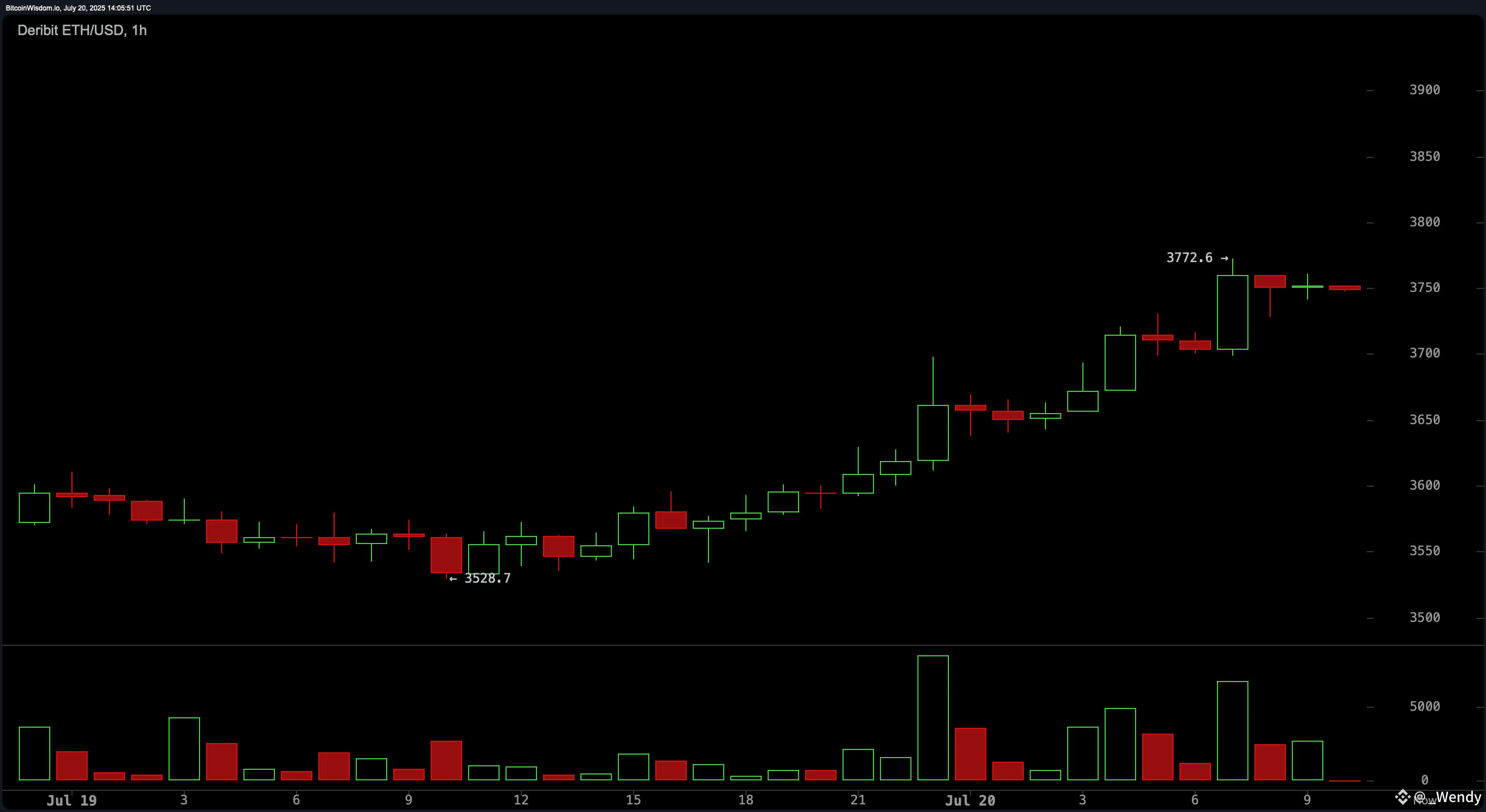

Ethereum ( ETH) just hit a new high of $3,772 per coin on Deribit versus the U.S. dollar, and it’s still climbing. Its piece of the $3.9 trillion crypto economy has expanded from 10.9% just three days ago to a cool 11.6% today, boasting a $452.66 billion market capitalization.

Traders Go All-In on Ethereum

As of Sunday, July 20, ethereum (ETH) is valued at $3,745 each, having jumped 25.5% this week. Just three days prior, one ether was worth 0.029 BTC, and it has since climbed to 0.03173 BTC. Across social media platforms like X, many ETH fans are convinced this is just the beginning.

“The run ethereum is about to go to, is gonna be glorious,” one person wrote. “ BTC dominance down, alts getting stronger by the day,” the X account added.

Today, BTC’s market share is down to 60.2%, while ETH’s has climbed to 11.6% of the $3.9 trillion crypto market. A big reason for this increased interest in ether comes from public companies embracing ETH for their treasury plans and from spot ETH exchange-traded funds (ETFs) bringing in significant amounts of capital inflows.

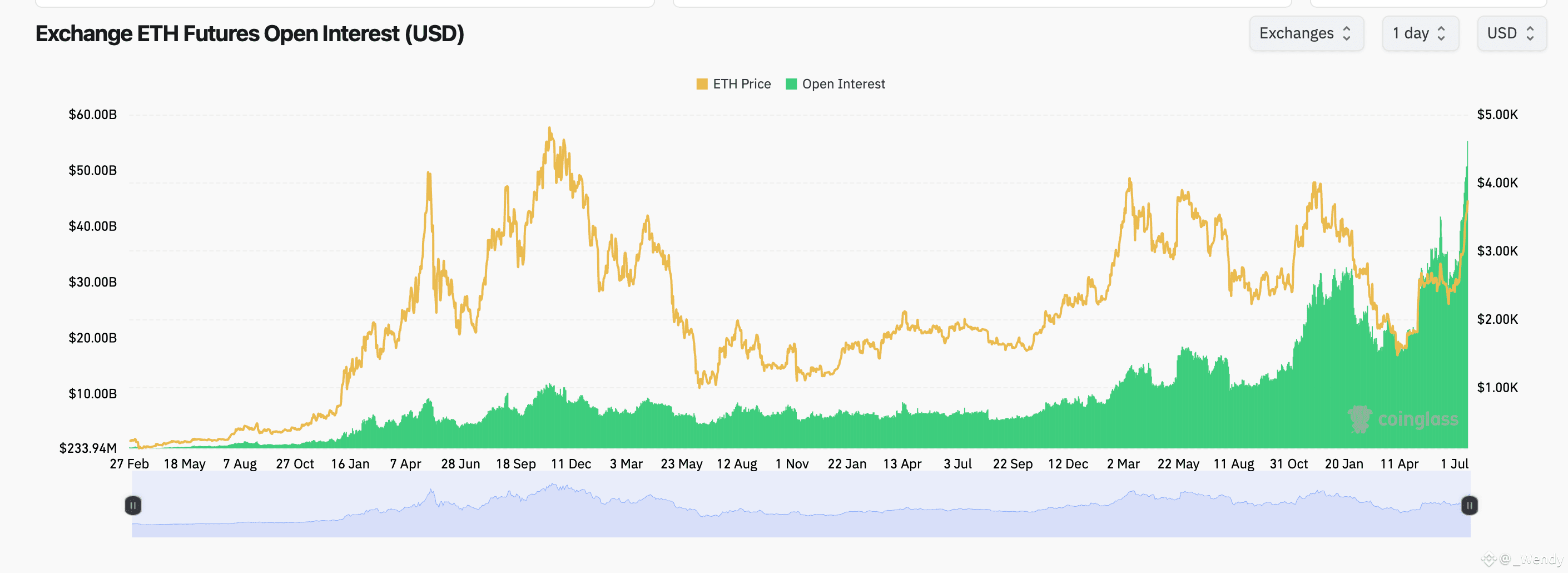

Ethereum futures open interest (OI) has blasted through the $55 billion mark, setting a new all-time high and painting the chart green with excitement. As ETH’s price tears toward the $4,000 line, the rising tide of open contracts is drawing serious attention. Data shows a synchronized dance between price and OI, with both building momentum in tandem—especially since mid-April.

It’s a clear sign that traders are piling in, betting big on ethereum’s next move. CME and Binance are leading the futures frenzy, with Binance commanding the largest share—2.64 million ETH in open interest, valued at $9.88 billion. CME isn’t far behind, posting $7 billion in OI, while Gate has quietly stacked $7.15 billion with the second-largest ETH position by dollar value.

Notably, MEXC and BingX are seeing some of the highest 24-hour growth, up 6.86% and a whopping 11.18%, respectively. However, not everyone’s in sync—Kucoin and BingX show a sharp split between short-term gains and daily drop-offs, hinting at turbulent plays beneath the surface.

Ethereum options markets are heating up fast, and the data screams bullish enthusiasm. On Deribit, the most popular contracts are loaded with upside bets—like the Sept. 26, 2025 $4,000 call, leading with nearly 100,000 ETH in open interest. Traders are also eyeing the skies with the $6,000 December 2025 strike, showing they’re not afraid to shoot their shot. Even the $12,000 calls saw the most volume over the past 24 hours—yes you read that correctly, $12,000—That’s some serious moon talk.

Calls are absolutely dominating puts, with open interest skewed 66.43% to 33.57%. That’s 2.29 million ETH stacked in bullish bets versus 1.15 million ETH on the downside. The same pattern plays out in 24-hour volume—62.49% of it comes from calls, further underlining the optimism flooding the options desk. This tilt toward upside contracts suggests traders are positioning for explosive moves rather than hedging the downside.

Long story short: traders are loading up on spot ETH, futures, and options across the board, and with the spot price and open interest both climbing, the market’s got its eyes wide open on what comes next.

#Binance #wendy #BTC #ETH $BTC $ETH