Key Takeaways

Glassnode analysis shows Bitcoin is in a classic post-euphoria consolidation phase.

BTC trades between $104.1K–$114.3K, a historical “consolidation corridor” after all-time highs.

A dip to $104K would signal seller exhaustion, while recovery above $114.3K would confirm demand strength.

Short-term holders’ profitability collapsed from 90% to 42% during the recent leg down.

BTC in Post-Euphoria Consolidation

Bitcoin (BTC) is showing signs of a textbook bull-market correction, according to the Sept. 4 edition of Glassnode’s The Week Onchain newsletter.

BTC/USD currently trades around $113,213, nearly 10–15% below its August all-time high, as volatility spikes. Analysts highlight the $104,000–$114,000 range as a critical consolidation corridor that historically follows euphoric market peaks.

Why $104K Matters for Bitcoin

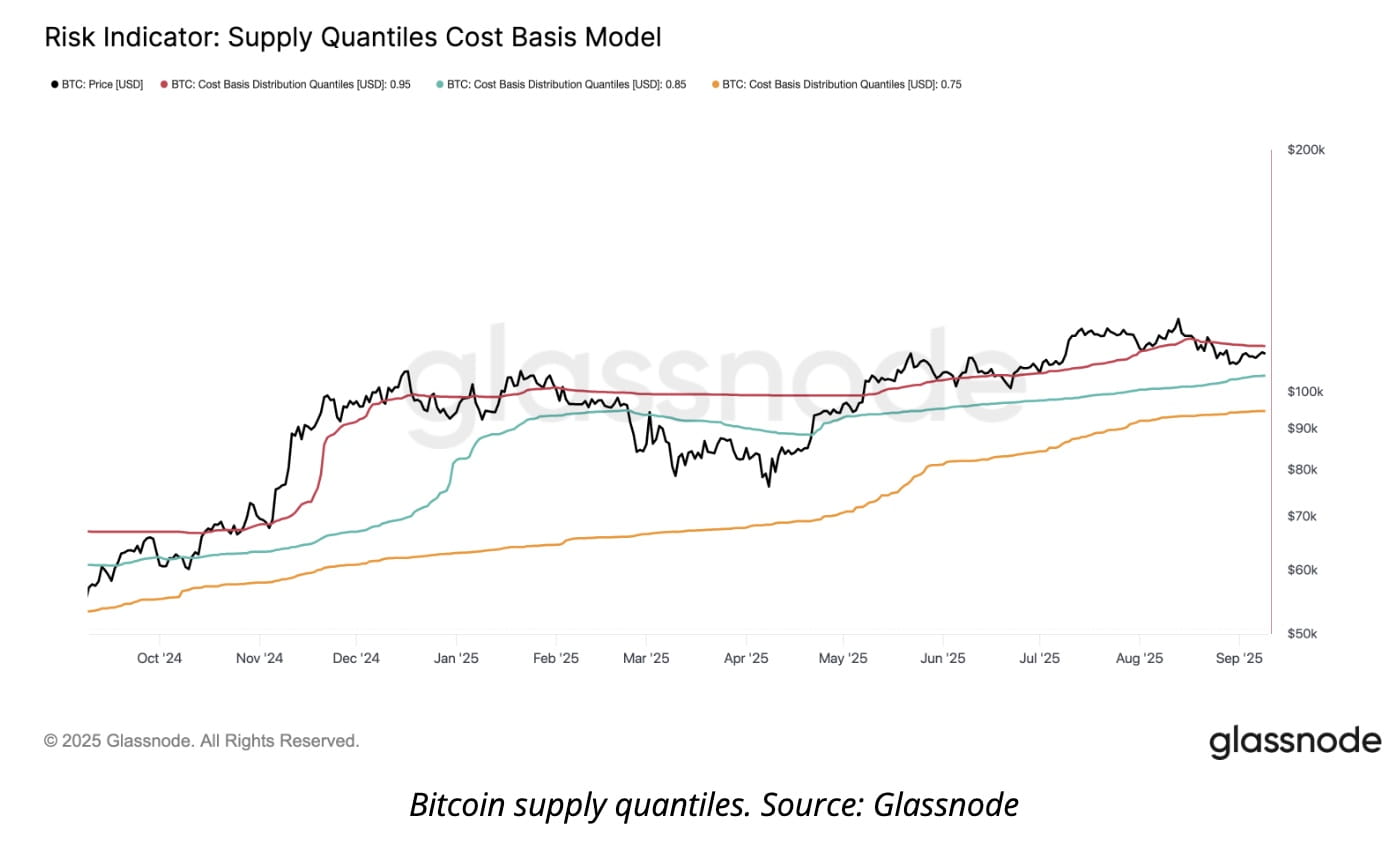

Glassnode’s research focuses on profit quantiles, which track the cost basis of active supply. Currently, Bitcoin sits between the 0.85 and 0.95 quantiles ($104.1K–$114.3K).

Below $104.1K: Market would replay post-ATH exhaustion phases, as seen earlier in the cycle.

Above $114.3K: Would signal demand reclaiming control and confirm renewed bullish momentum.

“Breaking below $104.1K would replay the post-ATH exhaustion phases, whereas recovery above $114.3K would signal demand finding its footing,” Glassnode explained.

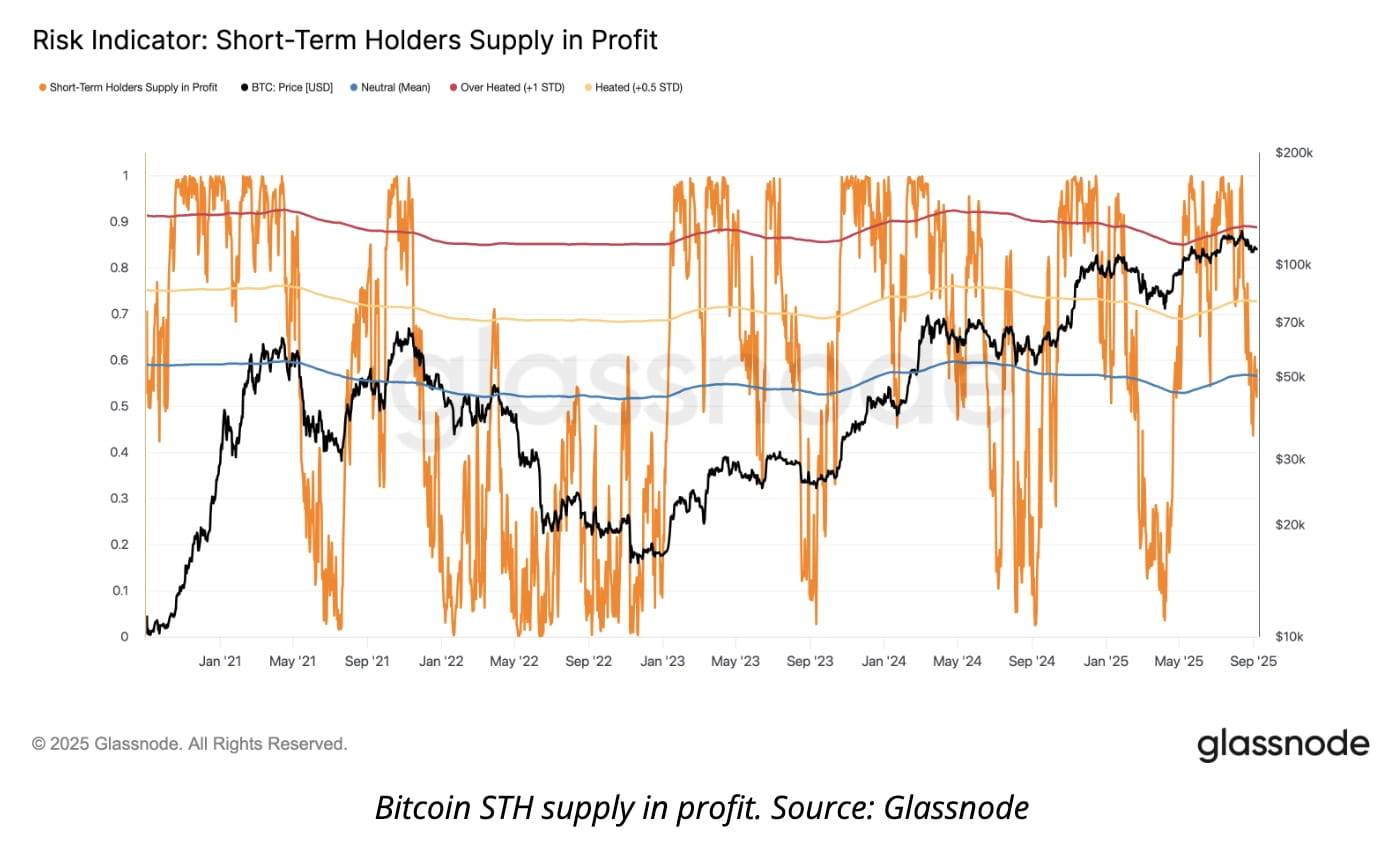

Short-Term Holders Under Stress

Short-term holders (STHs), wallets holding BTC for up to six months, play a crucial role during corrections. But their profitability has collapsed:

At $108K, STHs’ share of profitable supply fell from 90% to just 42%.

This “cooling-off” period is typical of overheated markets shifting into stress zones.

While many STHs sell under pressure, selling at a loss often leads to exhaustion, paving the way for rebounds — as seen with BTC’s bounce back to $112K.

Market Outlook

Glassnode emphasizes that Bitcoin’s August peak marked the third euphoric rally of this bull cycle, each of which has proven unsustainable for long stretches. The current setup suggests a volatile sideways market, with $104K as the key downside level and $114K+ as the upside trigger for trend continuation, according to Cointelegraph.