I’m not here to spread FUD, but this is a serious concern that every holder needs to understand. I’ve got Bitcoin for the long haul (8+ years), so I’m not trying to scare anyone off—just sharing some hard truths.

We all know Bitcoin’s decentralization is its strongest suit, but here’s the thing: We’re not as decentralized as we think.

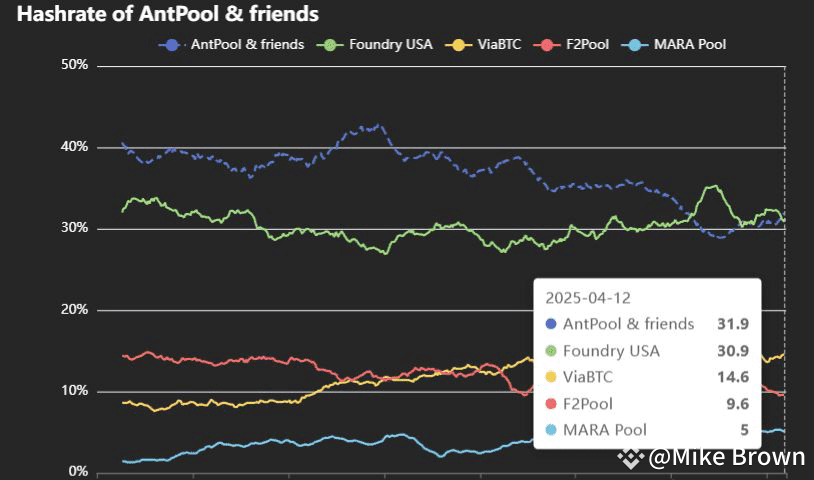

It’s not about $BTC distribution—it’s about the distribution of computing power across the network. The risk? If one entity controls over 51% of the hashrate, Bitcoin’s security and decentralization are compromised. That’s the 51% attack risk, and it’s a huge threat.

Stay aware.

By analyzing the Coinbase transaction (the first transaction in every block), we can track who controls what part of the Bitcoin network.

The miner inserts it and usually contains a unique tag that identifies the pool.

This makes it easy to see which pool mined the block.

Take Antpool, for example—they use the tag /AntPool/.

By tracking this data, we can clearly see how much of the block share each major mining pool controls.

The results are pretty alarming: The top 5 mining pools are responsible for over 80% of all blocks, meaning they hold more than 80% of Bitcoin’s total hashrate.

We can also measure centralization over time using the Mining Centralization Index, which shows how much hashrate is held by the top 2 to 6 pools.

Satoshi envisioned a Bitcoin that would become more decentralized over time as adoption grew, but the opposite is happening.

What’s even more concerning is that some smaller pools seem to use identical block templates to larger ones, suggesting the existence of proxy pools.

For example, while Antpool officially holds around 20% of the network, its proxy pools push that number up to 30%.

When you factor in Antpool and its proxies, the mining centralization index skyrockets from 85% to 96%, with the top 6 pools controlling the vast majority of the hashrate.

And that’s not even accounting for potential proxies tied to other major pools.

Bitcoin has gone through phases of better decentralization, like in 2017 or between 2017 and 2022. But since 2023, it’s become increasingly centralized.

That timing lines up closely with the beginning of Bitcoin ETF developments, probably not a coincidence.

Among the top 5 mining pools, 2 are based in the US and 3 in China.

+ US: Foundry and MARA Pool

+ China: Antpool, ViaBTC, and F2Pool

That means the US controls over 40% of the Bitcoin network, and China 55%, with just 5 pools.

It’s insane when you think about it.

In theory, these pools have no incentive to attack the network since their business depends on Bitcoin’s success.

But don’t forget, these are regulated companies. Their respective governments can pressure them to change things on the network if they want to.

Back in December, there was an incident where a transaction was censored in a block mined by F2Pool.

It’s hard to say whether this was intentional (e.g. sanction enforcement) or just a coincidence, but Bitcoin core developer Peter Todd doesn’t rule out censorship as a possibility.

But as I always say, every problem has a solution.

Making Bitcoin more decentralized is a tough battle, a true David vs Goliath situation.

Here’s what we can do:

+ Support smaller mining pools

+ Encourage large miners to go solo

+ Redirect hashrate to decentralized pools

+ Promote home mining, even on a small scale