Not Because of Hopium. Because the Data Demands It.

Everyone says “never go all in.”

I did.

Not on memes.

Not on influencer calls.

But on pure macro, liquidity, and structural signals that scream one thing: Bitcoin’s bottom is in — and the next leg is loading.

This isn’t just another “bullish thread.”

This is the full playbook.

The Setup: Why Now, Not Later

Crypto’s been wrecked for months.

Retail’s gone quiet, alts are bleeding, sentiment is near historic lows — and that’s exactly what the smart money loves.

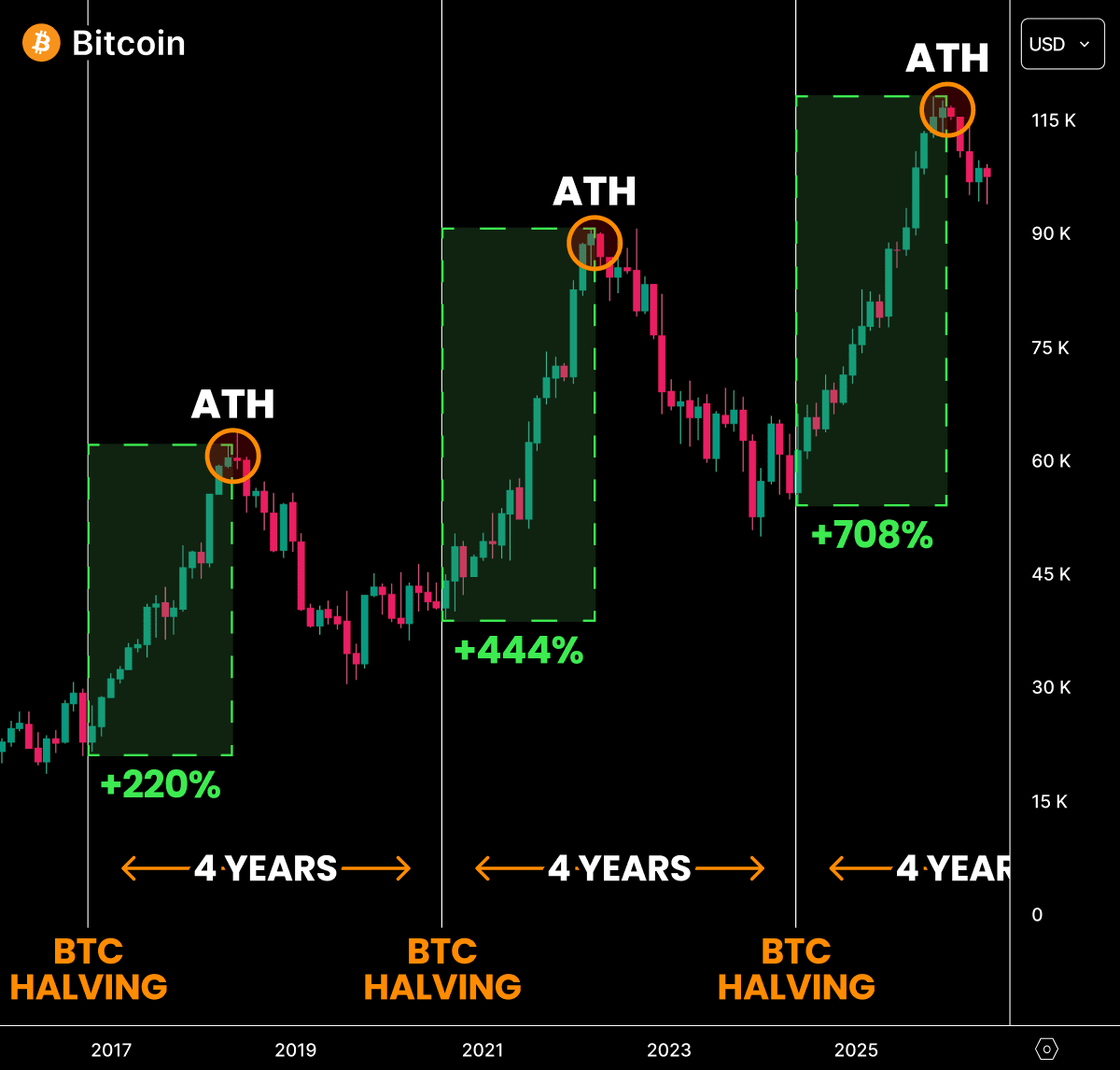

The same conditions appeared in:

Late 2018 before BTC 20x’d

March 2020 before the world went parabolic

Late 2022 before ETF speculation began

Every cycle bottom is wrapped in fear, not hype.

Now, zoom out. The macro setup is aligning perfectly again.

Macro Is the Silent Bull

Forget charts for a second.

Look at what’s happening globally:

Credit expansion continues → Liquidity’s coming back.

QT ends this December → More fresh capital hits risk assets.

Rate cuts in 2025 → Cheap money = risk-on.

Fed balance sheet expanding again → They’re printing quietly.

Every one of those events has historically pushed Bitcoin higher within 3–6 months.

You don’t fade liquidity. You front-run it.

The False Signal Everyone’s Afraid Of: “Death Cross”

Everyone on CT’s screaming about the Death Cross.

They always do right before the reversal.

Look at history:

In 2023 → Death Cross marked the local bottom.

In 2024 → It came right before the rally.

In 2025 → It’s happening again, right as sentiment collapses.

It’s not a death signal.

It’s a reset indicator.

The Data: Not Even Close to a Top

There’s no blow-off top, no mania, no emotional volume spikes.

Retail’s not even here.

Google searches for “Bitcoin” are 70% below 2021 peak levels.

When everyone’s calm, that’s not the end — that’s the quiet accumulation phase.

The Genius Act: The Legal Catalyst No One’s Watching

Here’s where things get really interesting.

The Genius Act, passed under the radar, essentially makes stablecoins backed by U.S. reserves.

That means:

Big money can now legally deploy capital into stables → crypto rails.

Institutional risk is minimal.

The wall of money that was waiting on compliance? It’s moving.

In other words, regulation just flipped bullish.

The Structural Squeeze

Global sovereign debt keeps growing.

Currencies are bleeding.

Funds and family offices are quietly rotating into hard assets again — and Bitcoin sits at the very top of that food chain.

This isn’t a “crypto trade” anymore.

It’s a liquidity trade.

The Technicals Agree

Across all major timeframes:

Oversold signals on RSI

Funding rates normalized

Whale accumulation back at Q1 levels

Exchange balances hitting multi-year lows

Combine that with institutional cold wallets spiking — and it’s clear:

Big money is buying this dip, not selling.

The Equation That Matters

Liquidity + Fear + Oversold = Acceleration Phase

We’ve seen this movie before.

The first act is disbelief.

The second is rotation.

The final act is euphoria — and it hasn’t even started yet.

My Play: 100% BTC. No Diversion.

I’m not betting on memes.

Not chasing microcaps.

Not rotating into hype narratives.

I’m betting on math, macro, and market memory.

And every one of those says the same thing:

“We’re closer to the next all-time high than the next collapse.”

What Comes Next

Here’s my personal forecast:

BTC → Stabilizes between $100K–$120K

ETH → Breakout toward $8K

Alts → Start rotating 4–6 weeks after BTC confirms range

New narratives (AI, RWAs, FHE) lead Q1 2026

If we break below $95K?

I’ll reassess.

If not — this is the bottom before the next 2x.