Washington’s “Crypto Week” has brought digital assets into focus on Capitol Hill, with several industry experts weighing in on what the proposed legislation could mean for the future of crypto.

Now, with three major bills—the GENIUS Act, the CLARITY Act, and the Anti-CBDC Surveillance State Act—advancing through Congress, ambiguity could soon give way to a more structured regulatory environment.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.#GeniusAct #Trumphttps://t.co/Lm2tCBbimp

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.#GeniusAct #Trumphttps://t.co/Lm2tCBbimp

— Cryptonews.com (@cryptonews) July 16, 2025

Turning Point in U.S. Crypto Regulation

Gracy Chen, CEO at Bitget, called the week “a turning point,” noting that the GENIUS Act delivers the first federal framework for stablecoin licensing, reserves, and disclosures.

Meanwhile, the CLARITY Act seeks to resolve longstanding jurisdictional turf wars between the SEC and CFTC by offering concrete definitions for digital assets: whether they fall under the category of securities, commodities, or stablecoins.

The Anti-CBDC Act sends an equally clear message—by prohibiting the Federal Reserve from issuing a retail central bank digital currency, lawmakers are affirming a stance on financial privacy.

These proposals show more than policy evolution—they indicate the beginning of a new phase where crypto is no longer treated as an outsider asset class. Crypto exchanges and investors are already repositioning for a future shaped by regulatory frameworks, not just code and community.

Behind the Optimism: Global Context and Institutional Pressure

While U.S. crypto stakeholders are celebrating legislative momentum, not everyone sees this as a leading achievement.

For example, Manthan Davé, co-founder of Ripple-backed custodian Palisade, argues the GENIUS Act represents progress—but only in the context of the U.S. playing catch-up.

Europe’s MiCA framework, Davé notes, already demonstrates how regulation can empower rather than constrain innovation. By contrast, the GENIUS Act risks building a fragmented stablecoin structure that fails to interoperate with decentralized finance protocols.

Without pathways for regulated entities to issue stablecoins that are fully composable within on-chain financial systems, the U.S. could miss a key opportunity to shape the future of tokenized finance.

Davé points out that if U.S. stablecoins evolve into tightly controlled, non-interoperable digital dollars, they’ll resemble traditional money more than they will transformative Web3 infrastructure.

The true value of stablecoins lies not only in their backing, but in their ability to serve as programmable, borderless collateral, integral to lending, settlement, and tokenised Treasury markets.

He argues that without this flexibility, institutional capital will flow to jurisdictions where composability is enabled and innovation doesn’t face unnecessary roadblocks.

Markets Respond to Policy Momentum

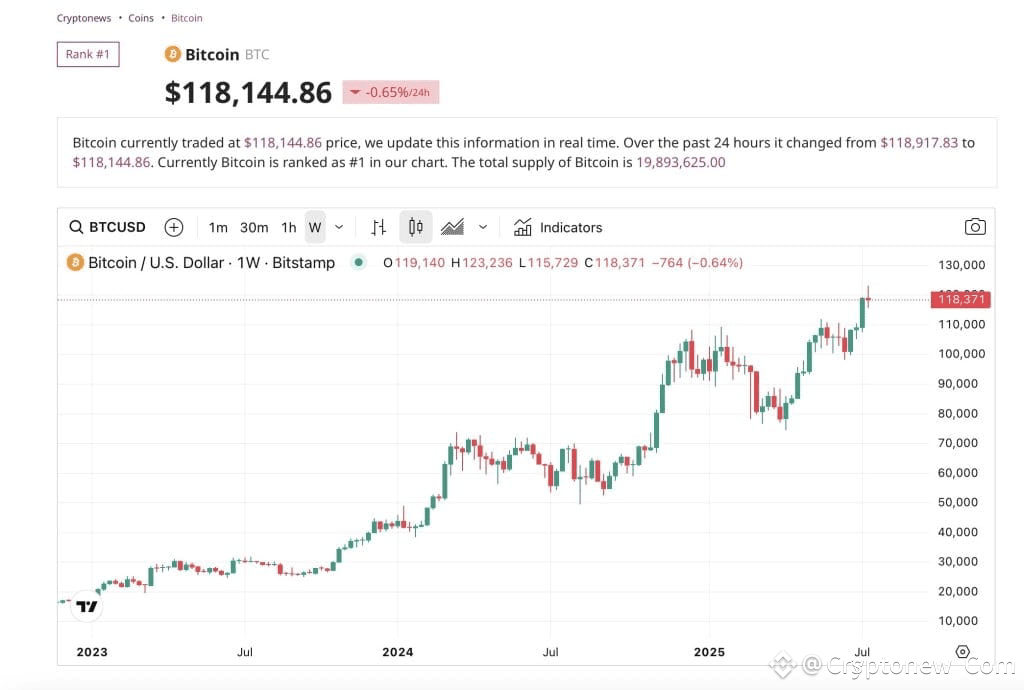

Investor sentiment has already turned bullish in anticipation of a regulatory breakthrough. Bitcoin surged past $120,000 on Monday, briefly touching $123,000—marking a new record high and reinforcing the view that legal clarity could serve as a major catalyst for digital asset inflows.

At the time of publication, Bitcoin is trading at $118,144.

Analysts attribute the recent surge to growing confidence that regulation could unlock sidelined institutional capital. With defined categories for tokens, stablecoin compliance measures, and a halt to retail CBDC development, the market is interpreting this shift as a green light for scaled participation.

Bitget’s Gracy Chen notes that institutional appetite is closely tied to certainty. Clear licensing paths for stablecoins, plus delineated regulatory responsibilities, could improve market integrity and lower barriers to entry.

While smaller firms may face pressure from compliance costs, the long-term trajectory points toward a rules-based market where crypto can operate on the same footing as traditional finance.

As Congress prepares for floor votes on all three bills, the tone has shifted. Crypto is no longer an experimental frontier—it is fast becoming a regulated asset class in the eyes of U.S. law. Whether this transformation keeps pace with the rest of the world is still unclear.

The post U.S. Crypto Week Brings Regulatory Shift: What the GENIUS, CLARITY, and Anti-CBDC Acts Really Mean appeared first on Cryptonews.