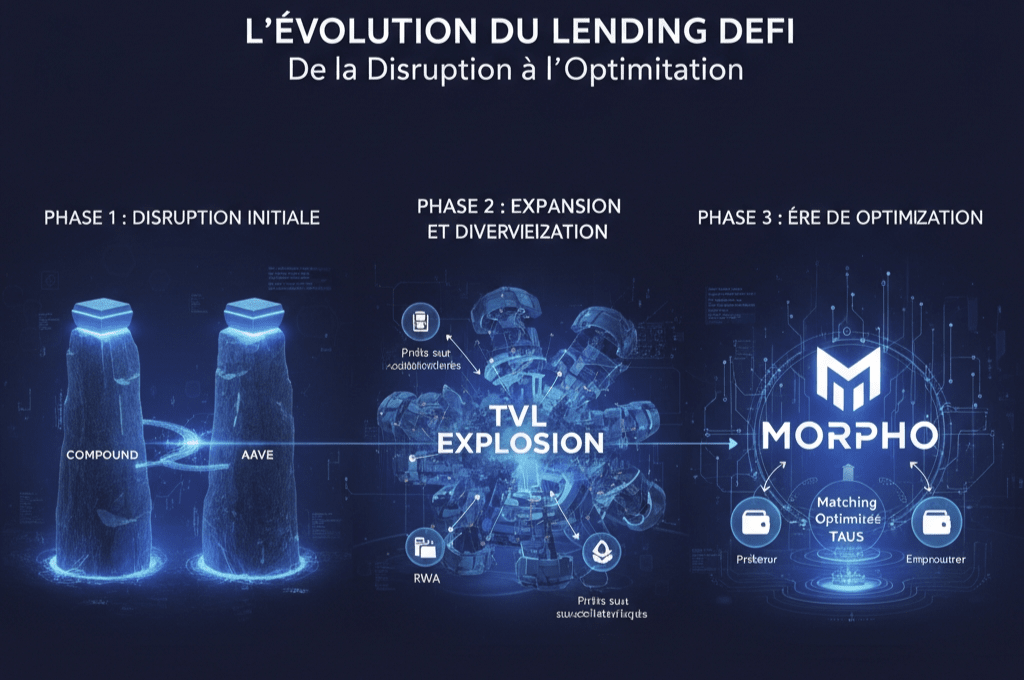

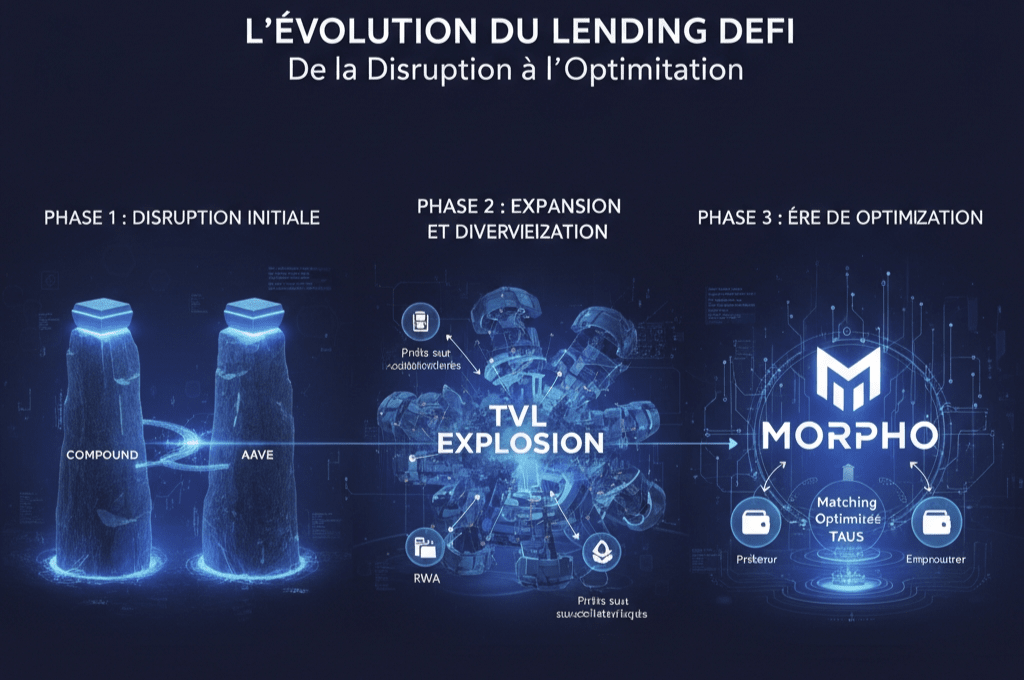

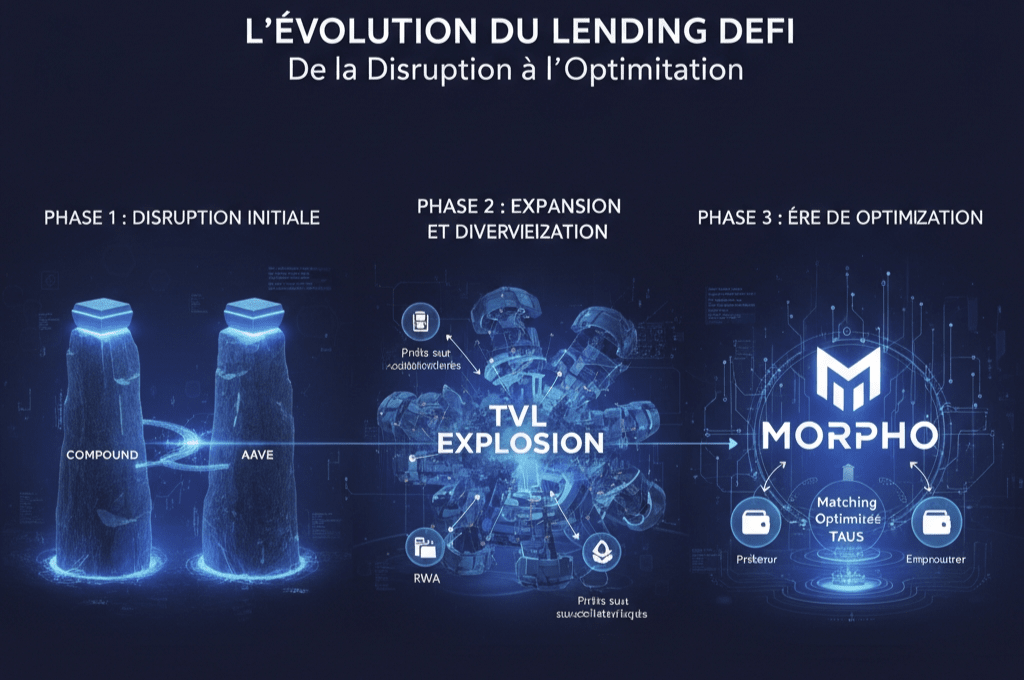

Decentralized lending has come a long way since its beginnings. Understanding this evolution allows us to grasp why protocols like Morpho make a difference today.

@Morpho Labs 🦋 #morpho $MORPHO

Phase 1 (2018-2020) : The initial disruption

Phase 2 (2020-2023): Expansion and diversification

Many protocols have emerged, each with its specifics: under-collateralized loans, isolated markets, integration of real-world assets. The TVL of the sector has exploded, validating the product-market fit of DeFi lending.

Phase 3 (2023-present): The era of optimization

With the foundations laid, attention turns to capital efficiency: how to maximize the return on every dollar without compromising security? This is where solutions like Morpho come into play.

The issue of capital efficiency

In traditional pools, part of the interest paid by borrowers never reaches lenders. This gap, minimal but structural, is not captured by the protocol and is lost in the mechanics of pool allocation.

The innovation of optimized matching

Morpho offers an incremental but powerful improvement: to connect participants directly when possible, while maintaining the security of established protocols (Aave, Compound).

Key benefits:

Maximum security: relying on battle-tested infrastructures.

Risk reduction: proven code, fewer vulnerabilities.

Trends and implications

The growing adoption of optimization solutions suggests that DeFi is maturing towards greater efficiency. Users are becoming more demanding and less tolerant of inefficiencies.

What this implies for the future

Modular and composable architectures to graft optimization layers.

Specialization of protocols: some for security, others for efficiency.

Standardization of interfaces to facilitate integration and innovation on higher layers.

💡 In summary: DeFi lending is no longer just a matter of disruption. It’s now about optimizing every invested dollar, and protocols like Morpho are showing the way to a more efficient, safe, and mature market.