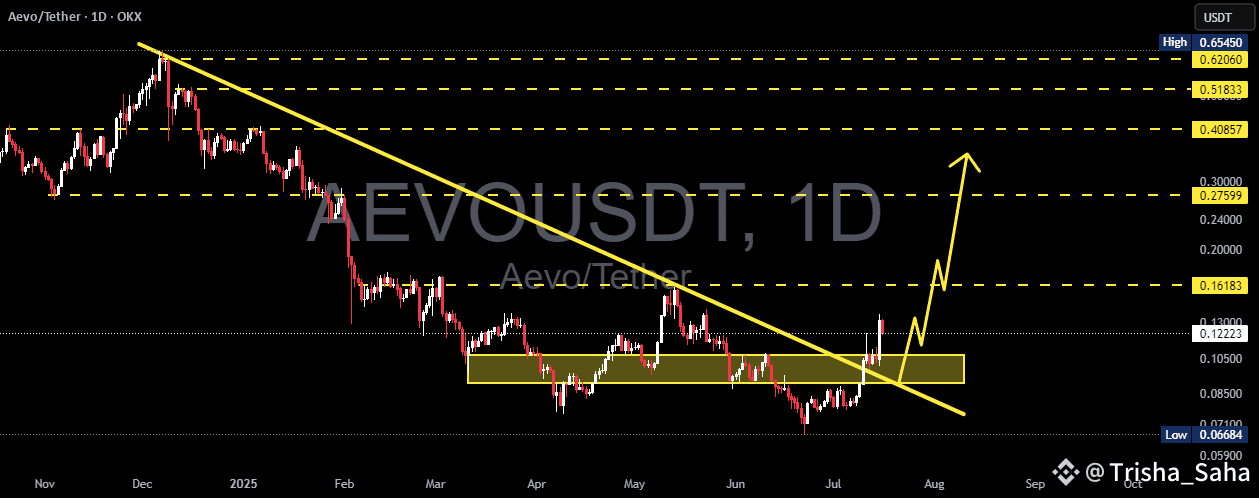

🔍 Chart Overview & Pattern Analysis

The AEVO/USDT daily chart reveals a significant breakout from a long-term descending trendline that has been intact since November 2024. This trendline acted as a strong dynamic resistance, suppressing every bullish attempt—until now.

A clear multi-month accumulation zone is visible between $0.080 – $0.105 (highlighted in yellow). Price tested this support zone multiple times, forming a strong base of demand. The combination of horizontal support and descending resistance creates a classic descending triangle breakout, often signaling a trend reversal when broken to the upside.

What's more, price action recently:

Broke above the trendline with strong bullish candles

Retested the breakout zone successfully

Is now forming a potential bullish continuation structure (mini bull flag or pennant)

This structure suggests that the bulls are not done yet—and momentum could be accelerating.

🟢 Bullish Scenario – The Path to Higher Highs

If AEVO continues to hold above the breakout zone, the following upside targets become very realistic:

✅ Target 1: $0.16183 – Previous resistance zone, short-term TP.

✅ Target 2: $0.27599 – Key horizontal resistance from late Q1 2025.

✅ Target 3: $0.40857 – Weekly structure resistance.

✅ Target 4: $0.51833 – Bullish extension zone.

🎯 Ultimate Bull Target: $0.62660 – Full recovery to pre-downtrend levels.

Confluence factors supporting this bullish outlook:

Breakout above dynamic and static resistances

Accumulation breakout after long consolidation

Higher low and bullish retest pattern

Bullish momentum building with volume confirmation (volume not shown but implied)

🔴 Bearish Scenario – Key Levels to Watch

In case of a false breakout or macro weakness:

Breakdown below $0.105 could invalidate the bullish structure

Price could revisit $0.080 or even $0.06684 (last line of defense)

A daily close below this zone would shift the bias back to bearish or neutral

However, as long as price stays above the yellow support box, the bullish thesis remains valid.

---

🧠 Key Technical Highlights

Pattern: Descending Triangle Breakout + Accumulation Base

Trend Shift: From Bearish to Bullish (confirmed with breakout + retest)

Momentum: Building up toward higher time frame resistances

Market Psychology: Smart money likely accumulated during sideways chop

📣 Final Thoughts

AEVO/USDT is showing one of the cleanest breakout structures in the altcoin space right now. With clear upside targets, a retested breakout zone, and strengthening market structure, this could be the early phase of a major bullish leg.

Traders and investors should watch for confirmation of higher highs and pullbacks to the $0.105 zone for potential entries.

#AEVOUSDT #CryptoBreakout #TrendReversal #AltseasonReady #DescendingTriangle