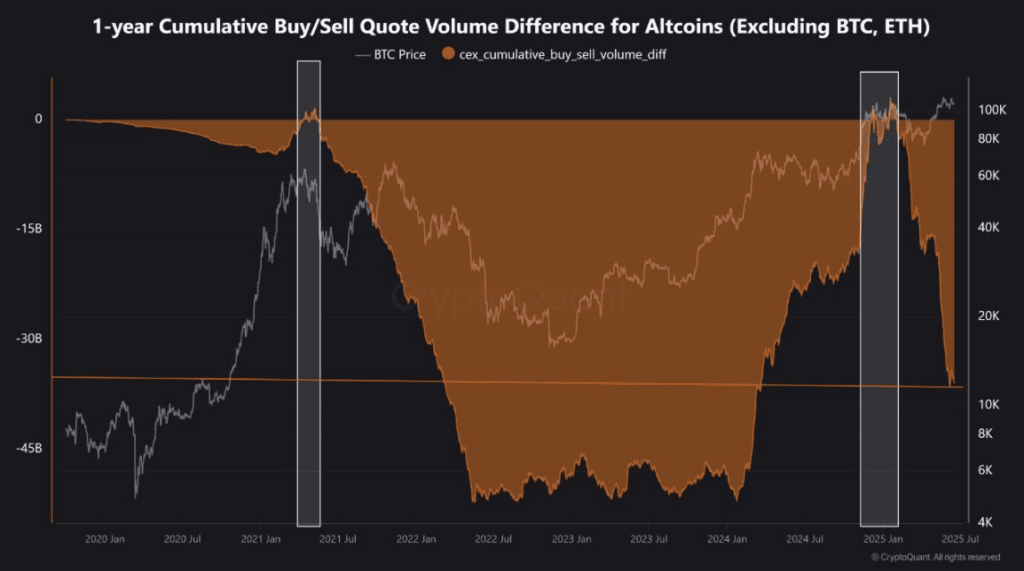

The 1-year buy-sell volume for altcoins dropped below -45B while BTC maintained gains above 100K

Volume has remained negative since mid 2021 showing that interest in altcoins has not yet returned

Analysts say altseason may not happen unless this volume metric starts to move back above zero again

Altcoin market sentiment remains uncertain as cumulative buy-sell volume for non-BTC and non-ETH assets continues to lag behind expectations. A recent chart from CryptoQuant shows the 1-year cumulative buy/sell quote volume difference for altcoins has dropped significantly. The chart excludes Bitcoin and Ethereum, focusing solely on alternative assets. The data reveals the metric remains deep in negative territory, despite recent improvements in BTC price action.

Source: X

Source: X

The quote was supported by CryptoQuant contributor Burak Kesici, who noted that a full altseason remains unlikely unless this metric turns upward. He cautioned that current excitement might be premature without measurable improvement in volume trends across altcoins.

Key Metric Signals Persistent Altcoin Weakness

The 1-year cumulative buy-sell volume difference has historically indicated shifts in market structure. When the metric rises above zero, it suggests buyers dominate sellers. In contrast, a dip below zero highlights stronger selling pressure across centralized exchanges.

Since mid-2021, the metric has remained firmly below the zero line. It reached lows exceeding -45 billion USD during the bear phase spanning 2022 to 2023. Despite a minor recovery through late 2024, the metric has again declined sharply.

Burak Kesici noted that altcoin rallies require this indicator to improve meaningfully. Without positive momentum in buy-side volume, sustained altcoin growth may not materialize. Traders and analysts continue to monitor this chart as a vital health check for broader market participation.

Bitcoin's price trend diverges from this data. Even as BTC climbs above 100K, altcoin buy-side strength fails to mirror that trajectory. This gap suggests investor focus remains heavily concentrated in BTC while capital rotation into altcoins remains limited.

Altseason Outlook Tied to Volume Recovery

The chart’s implications extend beyond technical readings. It questions whether true altcoin momentum is building or if current interest is speculative. Kesici described the lack of volume recovery as a major hurdle for any sustained altseason.

He warned that hoping for altcoin rallies without volume confirmation could be wishful thinking. The quote implies traders should manage expectations and track on-chain activity closely. If the cumulative volume fails to shift soon, short-term altcoin performance may remain subdued.

The data further illustrates how centralized exchange behavior can reflect broader sentiment. Unlike DeFi volumes, centralized order books offer a clearer look at retail and institutional flow. That transparency makes this metric useful for forecasting major rotations in the crypto space.

Historically, strong altcoin seasons followed a notable rise in this indicator. The last time this occurred was in early 2021, just before a major rally. Since then, however, activity has weakened, and despite rising prices, volume trends show reduced conviction.

Will Volume Rebound or Signal a Longer Winter?

This leads to the central question: can the cumulative altcoin buy-sell volume metric reverse in time to spark a new altseason?

Altcoins remain under pressure. Despite rising asset prices in select sectors, broader interest remains narrow. Without volume, rallies may lack sustainability. Kesici’s analysis suggests that until this metric rises again, a lasting rotation into altcoins could remain elusive.

The latest chart from CryptoQuant provides visual confirmation. Orange bands representing the cumulative difference continue to widen below the zero mark. As BTC strengthens, all eyes remain on whether altcoins will follow—driven not by hope, but by data.