Long-term Bitcoin holders slowed sales after July’s historic profit-taking streak.

Elliott Wave analysis points to a short-term decline for the CME gap.

Price may consolidate into November before a breakout is expected in late 2025.

Bitcoin profit realization among long-term holders has cooled in August after heavy selling in July. Glassnode data indicated that November 2024 through early 2025 also recorded significant spikes in realized profits.

$BTC profit realization by long-term holders (7D SMA) has slowed in August after a July run consistently above $1B/day – one of the largest profit-taking periods on record. pic.twitter.com/LmvABXqbzb

— glassnode (@glassnode) August 11, 2025

These peaked near $2.75 billion, driven by holders across multiple age cohorts. Notably, addresses holding for 6–12 months and over one year contributed heavily to the realized gains. In July, the pace of profit-taking remained elevated over several consecutive weeks.

The August data reflects a marked decline in selling pressure from these groups. Analysts said the reduced realization could indicate that holders are showing renewed conviction in retaining their positions. The stabilization of price near recent highs may also point to a consolidation phase after months of heightened market activity.

Technical Structure Signals Potential Gap Fill

Analyst Crypto Tony outlined that Bitcoin’s price action is currently following a potential leading diagonal pattern. His chart, using CME Futures data, highlights what he described as a “BIG CME gap” that traders should monitor. The pattern has developed from February through August, following a structured Elliott Wave sequence.

$BTC / $USD – Update

BIG CME gap to pay attention too. Ties in well with my leading diagonal idea. pic.twitter.com/OAyzT1Nsdl

— Crypto Tony (@CryptoTony__) August 11, 2025

Current price movement is completing wave (v) of the diagonal. This structure could lead to a short-term decline aimed at filling the CME gap. The analysis projected that after this move, Bitcoin may trade sideways between September and November before resuming its broader uptrend.

Outlook Into Late 2025

The CME Futures-based projection ties the gap-fill narrative to a longer-term bullish structure. Crypto Tony suggested that resolving the expected consolidation range could set the stage for a strong upward breakout. If the Elliott Wave sequence holds, this move is anticipated to unfold in late 2025.

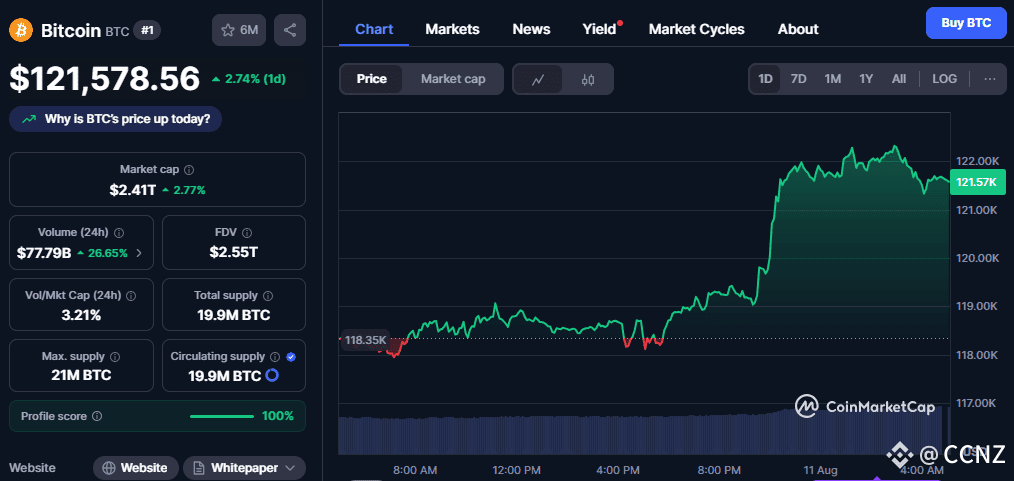

Source: Coinmarketcap

Source: Coinmarketcap

At press time, Bitcoin was trading at $121,578.56, having gained 2.74% in the past 24 hours. Traders continue to monitor on-chain data and technical patterns for signals of the next price direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.

<p>The post Bitcoin Selling Pressure Eases in August After July’s $1B Daily Profits first appeared on Coin Crypto Newz.</p>