Summary

Global Risk-On Sentiment: Bitcoin and U.S. stocks soar, both hitting new all-time highs.

Washington's "Crypto Week": U.S. legislation marks a historic shift, aiming to "win the Web3 race."

New Corporate Treasury Trend: From "Bitcoin treasuries" to "diversified digital assets," institutional adoption accelerates.

Inflation Watch: Upcoming CPI data could show a tariff-driven acceleration, testing market sentiment.

Q2 Earnings Key Inflection Point: High valuations meet lowered forecasts, posing a key test for market optimism.

Market Overview

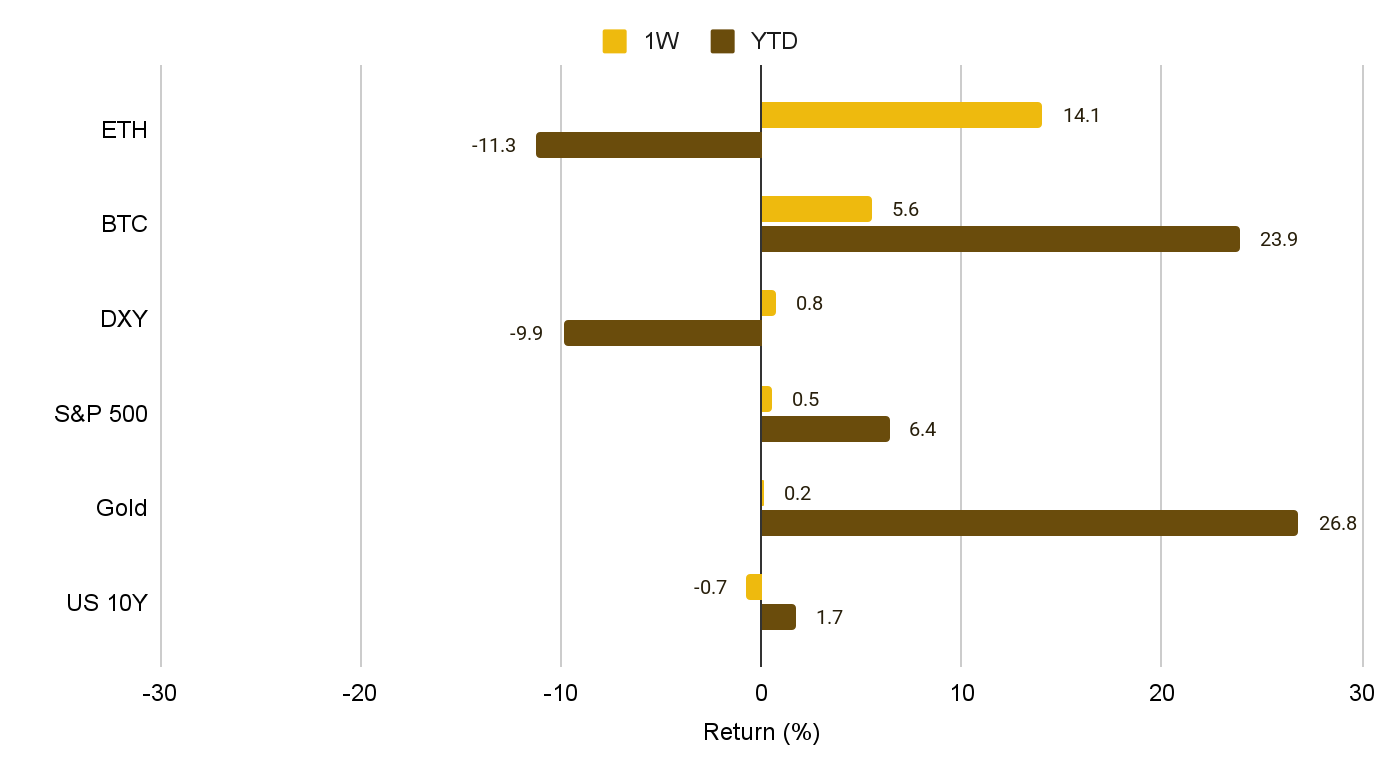

Over the past week, macro capital markets remained risk-on as investors rotated out of defensive sectors to chase AI, tech, and cyclical stocks. U.S. markets saw a 12th consecutive week of inflows into crypto spot ETPs, setting a record and driving BTC prices alongside Nasdaq and S&P indices to new all-time highs. Significant inflows into emerging markets further confirmed the global risk-on sentiment. Meanwhile, with peak trade and geopolitical risks fading, gold and oil entered a consolidation phase.

Figure 1: Weekly and YTD Performance – Crypto and Global Market Assets

1. Digital Assets

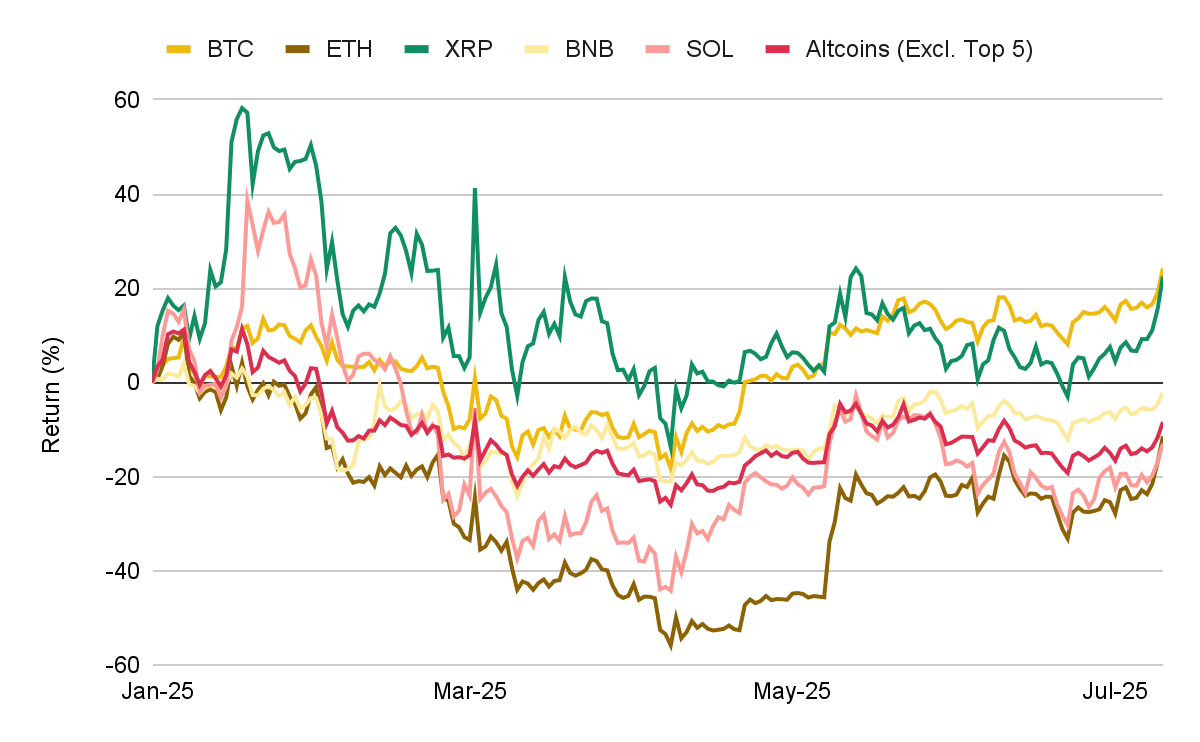

Cryptos delivered a strong performance over the past week. BTC reached a new all-time high, with even stronger momentum observed in Altcoins. Consequently, BTC Dominance slightly decreased to 63.8%, its lowest level in three weeks. Key themes to note include:

Price Action & Market Sentiment: Bitcoin's price surged, continuously rising to a peak of US$118,200 after breaking its all-time high on July 9. The total crypto market capitalization approached US$3.67 trillion. The Crypto Fear & Greed Index stood at 67, indicating a "Mild Greed" market sentiment that is not yet overheated.

Institutional Capital Inflows: A core driver of this rally is sustained institutional demand. The total assets under management (AUM) for crypto ETFs surpassed the US$160 billion mark. This growth was fueled by new ETF applications, corporate adoption of Bitcoin on balance sheets, and innovative products like in-ETF staking.

Treasury Strategy Expanding: The trend of corporations adding cryptocurrencies to their reserves is accelerating and diversifying. This week, Thumzup Inc. announced the addition of XRP and DOGE to its Bitcoin-dominated corporate treasury, a move involving Donald Trump Jr. Concurrently, Binance founder CZ indicated on social media that over 30 teams are interested in launching public companies with BNB treasury-related strategies. This signals a narrative shift from a singular "Bitcoin treasury" to a more diversified "digital asset treasury" strategy, potentially unlocking significant capital inflows for major altcoins and legitimizing them as corporate reserve assets.

Figure 2: YTD Indexed Performance – Major Digital Assets

2. Global Markets

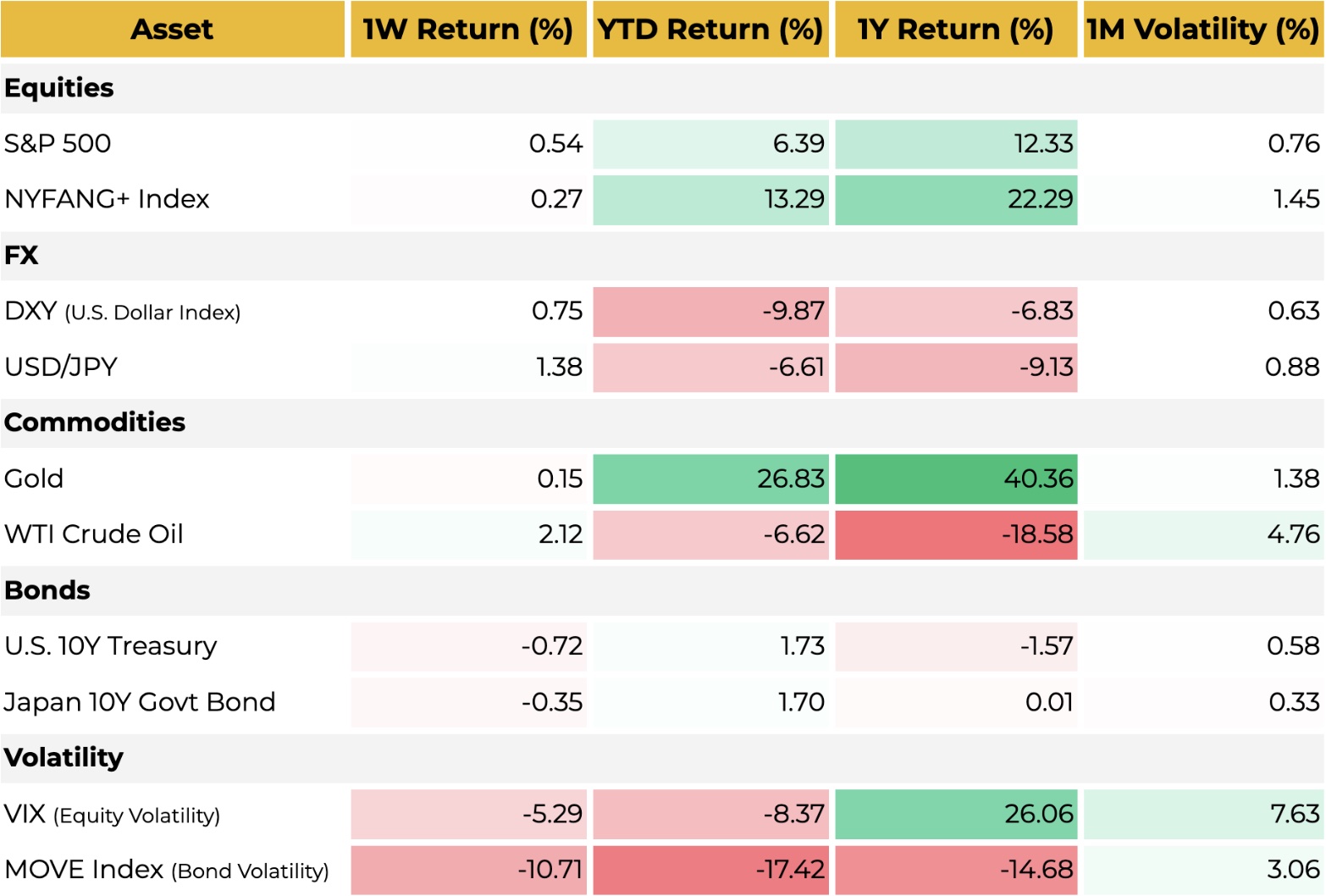

Figure 3: Multi-Asset Performance – Equities, FX, Commodities, Bonds, Volatility

Equities:

After reaching an all-time high, U.S. stocks experienced a brief pullback on Monday following the announcement of a new tariff list. However, the market appeared to have largely priced in the tariff rhetoric and did not overreact, with equities gradually recovering their losses.

Tesla shares plunged as much as 8% this week, although they later recovered most of the losses, after CEO Elon Musk announced the formation of the "American Party" to enter politics, sparking market concerns about his divided focus. However, Musk's suggestion that the new party would favor centrism, deregulation, reduced government spending, and support for Bitcoin (BTC) garnered support from the crypto community.

Bonds:

Yields initially jumped after the passage of the "One Big Beautiful Bill" (OBBB) on July 3 due to concerns over U.S. fiscal sustainability. However, good result of 10&30 year Treasury auctions this week caused yields to fall across the board, with the 10-year yield dropping from 4.42% to 4.36%.

Commodities:

Gold was little changed this week. Crude oil prices rebounded slightly, as a higher-than-expected official selling price from Saudi Arabia and concerns that tariffs could disrupt global supply chains outweighed the negative impact of increased production. President Trump's announcement of a 50% tariff on copper caused its price to surge by over 13%.

FX:

The U.S. Dollar Index (DXY) consolidated in a narrow range of 97.5-97.7 this week, showing little change after falling to a three-year low earlier in the month.

Volatility:

The VIX index fell 5% this week to a 4.5-month low, driven by optimistic sentiment in the stock market as peak macro risks from trade and geopolitical conflicts receded.

3. Intermarket View

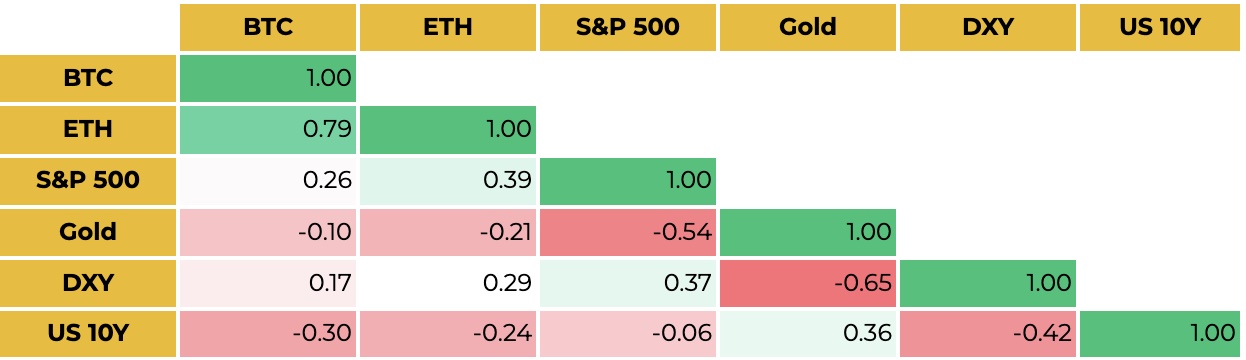

BTC and ETH correlation has further strengthened as ETH finally caught up with BTC’s rally. The slight increase in crypto’s positive correlation with the S&P 500 reflects its alignment with the broader global risk-on sentiment.

Figure 4: BTC 2M Correlation Matrix (vs ETH, S&P 500, Gold, DXY, US 10Y)

Macro Outlook: Strong NFP, Asymmetric Fed, Tariffs Materialize

The Federal Reserve's meeting minutes confirmed the market's existing knowledge of a "divided" view among officials. While most believe a rate cut is warranted this year, a cut in July is unlikely, and there is "considerable uncertainty" about the ultimate impact of tariffs. As such, the minutes had no significant market impact.

The June Non-Farm Payrolls (NFP) report superficially beat expectations with 147,000 jobs added (vs. consensus of ~129,000), and the unemployment rate fell from 4.2% to 4.1%. While this data was strong enough to "close the door on a July rate cut," it was also positive enough to bolster market sentiment around economic growth.

The U.S. is currently implementing a combination of policies with opposing effects: tariffs are contractionary, aimed at curbing imports and demand, while the tax cuts from the OBBB are expansionary, designed to stimulate domestic investment and consumption. This policy conflict has effectively hedged some risks, reducing overall market anxiety.

Monetary Policy Observation

The Fed's policy bias is currently asymmetric. Given the backdrop of declining inflation and a gradually slowing labor market, the threshold for the Fed to adopt a more hawkish stance than the market expects is very high. Unless inflation not only rebounds due to tariffs but also shows persistence and clearly leads to unanchored expectations, the likelihood of the Fed delaying its pivot is low. Therefore, the risk balance appears tilted toward the Fed cutting rates as expected, or potentially adopting more aggressive easing if political pressures intensify.

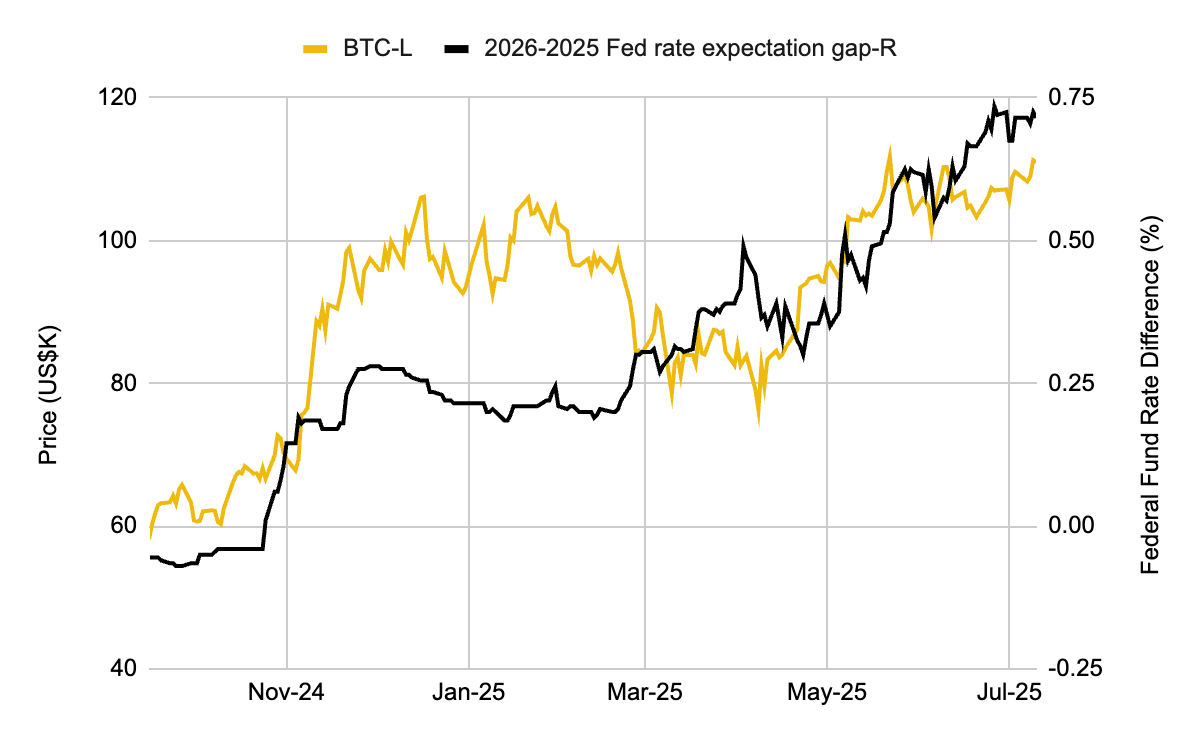

In fact, although rate cut expectations for this year have remained stable at around two cuts for the past two months, the market's expectation for the spread between the Fed funds rate at the end of 2026 and 2025 has been continuously widening. This indicates that the market is increasingly pricing in a more dovish Fed next year.

Figure 5: Market expectations for rate cuts next year keep rising

This potential dovish policy shift, combined with fading economic tail risks, creates a "Goldilocks" market backdrop — an economy that is neither too hot nor too cold, which is favorable for risk assets. Despite concerns about high valuations, global equity markets, particularly in the U.S., have already reacted positively.

The Impact of Tariffs is Set to Materialize

While the above view is based on a six-month outlook, a monthly observation suggests a risk of inflation picking up after July, which could cause market sentiment on rate cuts to waver.

Although inflation data has so far shown no impact from tariffs, this lag is expected due to three main factors: the largest tariffs only took effect in early April, customs authorities are allowing importers to delay payments, and companies have been front-loading inventories. These factors have postponed the pass-through of tariff costs to consumer prices. Goldman Sachs, for example, predicts that tariffs will push up core PCE by about 1 percentage point by December, bringing annual inflation to 3.3% (2.3% excluding the tariff impact). While the Fed has indicated it views tariff effects as largely one-off so unlikely to change its stance—the risk of resurgent inflation data shaking market confidence cannot be dismissed.

Q2 Earnings Season: Another Key Inflection Point

Despite the current positive macro sentiment, it is important to note that we have entered the Q2 earnings season for U.S. stocks, with a peak of high-profile corporate data releases expected after July 15. According to FactSet, the forward 12-month P/E ratio for the S&P 500 is currently 22.2x, which is above the 5-year average (19.9x), the 10-year average (18.4x), and the ratio at the end of Q1 (20.2x), indicating relatively high market valuations.

Furthermore, analysts have recently made unusually sharp downward revisions to their forecasts. The estimated earnings growth rate for Q2 2025 is now only 5.0% (compared to 9.4% estimated on March 31), the lowest since Q4 2023 (4.0%). Full-year 2025 EPS estimates have also been significantly reduced, falling 3.6% from $274.12 at the beginning of the year to $264.16. Therefore, unless actual results significantly exceed expectations, this level of earnings growth could limit the overall upside for the U.S. stock market and curb further optimistic sentiment.

Trade Developments

This week, President Trump signed an executive order extending the deadline for tariff decisions from July 9 to August 1. Concurrently, the White House announced that unless a new trade agreement is reached by August 1, it will impose high tariffs of 25% to 40% on 14 specific trading partners. Many market participants believe these new rates will generally not be implemented, but certain countries remain at risk. This creates an asymmetric risk profile for the overall U.S. effective tariff rate (ETR): it is unlikely to decrease further, while the probability of an increase is higher.

Countries that received tariff warning letters include: Japan, South Korea, Malaysia, Thailand, Indonesia, Cambodia, Bangladesh, South Africa, Bosnia, Kazakhstan, Laos, Myanmar, Serbia, and Tunisia.

Potential Impact: If the tariffs on these countries and the previously announced tariffs on Vietnam are fully implemented, it would add another 1.4 percentage points to the U.S. ETR.

Notable "Exceptions": Major trading partners such as the European Union, India, Taiwan, and Switzerland did not receive similar letters this time, which the market has interpreted as a positive signal that they may be better positioned to avoid the new round of tariff shocks.

In Bitcoin's limited history, the last major U.S. tariff hike occurred in 2019. That year, Bitcoin's price saw an intra-year volatility of 285% and a full-year gain of 94%. Year-to-date, Bitcoin's volatility has been 46% with a 25% gain, significantly lower than in 2019.

The Week Ahead

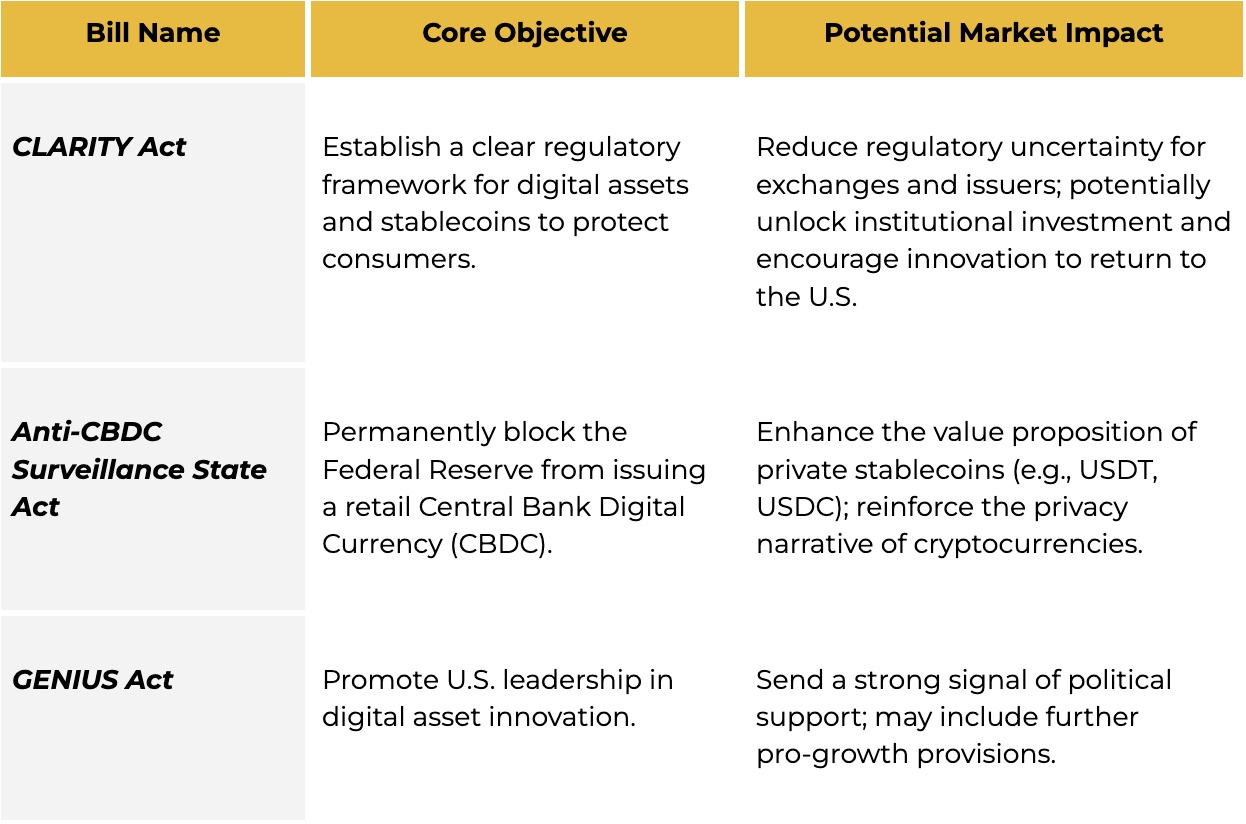

The political attitude in the U.S. towards the crypto industry is undergoing a historic shift from general skepticism to proactive legislative promotion.

The week beginning July 14 has been declared "Crypto Week" by the U.S. House of Representatives, with plans to vote on three significant crypto-related bills. This move is explicitly framed as part of an effort to "make America the crypto capital of the world" and "win the Web3 race."

Figure 6: Overview of Proposed U.S. Crypto Legislation ("Crypto Week")

On the economic data front, the next key test for the market will be the U.S. CPI data on Tuesday. After several months of soft data, the June CPI report is expected to show an acceleration in inflation, particularly in core goods, due to the impact of tariffs. The pass-through effects of tariffs are expected to become more pronounced in the coming months, potentially raising new inflation concerns in Q3 2025. However, as mentioned earlier, the June CPI data alone is unlikely to alter the Fed's stance.

Figure 7: Key Macro and Crypto Events for the Week of July 11–July 17, 2025