Many people think the crypto market's ups and downs are all about luck, but there is actually a clear logic and rhythm behind it.

As long as you grasp a few key macroeconomic indicators, you can predict market direction in advance, avoid major declines, and seize bull markets.

I spent 7 years summarizing this system, and you only need to spend 3 minutes reading this article 👇

📍1. Federal Funds Rate

This is the most important interest rate indicator in the US, affecting dollar liquidity and market risk appetite:

Rate hike ➜ Increased cost of funds ➜ Tightening ➜ Decline in risk assets (like BTC/ETH)

Rate cut ➜ Funds become cheaper ➜ Risk appetite increases ➜ Crypto assets strengthen

💡 Conclusion: The lower the interest rate, the more favorable it is for cryptocurrencies, especially $BTC and $ETH .

📍2. US CPI Inflation Index

Consumer Price Index (CPI) is key for the Fed's policy decisions:

Rising inflation ➜ Fed's hawkish stance (possible rate hike) ➜ Unfavorable for crypto

Declining inflation ➜ Expecting easing ➜ Favorable for crypto rise

📍3. US Dollar Index (DXY)

DXY measures the strength of the dollar against other currencies:

DXY rising ➜ Strong dollar ➜ Global liquidity tightening ➜ Crypto under pressure

DXY falling ➜ Dollar weakening ➜ Favorable for capital inflow into risk assets

💡 Conclusion: The stronger the dollar, the worse it is for crypto.

📍4. US Treasury Yield (10-Year/2-Year)

Reflects market expectations for future interest rates and economic outlook:

Rising yields ➜ High cost of funds ➜ Decreased asset valuations

Yield inversion ➜ Market worries about recession ➜ Fed may turn dovish

💡 Conclusion: Inversion may be a precursor to easing, bullish for the crypto market.

📍5. Global Liquidity Index (Global M2 / USD)

Measures whether global funds are abundant:

QE (Quantitative Easing) ➜ Market injection of funds ➜ Crypto rising

QT (Quantitative Tightening) ➜ Fund recovery ➜ Crypto downturn

💡 Conclusion: More funds, crypto rises; fewer funds, crypto falls.

📍6. Stock Market Trends (S&P 500 / Nasdaq)

The stock market reflects overall market sentiment and is highly correlated with the crypto market:

Stock market crash ➜ Decreased risk appetite ➜ Crypto assets also pull back

Strong stock market ➜ Market sentiment stabilizes ➜ Crypto rises

💡 Conclusion: Focusing on US stocks means closely monitoring the crypto market.

📍7. Volatility Index (VIX)

Represents the level of market panic:

High VIX ➜ Increased market risk aversion ➜ Significant selling pressure on crypto

Low VIX ➜ Market stability ➜ Increased risk appetite

💡 Conclusion: Low VIX is a good entry point, high VIX requires caution against risk.

📍8. Non-Farm Payroll and Unemployment Data (NFP & Unemployment)

Indicates whether the labor market is strong:

Strong employment ➜ Fed has no pressure to cut rates ➜ Crypto under pressure

Weak employment ➜ Increased probability of easing ➜ Positive for the crypto market

💡 Conclusion: Weak employment = Shift to easing = Spring for Crypto.

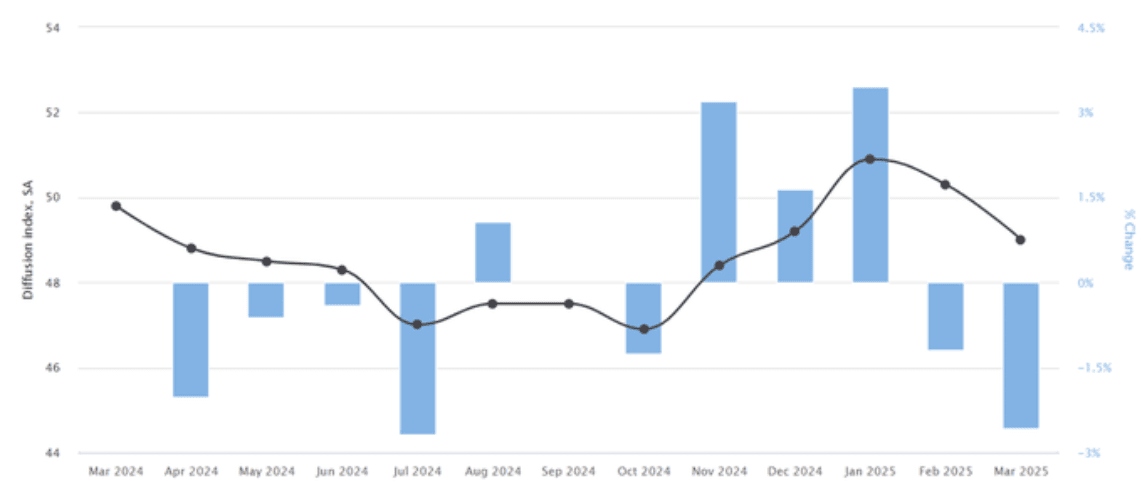

📍9. Purchasing Managers' Index (PMI)

Leading economic indicators predict changes in economic activity:

Declining PMI ➜ Signal of economic slowdown ➜ Fed may turn dovish

Rising PMI ➜ Strong economy ➜ Hawkish stance

💡 Conclusion: A declining PMI may actually drive crypto prices up.

📍10. Geopolitical and trade risks

Events like wars, sanctions, tariffs, etc., will affect capital flows:

Tense situation ➜ Traditional assets under pressure ➜ BTC becomes a hedge tool

Escalation of sanctions ➜ Some countries may turn to cryptocurrency assets for hedging

💡 Conclusion: In times of chaos, BTC is 'digital gold'.

✅ Conclusion:

You cannot predict how much it will rise tomorrow

But you can use macro indicators to judge the direction for the next quarter

🔍 Understanding macro = Preparing in advance = Avoiding major declines + Riding the main uptrend

📈 Learn this system, and you will no longer be a FOMO person, but the master of market rhythm.

This is the insight I have accumulated over 7 years, and now you have mastered it. What's next? Start using it to make your own judgments.