Key Takeaways:

Bitcoin forms a bearish engulfing candle after a 19% rally, signaling possible near-term pullback.

Miners’ Position Index hits highest level since Nov. 2024, while profit-taking reaches a record $9.29B.

Despite selling pressure, over 196,600 BTC was accumulated between $116K–$118K, reinforcing bullish conviction.

Bitcoin (BTC) is showing its first major bearish signal in over two months, encountering resistance around the $120,000 level amid record-high open interest and a spike in miner selling. Yet key support levels and heavy accumulation zones suggest the long-term bullish outlook remains intact.

Bearish Candle Hints at Cooling Momentum

On the daily chart, BTC printed a bearish engulfing candle, confirmed by a shooting star pattern, following a 19% price surge in just 21 days. This technical formation signals potential short-term exhaustion.

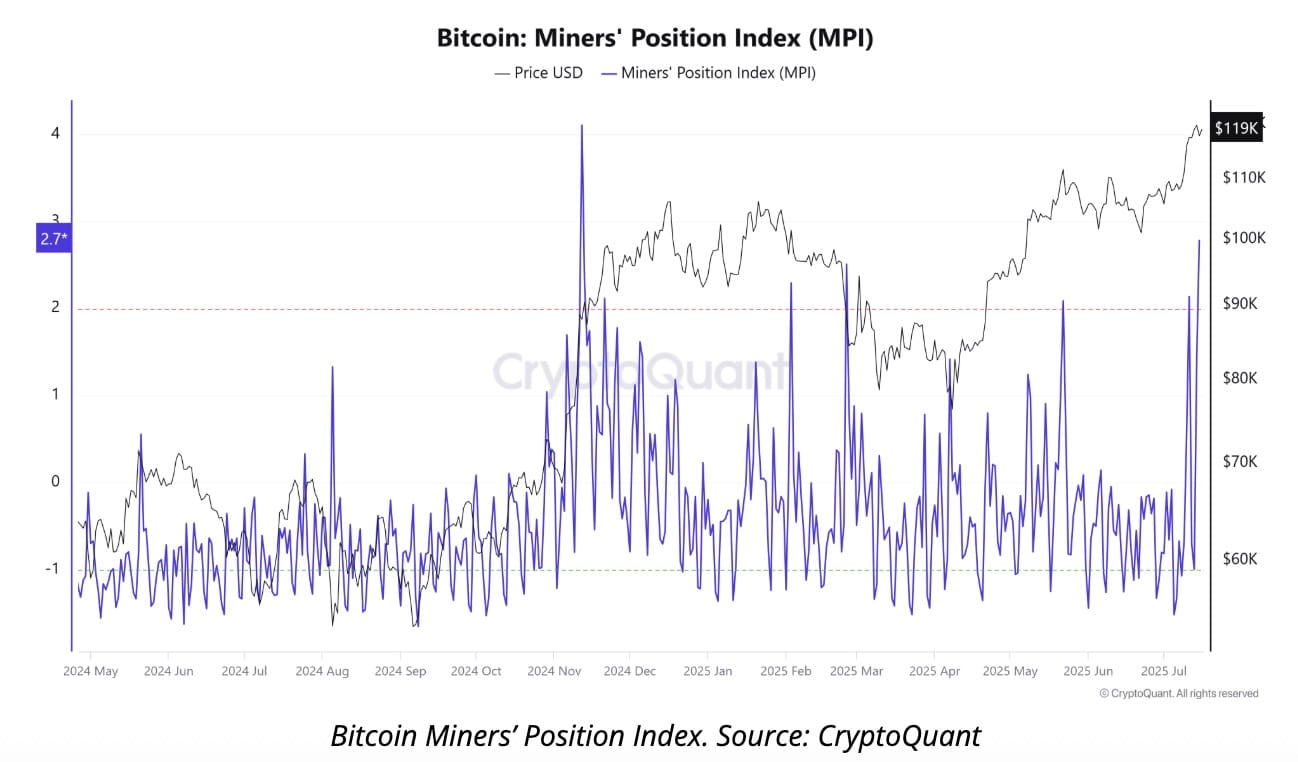

Adding to that caution, CryptoQuant data shows the Miners’ Position Index (MPI) surged above 2.78, its highest since November 2024. A high MPI reading implies that miners are sending more Bitcoin to exchanges — often a sign of selling pressure.

Meanwhile, realized profit and loss (P&L) from BTC moved to centralized exchanges hit an all-time high of $9.29 billion, indicating aggressive profit-taking behavior.

Frothy Open Interest and Market Sentiment Raise Caution

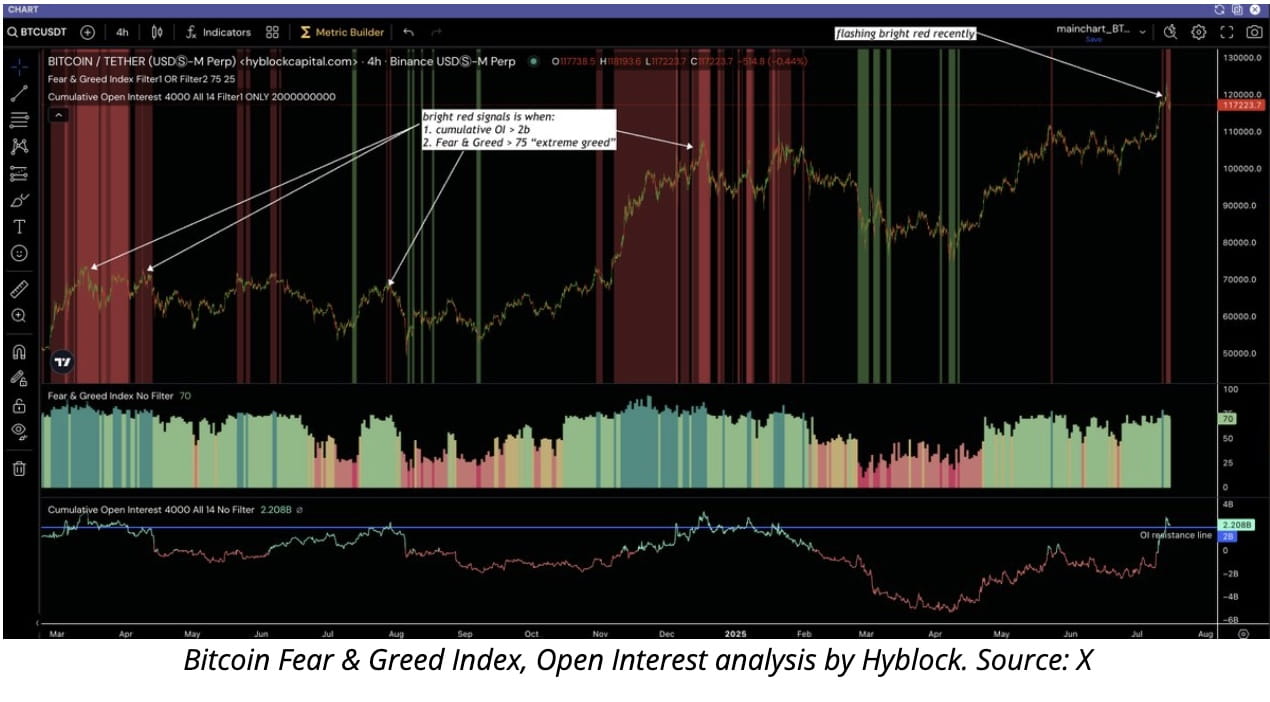

According to Hyblock Capital, Bitcoin’s open interest is nearing “frothy” levels. Combined with the Fear & Greed Index hovering in "Extreme Greed", historical data suggests a heightened probability of local tops and short-term corrections.

Crypto analyst Crazzyblockk noted that these conditions typically mark high-risk zones, though they rarely result in immediate trend reversals.

“Historically when both open interest is frothy and sentiment is extremely greedy, local tops form — but the cooling-off period may span days or weeks,” the analyst said.

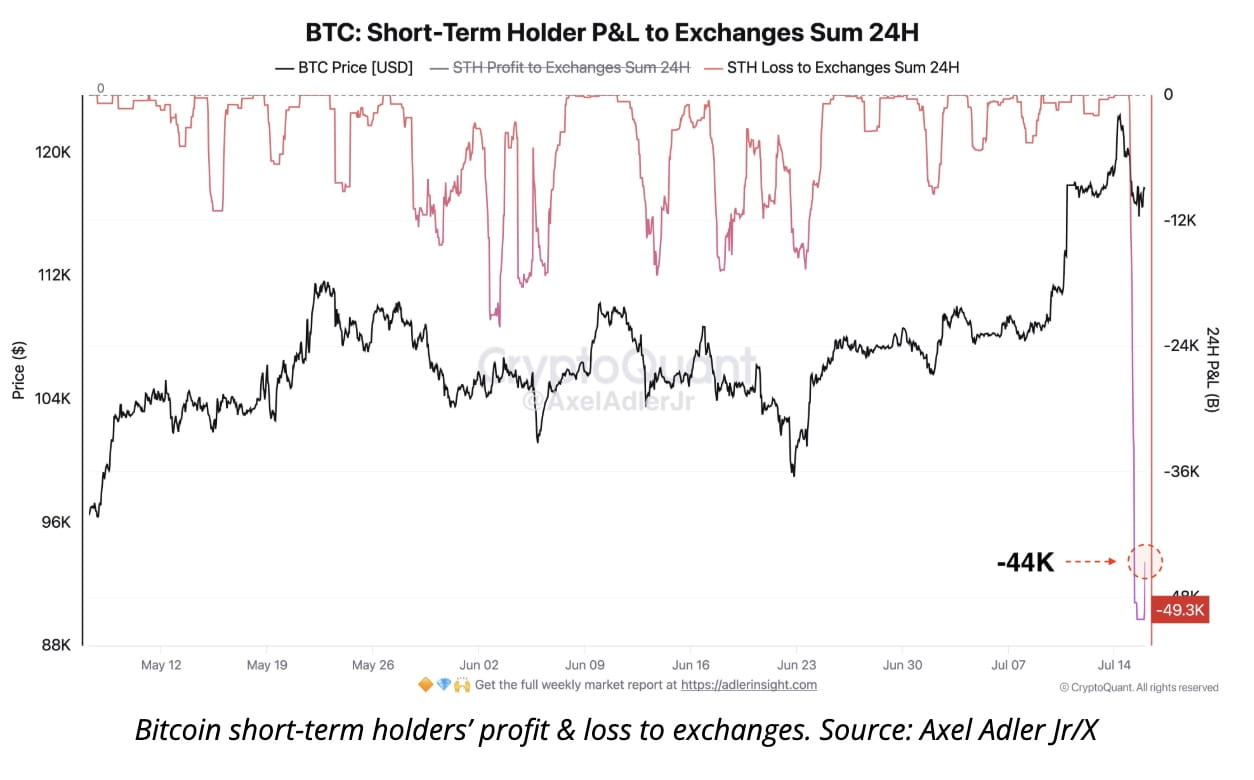

Dip Buying Remains Strong Despite Panic Selling

In the past 24 hours, nearly 50,000 BTC was sold at a loss, highlighting investor fear. However, onchain data from researcher Axel Adler Jr. reveals that over 196,600 BTC — worth more than $23 billion — was accumulated between $116,000 and $118,000, signaling strong buying support at the dip.

This substantial demand reinforces confidence that institutional and retail buyers continue to see Bitcoin as a long-term store of value, even amid short-term volatility.

Long-Term Bullish Structure Intact

As long as BTC holds above the $112,000 support zone, the broader bullish market structure remains valid. Analysts suggest the current pause is a healthy consolidation phase that helps flush out excess leverage and weak hands, especially following an overheated run-up.

While Bitcoin’s resistance at $120K may lead to near-term pullbacks due to rising open interest, miner selling, and profit-taking, bullish conviction remains high. Key support between $112K–$116K is critical to watch — and any sustained move above $122K could reignite bullish momentum toward new highs, according to Cointelegraph.