RedStone is a blockchain oracle provider delivering fast, gas-efficient and tamper proof cross-chain data feeds to power DeFi protocols on any blockchain.

RED is the native utility token, which has the following functions:

Staking:

Data providers in RedStone's oracle network are required to stake RED tokens to attest to the quality and consistency of the data delivered

Any tokenholder can stake RED tokens in RedStone AVS on EigenLayer, adding an additional layer of security to the oracle network

At launch RED will be supported by partner AVS as a Liquid Restaked Token.

Payment Currency: Users of RedStone oracle feeds pay stakers for data consumed in major tokens like ETH, BTC, SOL and USDC. These fees will accrue to staked RED.

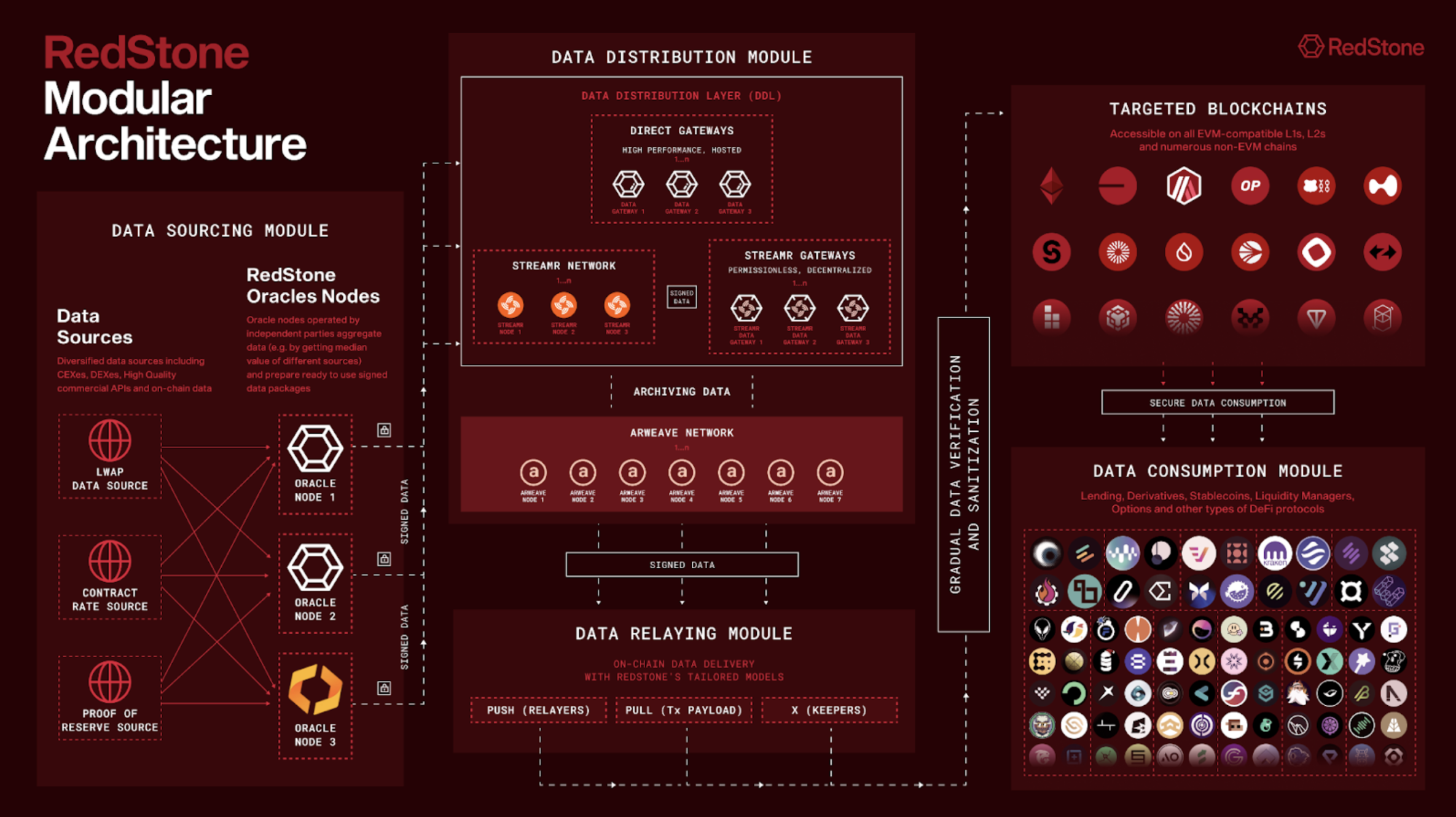

RedStone’s modular oracle stack allows it to support new chains, use cases and technologies significantly faster than competitors. It consists of four modules:

Data-sourcing module: Supports any modular pricing methodology including proof of reserve feeds, LSTs, LRTs, staked BTC, on-chain liquidity based feeds and more.

Data-distribution module: Supports multiple parallel oracle gateways including decentralized publicly run gateways and high-performance low-latency gateways.

Data-relaying module: Allows RedStone to support any oracle consumption model, including the push models used by all major lending protocols, pull models used by perp protocols, and any future model, such as ultra-low latency price feeds for upcoming chains.

Data-consumption module: Can be deployed easily to any chain, allowing RedStone to support any use case on any compatible blockchain with minimal scaling cost.

The project has raised $22.87MM USD from three rounds of private token sales.

As of February 25th 2025, the total and max supply of RED is 1,000,000,000 and the circulating supply upon listing will be 280,000,000 (28.00% of the total token supply).

Key metrics (as of February 25th 2025)

1. What is RedStone?

1.1. Project Mission & Value Proposition:

Project Mission: RedStone's mission is to become the most trusted data enabler for every use case on every blockchain.

Value Proposition: RedStone's modular oracle tech is built by builders for builders. RedStone delivers the most secure, accurate and reliable data feeds on the market in Push, Pull and bespoke models. RedStone’s modular oracle stack allows to support any asset, on any chain, for any use case.

1.2. Project Key Highlights:

In 2024 RedStone became the first oracle to support Liquid Restaking Tokens, and was adopted by EtherFi, Renzo, Kelp DAO and Puffer finance.

In 2024 RedStone became the first oracle to support yield-bearing stablecoins, was adopted by Ethena Labs, and later USDX, Elixir, Resolv.

RedStone developed the first BTC staking oracle, which was adopted by Lombard Finance and later pumpBTC, Lorenzo and Solv.

The only oracle implementing AI Agents communication framework CLARA.

RedStone has been the oracle of choice for every major new chain launching in 2024 and 2025, including Kraken's Ink L2, Unichain, Movement, Story, Berachain, Sonic, Soneium and more.

In 2025 RedStone became the first top oracle with an AVS.

In 2025 RedStone was added to Spark Protocol's oracle configuration, one of the largest DeFi lending protocols.

Status as of February 18th 2025

Status as of February 18th 2025

1.3. Existing Products:

RedStone is a top 3 oracle by the number of Clients & cumulative TVL protected, securing over $7B USD in TVS. RedStone's growth is explosive. In 2024 user growth increased by over 500%, and Total Value Secured by over 6000%.

RedStone is the only oracle that supports any data model, including push feeds, used by major lending protocols, and pull feeds, used by high speed perp protocols and low latency blockchains.

RedStone supports 78 blockchains and over 1,250 unique assets, more than any other oracle.

2. Technical Infrastructure:

RedStone: The Modular Innovation

Deep price discovery: RedStone price feeds source exchange rates not only from CEXes but also directly from on-chain trading venues (DEXes), enabling faster, more secure and versatile asset support than any competitor.

Product Offering: Price feeds engineered for quantitative needs, including LST and LRT feeds and Proof-of-Reserve feeds for BTC staking protocols.

Modular Innovation: Seamless support from AVS and RedStone OEV to low latency feeds, RedStone advances on multiple verticals as the complete oracle.

Security: Leverages EigenLayer AVS, with the ability to tap into $14B in economic security as needed.

Four Key Modules:

Sourcing Module: RedStone’s price feeds are sourced from a wide range of providers, including centralized exchanges like Binance, decentralized exchanges (DEXs) such as Uniswap, and aggregators like CoinMarketCap. With over 180 integrated sources, RedStone ensures robust data coverage.

Data Distribution Module: After the initial stage of price feed creation, in which asset data is gathered through proprietary fetchers and processed by a network of nodes—the data lands in the data distribution module. The Data Distribution Layer (DDL) is essential for ensuring data is accessible to the complementary modules that handle delivery to the destination chain. The DDL is a low-latency, highly scalable intermediary which temporarily stores the data, allowing it to be delivered onchain at a specified time using a preselected oracle model.

Data Relaying Module: Efficient and secure data transfer onto the blockchain involves embedding an additional payload within a user’s transaction and relaying the message to the directly on-chain environment. Simply put, data such as an asset’s price is embedded within the transaction trace that constitutes a user’s transaction. This is achievable because blockchains function as ledgers, systematically recording updated versions of information referred to as the state.

Data Consumption Module: Once the data package is delivered through one of the RedStone models, the unpacking process begins. This involves gradual data verification and additional sanity checks, all performed on-chain within the destination blockchain network where the price feed will be delivered.

RedStone Modular Architecture

RedStone Modular Architecture

Data Integrity With Signatures & Natively Cross-Chain Oracle:

Data integrity is ensured through the use of cryptographic signatures, with each data point signed by Data Providers. These signatures are verified on-chain, guaranteeing the authenticity of the data. As a result, the RedStone flow seamlessly inherits the robust security properties of the destination blockchain, maintaining trust and reliability throughout the process.

Exactly how modular is RedStone’s design?

RedStone’s modular architecture delivers scalability, security, and efficiency, enabling integration of new assets, reduced latency, and support for new networks. Its interchangeable components—data sources, validation mechanisms, and delivery methods—allow seamless updates and enhancements without disrupting operations. Here’s an illustration highlighting which components are interchangeable:

RedStone Design as Actively Validated Service (AVS)

Since RedStone’s infrastructure is fully modular, the data distribution and aggregation modules can also be implemented as an Actively Validated Service (AVS) leveraging shared security technologies like EigenLayer, enabling greater decentralization of both data distribution and aggregation. The RedStone AVS module shifts data validation off-chain, drastically reducing onchain gas costs.

RedStone AVS

RedStone AVS

3. Token Sale and Economics:

3.1. Token Distribution:

3.2. Token Release Schedule:

4. Roadmap & Updates:

4.1. Completed Milestones:

4.2. Current Roadmap:

Looking ahead will focus on fundamentals that merge on-chain finance with DeFi and the progressive AI revolution, driving the future of on-chain activity as more financial use cases will be emerging on blockchains. The key areas of focus will be:

Q1 2025:

Research, improvements and new use cases in the restaking sector including a big focus on Bitcoin staking primitives on top of Babylon.

Improving capital efficiency in DeFi and on-chain finance via Oracle Extractable Value (OEV) and adjusting collateral factors based on RedStone’s highest performance.

Q2 2025:

Creation of bespoke Real-World Asset (RWA) and Proof of Reserves (PoR) products for institutions, utilizing advanced Zero-Knowledge cryptography.

Exploration of new and exploitation of existing AI use cases that can be leveraged for oracles effectuality and further expansion of CLARA framework.

Creation of tailored RedStone Lightning product offering near-zero latency of price feed updates as the fastest possible oracle implementation.

Q3 2025: Introduction of bespoke offering allowing to onboard seamlessly corporate and institutional players on-chain at scale.

4.3. Commercial and Business Development Progress:

EigenLayer: RedStone is the first major oracle to be secured by restaking with RedStone AVS on EigenLayer. RedStone feeds can leverage the $10B restaked in EigenLayer for economic security, alongside restaked RED once live.

Unichain: L2s chose RedStone as the official oracle launch partner providing price feeds.

Aave: Biggest lending market and protocol in DeFi integrated RedStone feeds on Avalanche Spruce testnet.

Spark Protocol: Built on MakerDAO’s infrastructure, Spark Protocol is a leading lending and borrowing platform with over $5B in TVL that decided to integrate RedStone price feeds enhancing its oracle security.

Pendle: Leading yield-trading protocol is leveraging RedStone price feeds for LSTs and LRTs on cross-chain deployments like L2s and BNB Chain, ensuring accurate and real-time valuations for yield-bearing assets.

Berachain: Most Berachain ecosystem protocols (15+, including major ones like Dolomite and Beraborrow) rely on RedStone price feeds.

Story: A decentralized IP infrastructure network is leveraging RedStone data feeds as the major oracle partner. RedStone is live on Story with both price feeds and CLARA - communication and value exchange layer for autonomous agents.

Ethena: RedStone was the first oracle providing secure and real-time price feeds to support the USDe & sUSDe synthetic dollar ecosystem and enabling for DeFi integrations. RedStone is a key oracle partner for Ethena, soon supporting USDtb feed.

Movement: RedStone is the launch oracle partner for Movement, providing oracle support across the entire Movement environment, ensuring reliable and scalable data for its modular L2 ecosystem.

EtherFi: RedStone was a major oracle provider for liquid restaked Ether.fi assets, delivering secure and efficient price feeds to support weETH and other restaked assets across DeFi. As part of its commitment to advancing oracle security, Ether.fi has allocated up to $500MM in restaked assets to RedStone AVS, making it the first major deal securing oracles through EigenLayer’s restaking mechanism.

Morpho: An innovative lending market that enables highly customizable lending vaults through Morpho Blue, giving DeFi users greater flexibility and risk control. RedStone supports Morpho’s lending markets with its price feeds.

Hyperliquid: RedStone is live on HyperEVM, providing secure and efficient price feeds, for the official Aave fork, HyperLend. Additionally, RedStone is the exclusive oracle partner for HyperBeat.

5. Community:

6. Appendix: