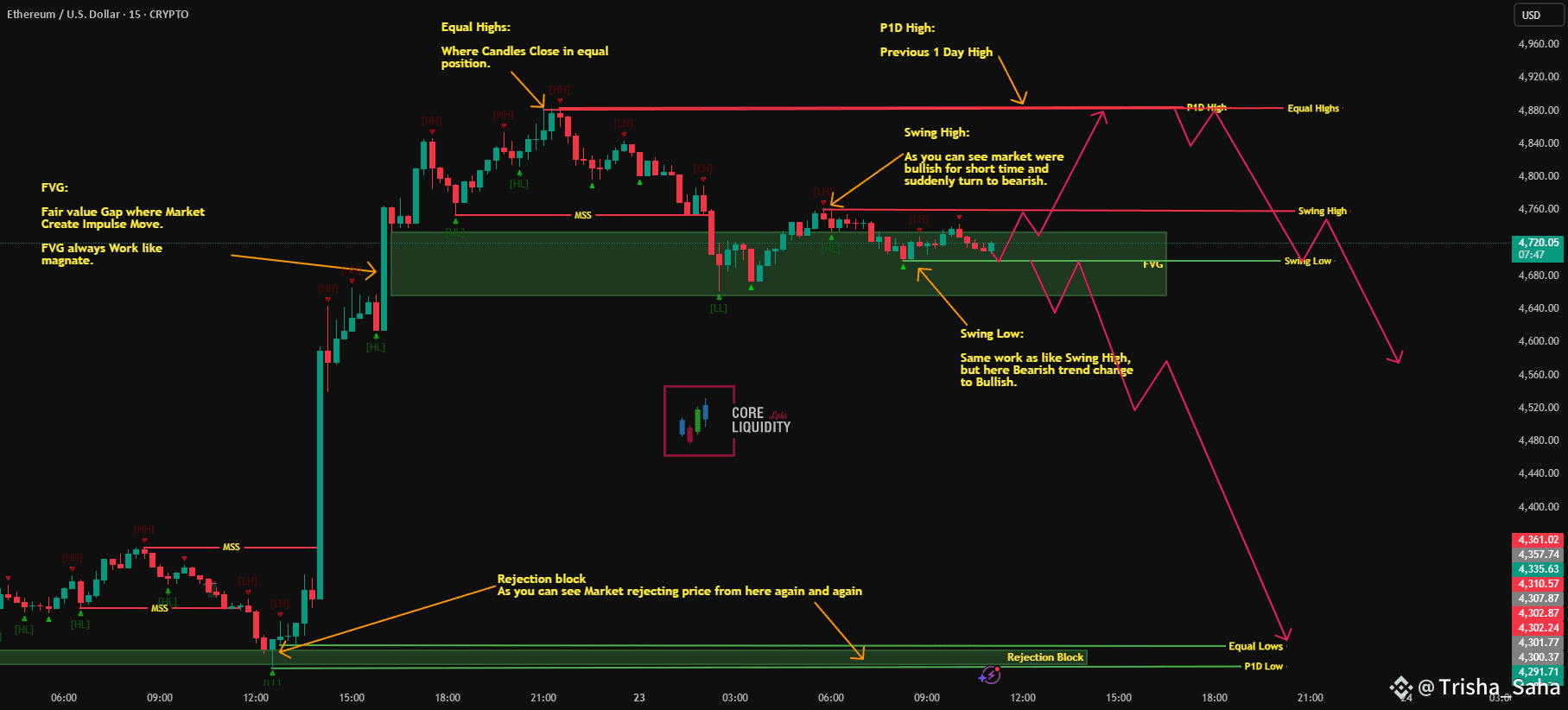

This chart highlights how market structure and liquidity zones interact, giving both trading opportunities and educational insights.

📌 Key Concepts on Chart

* FVG (Fair Value Gap): Acts like a magnet where price often returns to balance.

* Equal Highs: When candles close at the same level — liquidity builds here.

* Swing High: Short-term bullish momentum suddenly shifting bearish.

* Swing Low: Opposite of swing high — bearish momentum shifting bullish.

* Rejection Block: Zone where price rejects repeatedly, confirming strong demand or supply.

* P1D High / Low: Previous day’s high and low, important liquidity points.

📈 Bullish Idea

* Hold above swing low / rejection block

* Push into equal highs & P1D high

* Continuation possible toward liquidity above.

📉 Bearish Idea

* Failure at equal highs / P1D high

* Drop back through swing low

* Possible continuation toward equal lows / P1D low.

💡 Educational Note:

Market structure flows from Break of Structure → Retracement → Trade from POI (Point of Interest).

Patience to wait for liquidity zones is key.