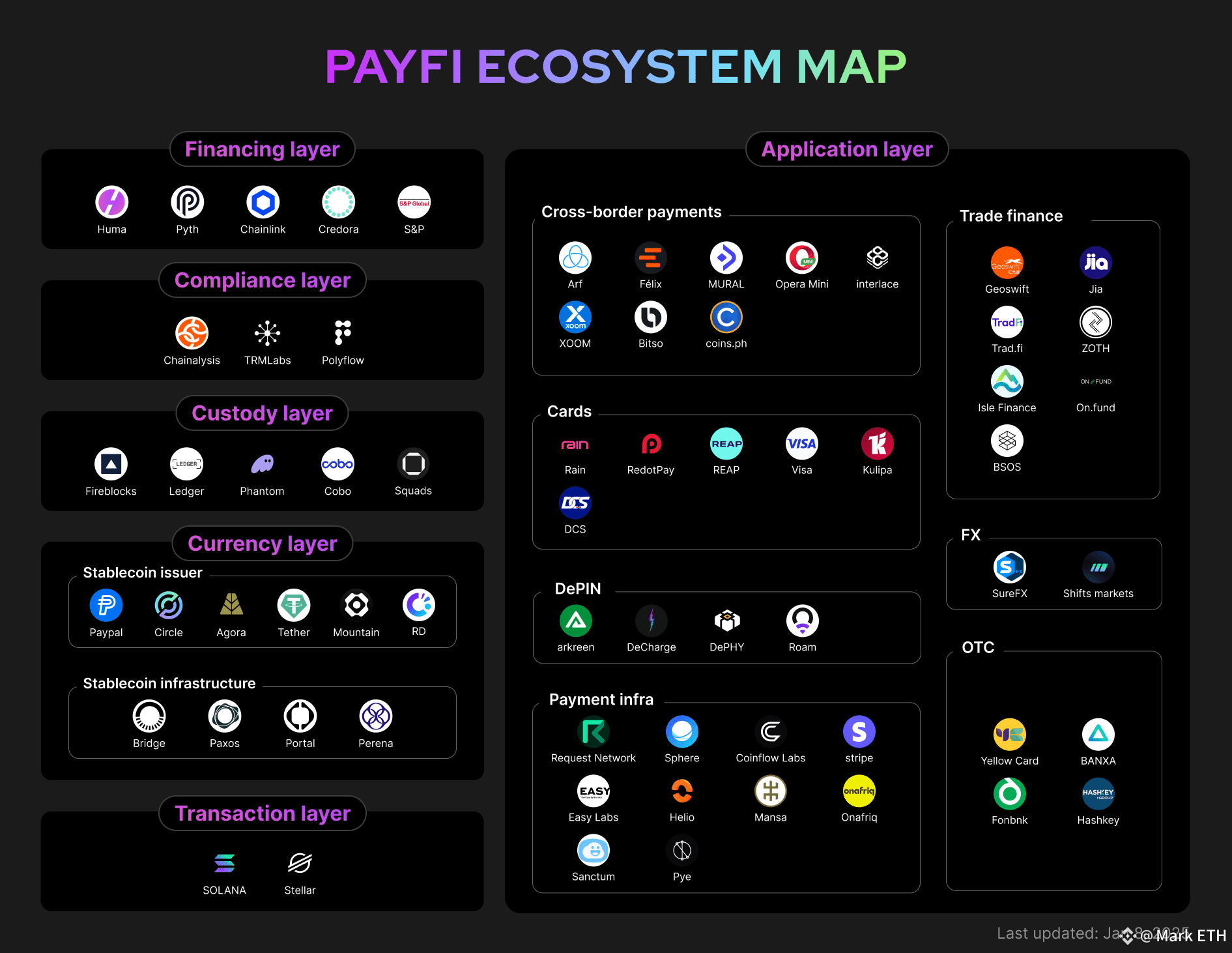

The world of payments and lending just got a serious upgrade. @Huma Finance 🟣 is quietly building something big and their latest moves show they’re aiming to make both global commerce and on-chain credit faster, simpler, and more accessible than ever.

Instant Global Payouts: From Days to Hours

For years, online sellers especially those in Asia have had to wait 3–5 business days to get paid when selling on marketplaces like Amazon.

The reasons?

Banks don’t run 24/7

Time zone differences slow things down

Outdated payment rails like SWIFT can’t keep up with global demand

That delay can be painful for sellers who need quick access to their earnings to restock inventory, pay suppliers, or simply manage cash flow.

Now, thanks to a new partnership between Huma Finance, Arf, and Geoswift, those days of waiting are over. Their combined solution brings same-day (T+0) settlement to marketplace sellers worldwide — starting with Amazon merchants in Asia.

Here’s how it works:

Huma’s PayFi Network provides the stablecoin-powered liquidity backbone

Arf ensures compliant, cross-border settlement

Geoswift delivers the local payout infrastructure across Asia

The result? Amazon sellers can now see funds hit their accounts within hours, fully compliant with AML/KYC rules, and with real-time transparency built in.

Key benefits:

Instant cash flow instead of waiting days

Global compliance from day one

Scalable infrastructure for millions of merchants

No SWIFT delays this is built for the digital age

Borrowing Against the Future: On-Chain Income-Based Lending

While instant payouts solve the speed problem for sellers, Huma Finance is also tackling another massive opportunity: uncollateralized lending.

Most crypto lending today requires over-collateralization you lock up more value than you borrow. But Huma flips the script. Instead of making you deposit crypto, their PayFi Network lets you borrow against your predictable future income whether that’s a salary, invoice payments, remittances, or other receivables.

The magic lies in Huma’s Time-Value-of-Money (TVM) model. By analyzing your cash flow patterns, the protocol can instantly release 70–90% of your expected future earnings — secured by smart contracts, without the need for traditional collateral.

Why it matters:

Unlocks liquidity for people and businesses without large crypto holdings

Turns reliable income streams into working capital

Makes credit more accessible, especially in emerging markets

Fully transparent and programmable on-chain

Why This Matters

Huma Finance isn’t just tweaking payments or lending they’re building an entirely new financial backbone for a 24/7 global economy.

With instant cross-border payouts and real-world income-based lending under one roof, they’re giving merchants, workers, and businesses the ability to move and access money at the speed of the internet.

Legacy finance runs on banker’s hours. PayFi runs on internet time.