Fidelity Investments has quietly launched an onchain tokenized share class of a U.S. Treasuries money-market fund on Ethereum, introducing the Fidelity Digital Interest Token (FDIT) for institutional clients.

Fidelity Takes Treasury Exposure Onchain With FDIT

FDIT is structured as an ERC20 token that records ownership, transfers, and settlement onchain, offering 24/7 transferability and operational features designed for institutions. The product is framed to provide blockchain-based bookkeeping with options for peer-to-peer (P2P) transfers and instant redemptions via stablecoins, while also aiming to interface with decentralized finance (DeFi) applications where appropriate.

According to materials describing the launch, the fund’s underlying exposure centers on OUSG (Ondo Short-Term U.S. Government Treasuries), a tokenized product backed by short-duration Treasuries and money-market instruments. OUSG is presented as accruing yield daily with no lockups, allowing FDIT to target Treasury-like returns while using Ethereum rails for issuance and transfer.

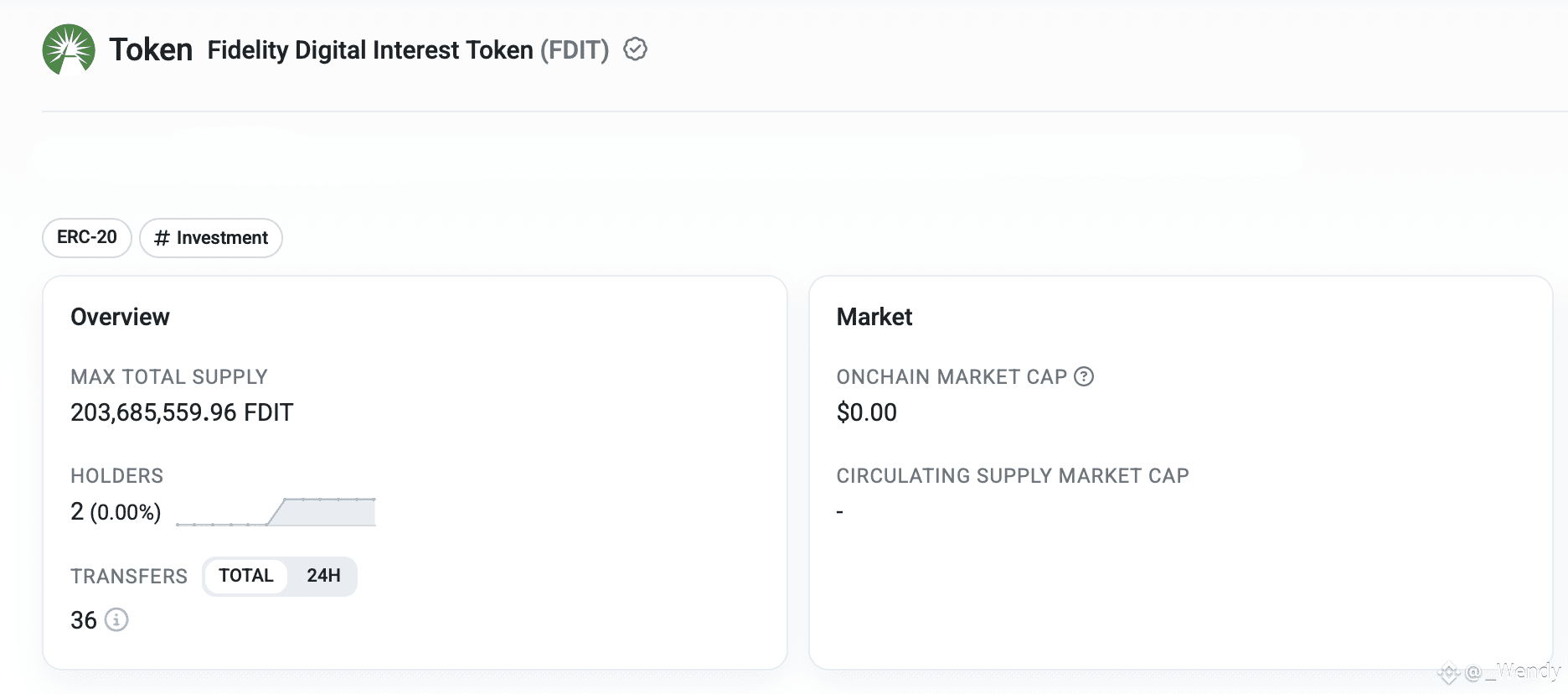

Fidelity’s onchain fund, according to etherscan.io stats.

Early scale figures place FDIT above $200 million in assets shortly after launch, with roughly 203.7 million tokens outstanding and a published contract address on Ethereum. The sponsor materials describe the token as a Fidelity-managed share class intended for qualified purchasers and institutional use.

Public documentation indicates Fidelity first signaled plans back in March 2025 under the name “Fidelity Treasury Digital Fund.” The onchain rollout drew attention from crypto proponents in early September without a formal press release, consistent with a “quiet launch” approach.

Fidelity’s move enters a market that already includes Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL), launched in collaboration with Securitize and currently reports to hold more than $2.2 billion in assets, according to rwa.xyz stats. FDIT is positioned as a direct competitor to BUIDL, with Fidelity’s distribution footprint cited as a differentiator.

Fidelity’s and many financial giants’ sponsors frame tokenized funds as part of a longer-term modernization of settlement and recordkeeping for traditional securities using public blockchain infrastructure.

Access to FDIT is described as limited to institutions that complete onboarding, with potential for broader availability over time. The financial product’s materials emphasize Ethereum’s liquidity and smart-contract tooling as reasons for deploying FDIT on that network.