Arbitrage has long been considered the “holy grail” of trading buy low on one market, sell high on another, and pocket the difference. With the rise of crypto automation, arbitrage bots now promise to do this faster and more efficiently than any human could.

But in 2025, with tighter spreads, faster markets, and more competition, is arbitrage still worth it? Can bots really capture these opportunities consistently?

Let’s break down how arbitrage bots work, the types available, and what to expect in today’s market.

What Are Arbitrage Bots?

Arbitrage bots automatically scan exchanges or markets for price differences and execute trades to profit from them. The key goal: exploit inefficiencies before they disappear.

Here are the main types:

Spatial Arbitrage Bots: Buy on one exchange and sell on another (e.g., Binance vs. Coinbase)

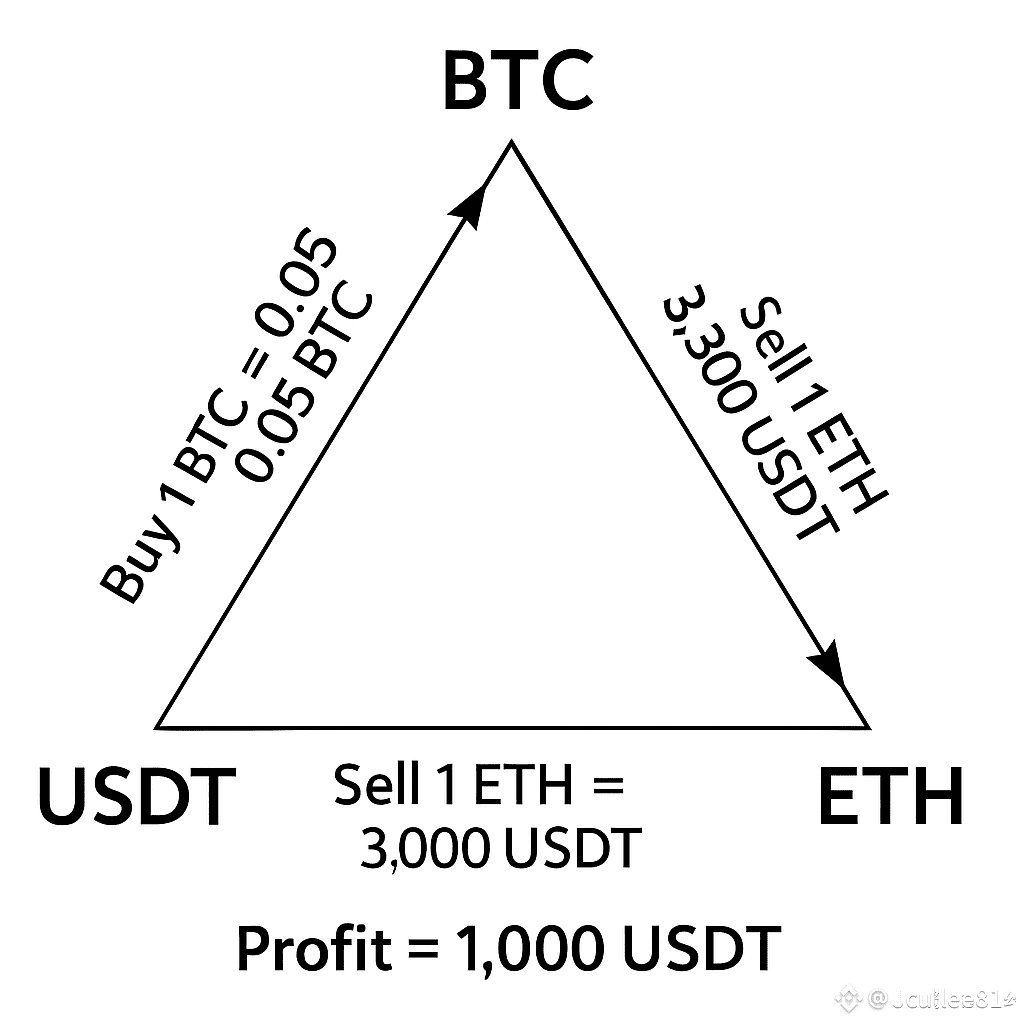

Triangular Arbitrage Bots: Exploit price discrepancies between three trading pairs on the same exchange (e.g., BTC → ETH → USDT → BTC)

Funding Rate Arbitrage Bots: Long on spot and short futures (or vice versa) to collect the funding fee difference

Why Arbitrage Is Harder in 2025

While arbitrage sounds simple, competition and market efficiency have made it harder to profit:

Faster arbitrage bots dominate and eliminate price gaps quickly

Tighter spreads between exchanges reduce profit margins

High gas or network fees can eat into your profits on chain

Slippage increases with large trade sizes or illiquid pairs

Exchange withdrawal limits may prevent fast execution between platforms

Pros of Arbitrage Bots

Low market risk (if executed correctly)

Passive profit opportunities without needing directional predictions

Automation handles dozens of pairs instantly

Great for high volume traders and institutions

Cons and Risks

Requires speed: slow bots miss the opportunity

Execution risk: if one leg of the trade fails, you lose

Withdrawal/transfer time between exchanges may delay arbitrage

Profits are small per trade you need volume and capital to make it worthwhile

Regulatory or KYC issues across exchanges may slow or block access

Tips to Make Arbitrage Bots Work in 2025

To succeed with arbitrage bots this year:

Use exchanges with fast APIs and low withdrawal fees (e.g., Binance, Kraken)

Focus on stable, high-volume pairs (BTC/USDT, ETH/USDT)

Avoid congested blockchains if doing cross-chain arbitrage

Test latency and execution speed with demo bots

Run your bot on a VPS or cloud server to reduce lag

Keep capital on multiple exchanges to avoid transfer delays

Example: Triangular Arbitrage on Binance

Let’s say:

BTC/USDT = $70,000

ETH/USDT = $3,500

BTC/ETH = 20

Your bot calculates that buying ETH with USDT, then converting ETH to BTC, and then BTC back to USDT, results in a small profit. It executes this loop instantly.

Final Thoughts: Arbitrage Bots Are Still Alive—But Not Easy

In 2025, arbitrage opportunities exist but they’re rare, fast, and often razor thin. You’ll need a lightning fast bot, solid capital, and smart execution to make it work.

Good for advanced users not ideal for beginners. If you’re new, start by testing on centralized exchanges like Binance and stick to triangular arbitrage before attempting cross exchange setups.

#Write2Earn #Arbitrage #BinanceSquareTalks #BinanceSquareFamily #Write2Earn!