Attention everyone! The market for AIA is releasing key signals! Broker chips are showing significant anomalies, and the rise above $1.04 may hide secrets!

(Monitoring Evidence👇)

Broker Movements: Making a Show on the Surface While Acting in the Shadows | Action: Creating Illusions with Volatility | Suggestion: Maintain Caution

🎰 The Truth Behind Market Games

Core Data Monitoring

Historical Volatility Range: $0.44-$1.04 (Amplitude up to 136%)

Key Liquidation Point: $0.823 (Concentration of Long Liquidations)

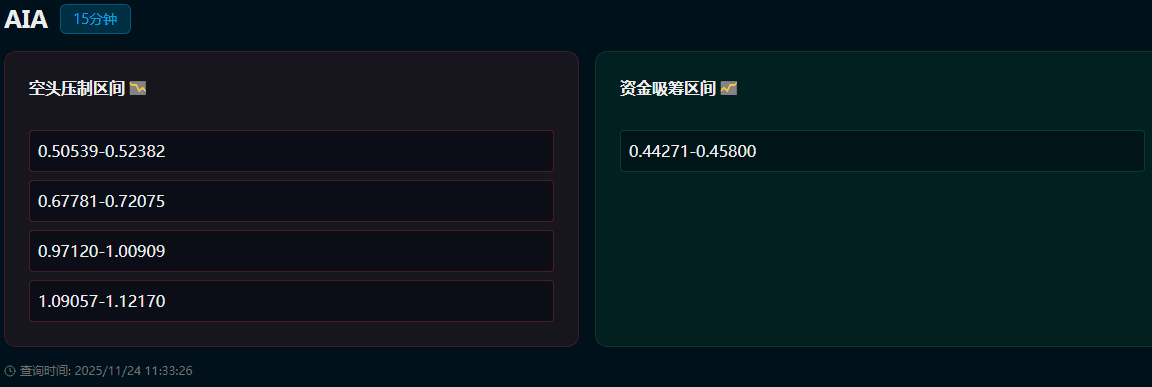

Resistance Level: $0.72 (Repeatedly Tested Without Effective Breakthrough)

Support level: $0.44-$0.46 (Key defense range)

🔍 Data-driven investment strategy

Quantitative trading advice:

Position management (based on volatility calculations)

Single opening should not exceed 2% of total funds

Within the $0.44-$1.04 range, it is recommended to build positions in 3-5 batches

Maximum drawdown controlled within 15%

Key price operation guide

Above $0.72: Reduce position by 80% (Risk-reward ratio >1:3)

$0.56-$0.62: Wait-and-see area (waiting for direction choice)

$0.44-$0.46: Light position trial long (stop-loss set at $0.42)

Risk control data

Intraday volatility: 18.5% (considered extremely high risk level)

Recommended leverage: Not exceeding 3 times

Margin utilization rate: <50%

Data validation entry and exit strategy:

Long signal: Steady at $0.65 for 4 consecutive hours, and trading volume increases by more than 30%

Short signal: Break below $0.55 support, combined with negative funding rates

Stop-loss setting: Based on ATR indicator, suggested at key price ±3%

💡 Data insights

From on-chain data, the $0.80-$1.04 range has accumulated a large number of short-term profit-taking positions, with a turnover rate of up to 85%, while the support strength in the $0.44-$0.56 range needs trading volume validation.

Data decision mantra: Prices remain unchanged, data leads, quantitative risk control ensures safety!

Disclaimer: The content of this article is based on public market data analysis and does not constitute investment advice.