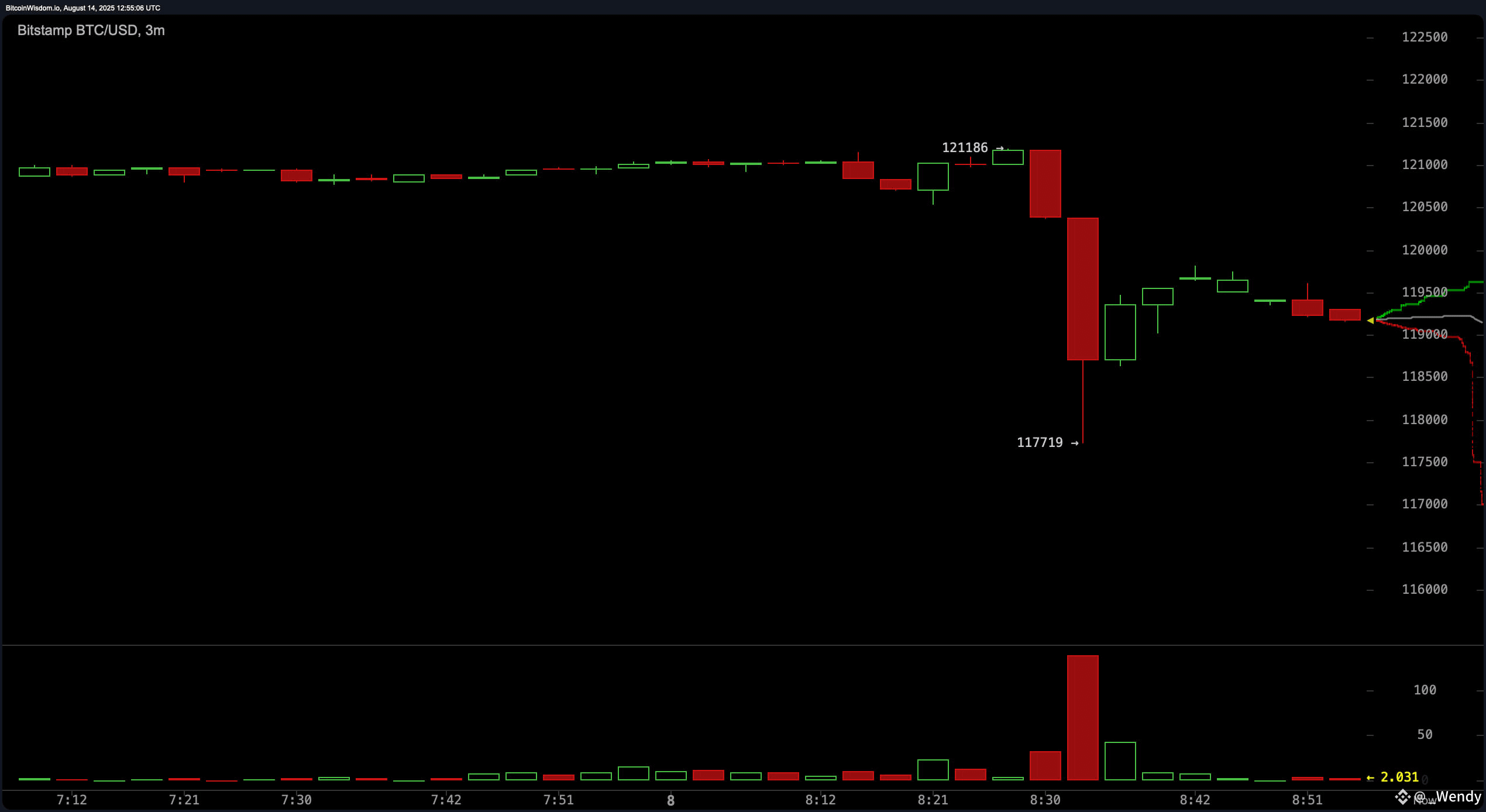

Bitcoin experienced sharp volatility, dropping to $117,719 before recovering above $118,000, following a surprisingly hot U.S. inflation report.

Bitcoin Tumbles Then Rebounds

The U.S. Producer Price Index (PPI), a key inflation indicator measuring wholesale goods prices, surged 0.9% for the month, significantly exceeding the forecasted 0.2% increase. This marked a sharp acceleration from the prior month’s stagnant 0.0% reading.

Economists view a higher-than-expected PPI as bullish for the U.S. dollar, signaling potential rising inflationary pressures upstream. The significant jump fueled immediate dollar strength. Analysts attributed the price pressures partly to the impact of tariffs implemented by the Trump administration.

The hotter-than-usual PPI data heightened market expectations that the U.S. Federal Reserve may need to maintain a restrictive monetary policy stance. This shift in sentiment directly impacted assets like bitcoin ( BTC), prompting the initial selloff as the dollar gained. Still, the CME Fedwatch tool shows a 96.5% chance a rate cut will happen on Sept. 17.

While bitcoin swiftly rebounded above $119,000, it dropped back below that range, and the day prior, it reached an all-time high of $124,517 per coin. The inflation data places increased focus on the upcoming September Federal Open Market Committee (FOMC) meeting. Market participants now see a higher probability that the Fed could maintain the rate or even signal readiness to raise the federal funds rate. Yet, prediction markets and CME’s Fedwatch tool do not show this sentiment.

Investors will closely monitor further inflation data and Fed commentary to gauge the central bank’s next move, which remains pivotal for currency and cryptocurrency markets. The PPI surprise highlights persistent inflation concerns.

#Binance #wendy #BTC $BTC