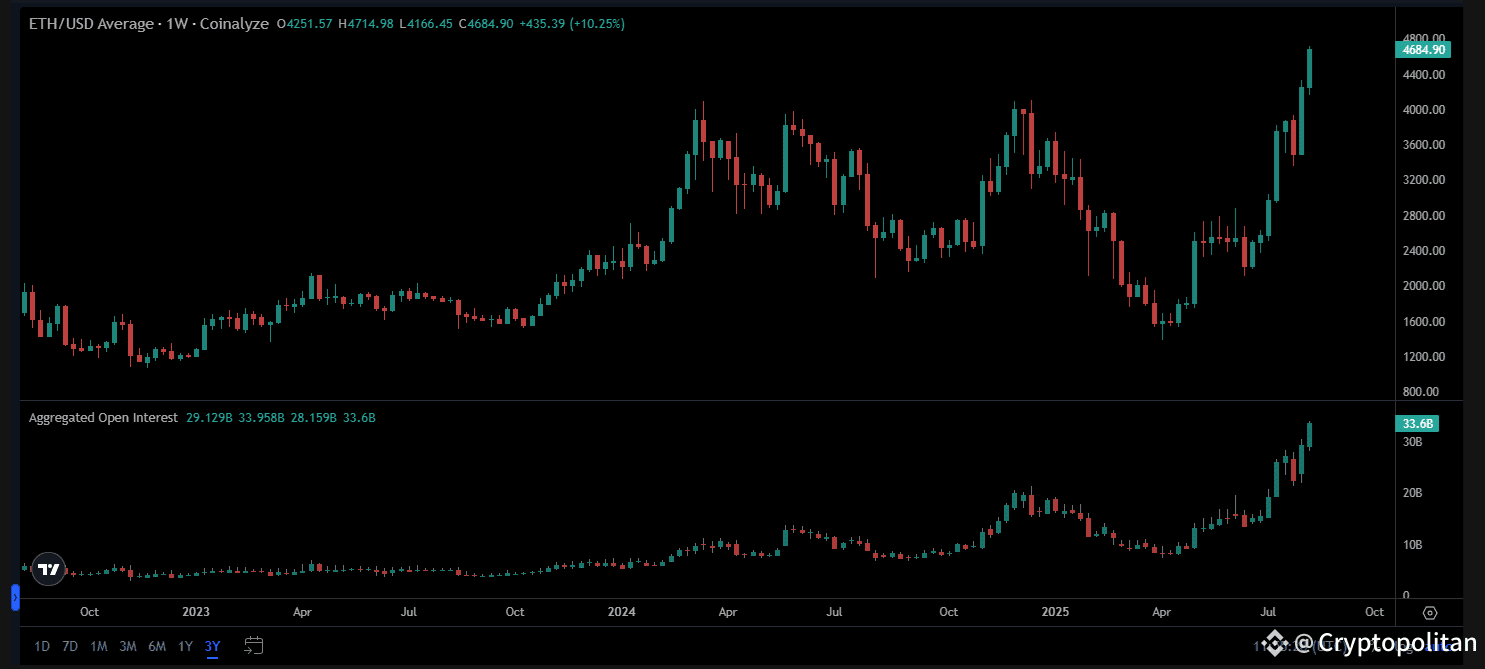

The Ethereum (ETH) market is heating up, with new inflows of liquidity for derivative positions. Open interest is once again at an all-time high, setting up positions for the next ETH price move.

The ETH derivative market is heating up, as risky traders are making bets on the next move of ETH. Futures open interest on the top crypto exchanges reached $33.6B based on Coinglass data. Open interest has been rising gradually but relentlessly, expanding despite the recent liquidations.

ETH open interest kept expanding to an all-time high, as derivative positions became more influential in setting the price direction. | Source: Coinalyze

ETH open interest kept expanding to an all-time high, as derivative positions became more influential in setting the price direction. | Source: Coinalyze

Derivative interest remains much higher in comparison to spot ETH buying, even with the latest whale moves. As Cryptopolitan tracked spot purchases, ETH faced growing demand from whale wallets and treasuries, far outpacing profit-taking. However, derivative trading has even more power to shift the balance on ETH and magnify the market’s natural direction.

Open interest reacted strongly to ETH’s march toward the November 2021 all-time peak above $4,800. In the past day, ETH open interest on all futures markets expanded by over 15%.

ETH traders shift to short positions

The bullish sentiment for ETH led some of the traders to shift to short positions. Currently, over 38% of all open interest is shorting ETH, risking a squeeze to a higher price range. Short positions for ETH remain extremely risky, as the token recently saw one of the highest liquidation rounds for 2025.

Shorting ETH was also attempted in the past week, with losses for riskier positions. The recent round of shorting took ETH close to the $4,800 range, but the available positions for liquidation are almost over. In the past 24 hours, ETH short liquidations reached $295.7M, becoming the most liquidated asset. This did not stop traders from replacing their positions or shifting their sentiment.

Open interest grew again, with long positions in the $4,100 range. This liquidity may also be attacked, leading to a retracement of the recent ETH gains. In the past, ETH has climbed under 10 times above the $4K range, always followed by a retracement.

This time, the ETH rally did not stop and reached a higher range with significant momentum. ETH is yet to enter price discovery, potentially signaling mainstream adoption and a shift in the use cases as the network draws in traditional finance.

Hyperliquid whales tend to short ETH

Whales on Hyperliquid have a slight dominance of short positions. A total of 283 whales shorted ETH, with 270 wallets going long.

The biggest ETH short position now has an unrealized loss of over $140M, with a notional value of $345.85M. The most significant long position for the day had a notional value of $177M and unrealized gains above $25M.

Recently, high-profile trader and crypto influencer Machi Big Brother closed his ETH long, realizing gains of $33.83M.

ETH is still around 6.4% away from its all-time high at $4,891, leading to expectations that the rally has still not finished. Recently, Standard Chartered boosted its prediction for ETH market prices, raising the target to $7,500 by year-end. The strong market direction is still helping the market, especially after months of sideways trading and stagnation.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.