Linea Labs, created by ConsenSys—the powerhouse behind MetaMask and Infura—has emerged as one of the most advanced zkEVM (Zero-Knowledge Ethereum Virtual Machine) networks in the Layer 2 space. Its vision is clear: scale Ethereum while preserving its core values of security, compatibility, and decentralization. By ensuring deep EVM equivalence, Linea enables developers and users to experience Ethereum’s full functionality at a fraction of the cost and speed, creating an ecosystem that feels native, not separate.

🪙 The LINEA Token: A Model of Ecosystem Synergy

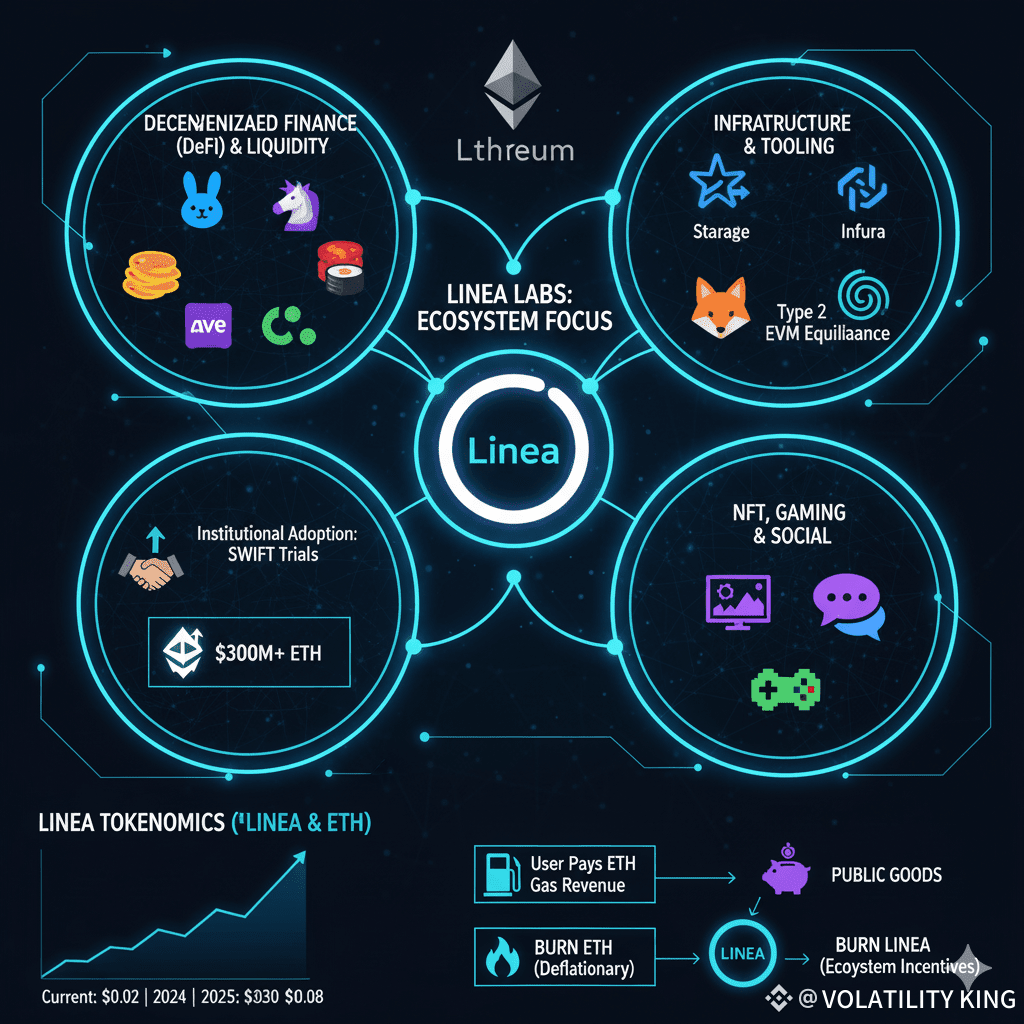

The LINEA token stands at the heart of the network’s architecture, crafted with an innovative tokenomic framework that mirrors Ethereum’s own growth cycle.

💎 ETH as the Only Gas: Linea uses ETH exclusively for gas payments, aligning the network’s economic base with Ethereum’s monetary design. This ensures consistent liquidity flow and maintains Ethereum’s dominance as the ecosystem’s settlement layer.

🔥 Dual-Burn Mechanism: A unique deflationary structure strengthens both Ethereum and Linea simultaneously.

• A share of ETH transaction revenue is used to buy back and burn ETH, supporting Ethereum’s deflationary model.

• The remaining portion is used to buy and burn LINEA tokens, ensuring that growing network activity directly decreases circulating supply.

🌱 Ecosystem Allocation: Up to 85% of LINEA’s supply is devoted to ecosystem incentives, liquidity provision, and developer growth—driving sustainable adoption rather than short-term speculation.

🌐 Linea’s Expanding Ecosystem: Powering Web3 at Scale

Linea’s rapid rise is anchored on three pillars: Institutional Trust, Developer Equivalence, and DeFi Liquidity. Each plays a critical role in making Linea a core hub for Ethereum-based innovation.

1️⃣ DeFi and Liquidity Layer

Low fees, instant finality, and high throughput have turned Linea into a magnet for DeFi giants.

• DEXs: Platforms like Uniswap, SushiSwap, and PancakeSwap V3 have deployed, while Etherex and Lynex are building strong native ecosystems with growing trading volume.

• Lending Protocols: Heavyweights such as Aave and Curve now operate on Linea, delivering capital efficiency and DeFi infrastructure essential to market liquidity.

• Institutional Adoption: The network’s credibility is reinforced through institutional use cases, including SWIFT trials and partnerships with firms like SharpLink Gaming, which allocated significant ETH reserves for staking and yield optimization on Linea.

2️⃣ Infrastructure and Tooling Layer

Linea’s Type 2 EVM equivalence guarantees total compatibility with Ethereum’s developer stack.

• Bridges: Integrations with Stargate and Across enable seamless, secure cross-chain transfers.

• Tooling Integration: Native connectivity with MetaMask and Infura ensures instant accessibility for both developers and users, minimizing friction in dApp deployment.

3️⃣ NFTs, Gaming, and the Social Frontier

Beyond DeFi, Linea’s efficiency is attracting NFT and gaming projects that depend on low latency and scalability.

• NFT Marketplaces: Lower minting and trading costs drive creative expansion in digital collectibles.

• Gaming Ecosystem: Web3 games leverage Linea’s throughput to deliver fast, fluid gameplay without compromising user ownership or security.

🔮 Price Outlook: The Future of the LINEA Token

Linea’s deflationary design, strong institutional alignment, and deep Ethereum integration make it one of the most promising zkEVM projects in the market.

📈 Mid-Term (End of 2025): As the dual-burn system gains traction and institutional TVL surges, LINEA is projected to reach $0.04.

🚀 Long-Term (2030): Sustained ecosystem expansion, coupled with continuous burn pressure and a thriving DeFi base, could propel the token toward $0.08, cementing its role as a deflationary asset within the Ethereum economy.

Linea Labs is not just another scaling solution—it’s the architect of Ethereum’s next evolution, harmonizing innovation, efficiency, and trust into one seamless ecosystem.