The latest minutes from the Federal Open Market Committee (held on October 28-29, 2025) reveal much more than just policy decisions.ey expose a Fed at a decision-point — and for markets relying on “easy money,” that’s a shake-up.

---

🧠 Key Highlights

The target range for the federal funds rate was cut by 25 basis points to 3.75%-4.00%.

But the cut came despite significant inflation concerns and a lack of strong data to justify aggressive easing.

The minutes show “many participants” felt it was likely appropriate to maintain the current rate for the rest of the year — not cut further.

The Fed signalled broad support for ending its quantitative-tightening (QT) programme as early as December 1 — shifting its balance-sheet strategy.

Analysts now place the odds of a December rate cut at ~25-30%, down sharply from prior expectations.

---

📉 What This Means for Markets

1. Growth stocks & tech: These relied heavily on the “easy money” narrative. If cuts are delayed, valuations get questioned.

2. Bond and yield markets: With QT ending earlier and no guarantee of rate cuts, yields could rise and curve twists become more likely.

3. Policy-risk premium: The world’s biggest central bank showing internal division means investors must price in uncertainty — not assume smooth sailing.

4. Liquidity dynamics: Ending QT signals less Fed support for markets; volatility is potentially higher.

5. Sector rotation: With easing less assured, sectors like value, defensives, financials may outperform high-growth plays that bet on rate cuts.

---

✅ What Investors Should Do Now

Revisit your assumptions: If your portfolio assumes a December cut, you may be positioned wrong.

Increase flexibility/liquidity: Keep some dry powder; when policy moves are uncertain, market reactions tend to be sharper.

Shift focus: Consider adding exposure to companies/segments less dependent on ultra-low‐rate environments.

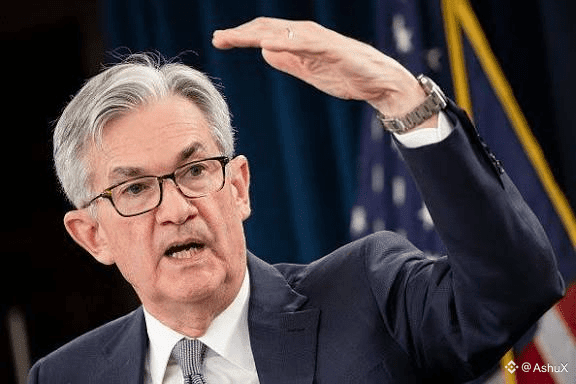

Monitor data & speeches: With the Fed saying “we’ll act when we see clear signals,” every inflation report, jobs number, and Powell speech becomes a trigger.

Manage risk: Hedging or reducing leverage is prudent — this is a phase where “fast” change matters more than “steady” growth.

---

The message from Powell and his colleagues is clear: We’re not ruling anything out, but we’re not committing either.

In plain terms: The era of “cut next meeting, cut the one after” is over.

Markets built on that assumption must adjust now.

#PowellWatch #FederalReserve #MonetaryPolicy #interestrates #MarketStrategy