More than 90% of ETH holders are now in profit after the token’s recent rally saw it hit $3,800 for the first time in over a year. Data from Sentora (formerly IntoTheBlock) confirmed this, noting that it is the highest level since December 2024.

According to the data, only a few addresses have bought ETH above its current price, which means that on-chain resistance above that price point has been very light, a factor that could push the token to further heights.

The sizable amount of holders in profit highlights the turnaround that ETH has experienced over the past few months. Per CoinMarketCap, the ETH value has increased by more than 120% in the last three months, going from around $1,800 to $3,800.

The majority of ETH holders are now in profit (Source: Sentora)

The majority of ETH holders are now in profit (Source: Sentora)

With the gains, concerns about ETH value, which dominated sentiments in the Ethereum community during the first half of the year, have faded away completely, replaced by bullish sentiments that the asset could hit a new all-time high.

However, the token has seen a slight decline today, falling less than 1% in what appears to be a minimal price correction even as it remains primed for further gains. Despite the price correction, the general opinion remains bullish for ETH with analysts from Sentora noting that the first major resistance for ETH is slightly below $4,000, as 2.39 million addresses are holding at a loss in this range.

Institutions and retail pile on ETH as interest increases

With the ETH price increasing, demand for the token has also been soaring, with institutions and retail investors buying the token. Over the past few months, several public companies have accumulated billions worth of ETH for their treasuries.

Interestingly, retail investors are also not holding back. Santiment data noted that social media discussion around ETH is now at levels similar to its price rise in May 2024. Ethereum now has over 152 million non-empty ETH wallets, the highest for any crypto token.

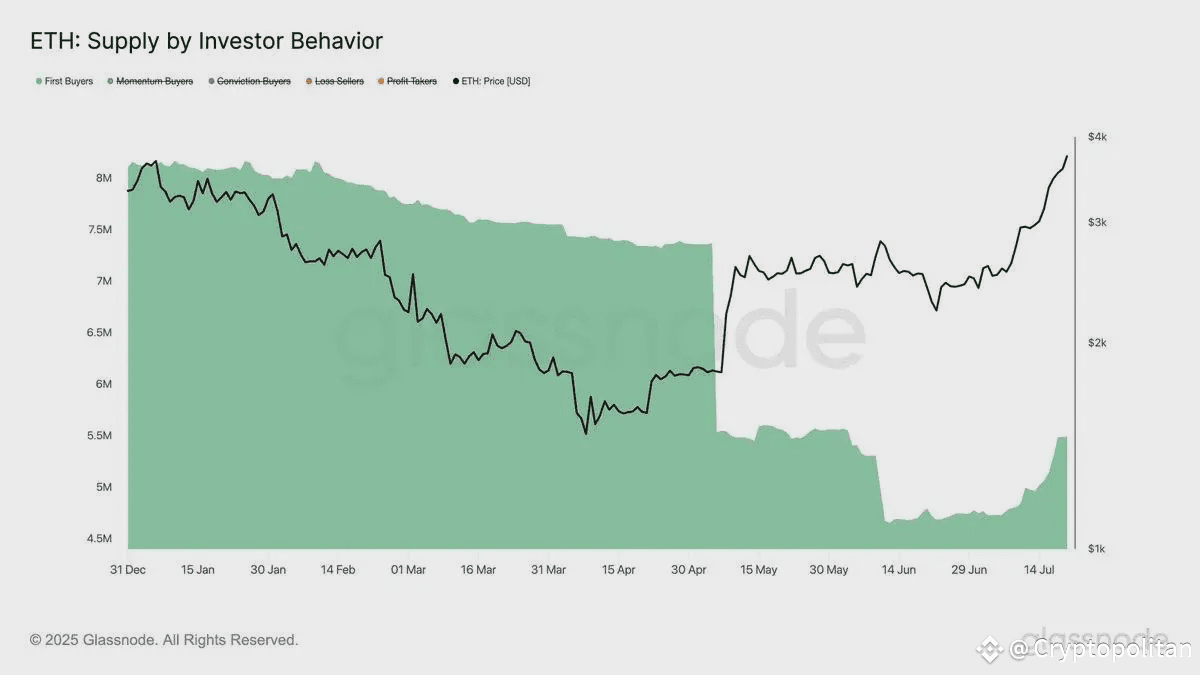

First-time ETH buyers are increasing (Source: Glassnode)

First-time ETH buyers are increasing (Source: Glassnode)

It appears that first-time buyers are also increasing their interest in the asset. According to Glassnode data, the supply of ETH held by first-time buyers has increased by 16% since early July, showing the return of new market participants and the injection of fresh capital.

Altcoin season is entering full swing

Meanwhile, ETH’s massive performance over the past three months appears to have kick-started the altcoin season, with several tokens now seeing a surge in their value. In the past 24 hours, major cap altcoins such as Solana and Dogecoin have seen 7.74% and 6.70% gains, respectively.

Santiment data highlighted other top performers, noting that PENGU gained 16%, HEX increased by 20%, PLSX 12% while KAS went up by 15%. Analysts note that this is the Bitcoin all-time high profits redistribution in full effect.

Interestingly, BTC is showing consolidation signs with the flagship asset declining more than 2% in the past seven days and now trading in the $118,000 range. On-chain indicators also show slower inflows and rising transfer volume.

With altcoins, led by Ether, soaring in value, Bitcoin dominance has also declined to 59.67%, its lowest level since March 2025 and far from the 65% less than 30 days ago. By comparison, ETH’s dominance at 11.58% has been at its highest level since January 2025.

Despite the gains, the altcoin season is yet to enter full effect. According to CoinMarketCap Altcoin Season Index, it is currently at 55/100, which means 56% of the top 100 tokens have outperformed Bitcoin in the last 90 days. Altcoin season signal is when 75% of the top 100 coins outperform BTC.

Nevertheless, the signs are already there with altcoin activity soaring. Data from CryptoQuant shows that altcoin trading volume on Binance Futures increased to $100.7 billion in a single day, marking the highest level since February 2025.

KEY Difference Wire: the secret tool crypto projects use to get guaranteed media coverage