indicators:

- BTC dominance (>40% = safe; <40% = altcoin mania → late-cycle) .

- Funding rates (>10% for months = speculative excess) .

3. Exit Strategy: Sell 80-100% by Dec 2025. Avoid "one more pump" traps.

🌐 What’s Next?

- Post-2025 : Bear market (expected 18-24mo). Accumulate BTC at -70% from ATH.

- 2030 Horizon: Experts project $1M BTC (ARK Invest) .

🎯 Bottom Line: Cycles don’t lie. Profit from patterns—not emotions.