Fidelity Asset Management has introduced a blockchain-based version of its Treasury money market fund, extending its digital finance presence.

The new product, called the Fidelity Digital Interest Token (FDIT), mirrors one share of the Fidelity Treasury Digital Fund (FYOXX) and is issued directly on the Ethereum network.

What is Fidelity Digital Interest Token (FDIT)?

According to RWA.xyz, the fund began operating in August with a portfolio that consists entirely of US Treasury securities and cash. Fidelity applies a 0.20% management fee, and Bank of New York Mellon is responsible for custody.

As of press time, its assets have already climbed to more than $200 million, though participation remains limited. Current records show the fund has just two holders—one with roughly $1 million in tokens and another managing the balance.

Fidelity Digital Interest Token (FDIT) AUM. Source: RWA.xyz

Fidelity Digital Interest Token (FDIT) AUM. Source: RWA.xyz

Fidelity has yet to comment on the fund publicly.

However, the fund’s launch builds on Fidelity’s earlier filing with the Securities and Exchange Commission (SEC), where it sought approval to add an on-chain share class to its digital Treasury fund.

That step signaled its commitment to real-world asset (RWA) tokenization, a trend gaining momentum across traditional finance.

Over the past year, global asset managers have been experimenting with blockchain rails to make markets more efficient, cut settlement times, and reduce costs.

This has drawn interest from traditional financial giants like BlackRock, the largest asset management firm in the world, already making significant progress in this market.

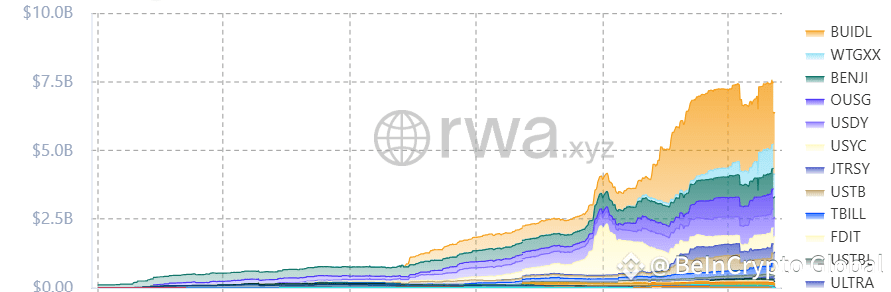

Over the past year, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has become the largest tokenized Treasury product, with a value of over $2 billion.

Notably, similar offerings from Franklin Templeton and WisdomTree have helped the broader market for tokenized Treasuries above $7 billion, according to RWA.xyz.

US Tokenized Treasuries. Source: RWA.xyz

US Tokenized Treasuries. Source: RWA.xyz

Considering the pace of this growth, analysts at McKinsey have estimated that tokenized securities could reach a market value of $2 trillion before the end of the decade.