The second-quarter earnings season is in full swing, and companies across industries are reporting numbers that, on paper, should be rallying the market.

But investors clearly aren’t impressed. Despite blowout results in banking, tech, consumer goods, and travel, the stock market is barely reacting, and in many cases, it’s punishing anything short of perfection.

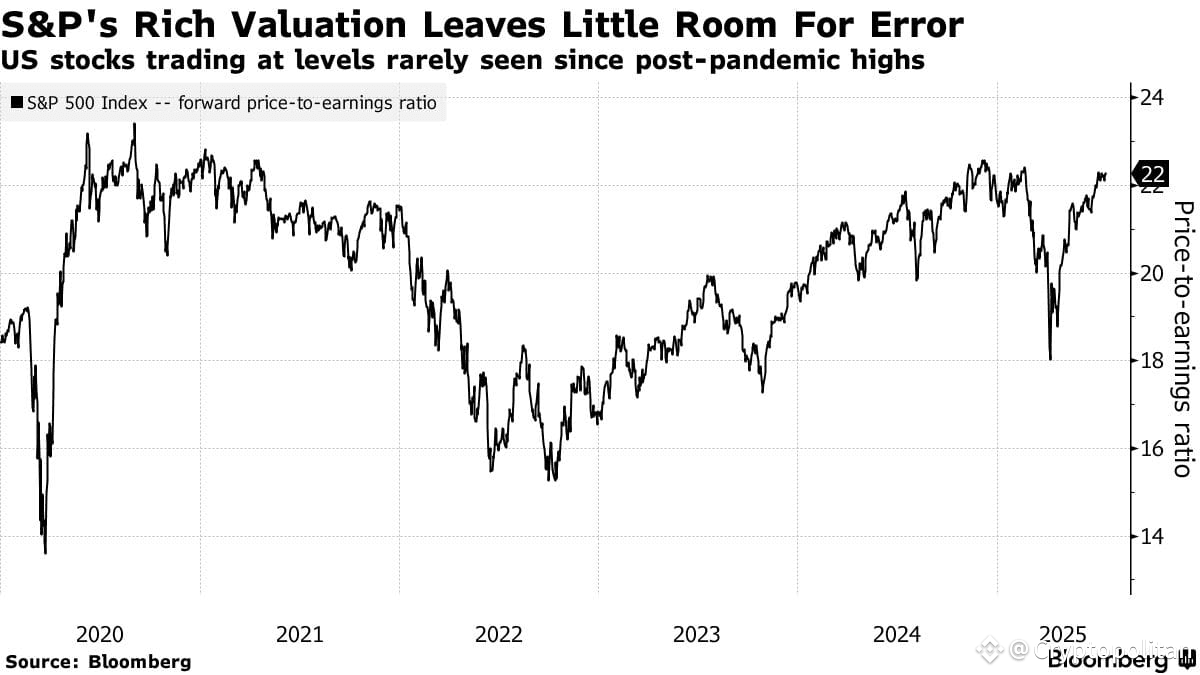

This is all happening while the S&P 500 sits near record highs, closing Friday after logging seven new all-time highs in just fifteen trading days. According to Bloomberg, valuations are sky-high, and the market has already baked in most of the optimism.

One of the loudest examples came from the financial sector. Goldman Sachs posted the biggest equity trading revenue in Wall Street history. Morgan Stanley beat net revenue forecasts. JPMorgan Chase had its best second quarter for stock trading ever, with fixed-income trading blowing past expectations.

None of it mattered. Goldman’s shares barely moved. Morgan Stanley closed down 1.3%. JPMorgan fell 0.7%. Bloomberg Intelligence analysts Gina Martin Adams and Michael Casper said, “Financials have crushed 2Q earnings expectations with a 94.4% beat rate so far, yet stocks saw only muted reactions as investors largely anticipated the results.”

Wall Street ignores beats and punishes misses

The same cold shoulder showed up in other sectors. Netflix beat every major metric and still lost over 5% by the end of Friday. United Airlines was optimistic about travel demand picking up, but again, no boost. Investors aren’t looking for good. They want exceptional, unexpected, and forward-looking.

“With stock valuations where they are, all the good news is priced into the market now,” said Greg Taylor, Chief Investment Officer at PenderFund Capital Management.

And if a company stumbles? The market is showing no mercy. The gap between how investors treat misses versus beats is the biggest it’s been in nearly three years, based on Bloomberg Intelligence numbers. “The margin of error here is small,” said Michael Arone, Chief Investment Strategist at State Street Investment Management. “When the valuations are high and you miss, the punishment is more severe.”

Source: Bloomberg

Source: Bloomberg

Even companies that hit on both profit and revenue are getting lukewarm applause. The only real winners this quarter in terms of share price were PepsiCo and Delta Air Lines, both of which had been lagging the market before their reports. Their stronger-than-expected numbers finally pushed shares higher. Most others weren’t so lucky.

There’s not much optimism about broad stock market movement either. “At an index level, good earnings are not likely the broad market catalyst investors are waiting for,” said Julian Emanuel, Chief Equity and Quantitative Strategist at Evercore ISI.

Consumer spending keeps results alive but doesn’t excite traders

Consumer strength is still holding up across sectors, which is probably the only reason earnings haven’t been worse. But it’s not lighting a fire under investors either. Mark Malek, Chief Investment Officer at Siebert, said:

“Banks can only be healthy when the economy is strong. So their earnings along with their commentary serve as a broader benchmark on economic health.”

That benchmark still looks solid. Companies from PepsiCo to Levi Strauss, Delta, and Netflix all showed that demand is there. Even with high inflation and sticky interest rates, people are still spending.

Retail numbers released Thursday backed that up. The Commerce Department reported a 0.6% increase in retail purchases last month. That came after two straight months of declines and beat nearly every forecast polled by Bloomberg.

But the calm doesn’t mean investors aren’t nervous. Next week’s earnings calendar is packed with heavyweight names including Alphabet, Tesla, Honeywell, Dow, Lockheed Martin, Northrop Grumman, and General Motors. With expectations already sky-high, the risk of being punished for anything less than spectacular is rising.

What’s making it worse is that analysts already slashed expectations before the quarter even started. Back in January, earnings growth for the S&P 500 was pegged at 9.5%. By Friday, that number had collapsed to 3.3%.

So that’s the picture right now: great numbers, weak reactions, brutal punishment for slips, and high expectations moving forward. And with Trump’s trade rules still casting a shadow, everyone’s wondering who’s going to take the hit from tariffs next.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now