#$SOL

Here’s a detailed look at what’s happening with SOL, why the recent break of its trend matters, and where things could go from here.

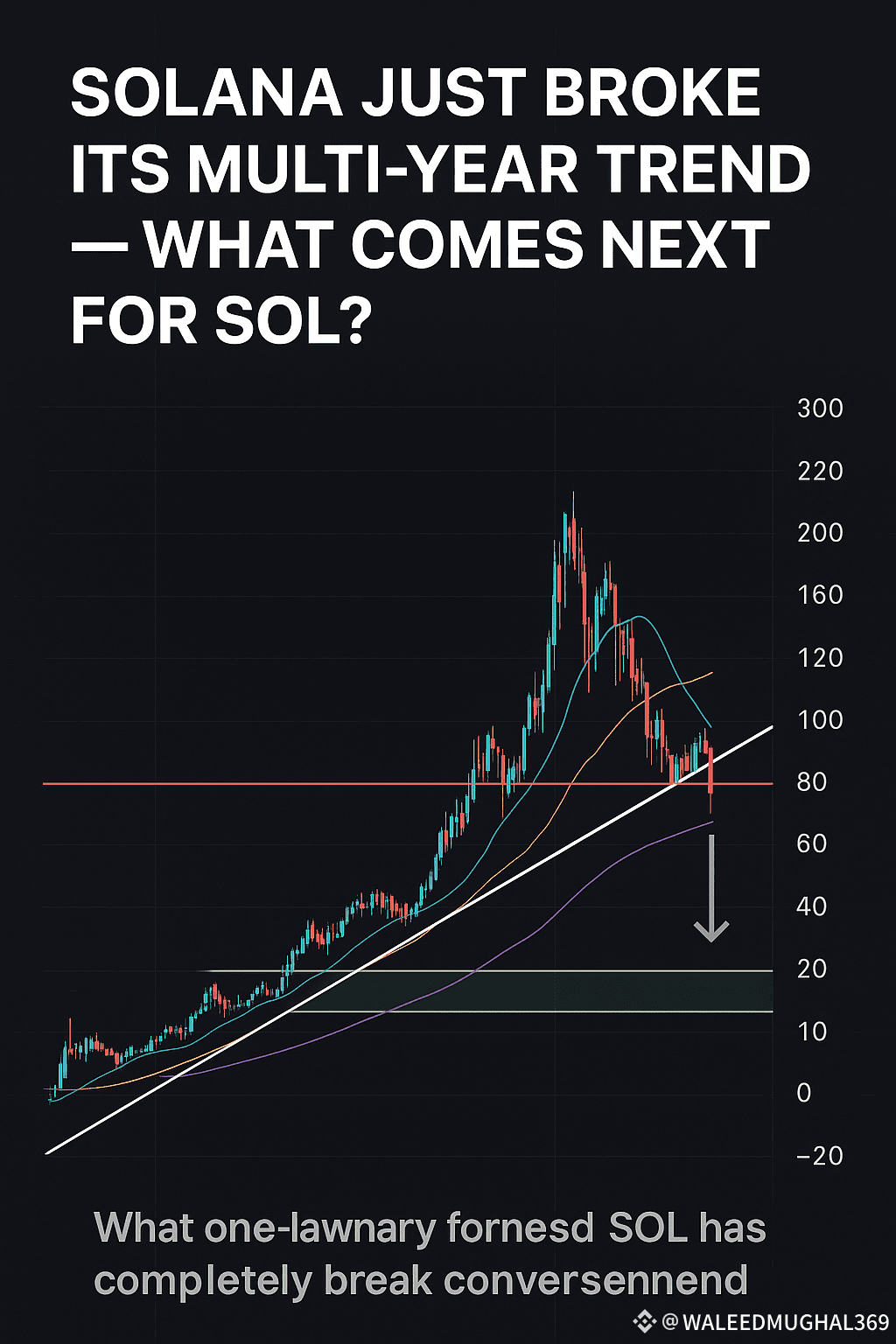

📉 What just happened? Trendline break confirmed

SOL has broken below a multi-year up-trendline that had been touched multiple times, signalling a potential structural shift. Binance+2Traders Union+2

Technical indicators show weakness: SOL is trading below its 20-day, 50-day and even 200-day moving averages, indicating both short- and medium-term bearish pressure. Traders Union

One report describes this as more than a corrective dip—arguing we may be entering a “wave-C” downtrend phase. Binance

$

✅ What still gives bullish hope

Despite the trendline break, other analyses suggest that the long-term bullish structure remains intact for Solana, provided key support holds. TradingView+1

On-chain/network fundamentals remain strong: active addresses, developer activity and ecosystem growth are still positive. CoinCodex

Some patterns in play: e.g., breakout above $220 with institutional accumulation were cited as potential build-blocks for a move higher. Brave New Coin

🎯 Key levels to watch

Support zone: Around $160-$175 is cited as critical. A drop below this may invalidate bullish structure. CoinCodex+1

Resistance / breakout levels: ~$220-$225 first meaningful barrier. A clean breakout above could pave way to ~$300+ or higher. Brave New Coin+1

Medium-term targets: Some analysts project $270-$330 as plausible if breakout holds. Bitget

🔍 Scenario planning: Where could SOL go?

Bearish scenario:

Trendline break leads to loss of support at $175 → drop toward ~$140-$160.

Oversold indicators may drag this lower if sellers dominate.

Base case / consolidation:

Price holds support at ~$160-$175, trades sideways while market digests.

Resistance near ~$220-$225 tested repeatedly.

Bullish scenario:

SOL reclaims and closes above ~$225 with strong volume → triggers breakout.

Momentum carries into ~$300+ zone, maybe beyond to ~$350-$400 if dozens of factors align. Brave New Coin+1

📌 What to keep an eye on

Volume & participation: Breakouts with weak volume tend to fail.

Broader crypto market: SOL often follows trends of larger assets like Bitcoin and overall risk sentiment.

On-chain metrics: Adoption, active addresses, protocol usage can provide early signals.

Technical confirmation: A confirmed close above key resistance (~$225) or a confirmed break below key support (~$160) will help clarify direction.

External macro / regulatory events: Crypto is sensitive to regulation, institutional flows, macro risk.

🧠 My takeaway

While the break of the long-standing trendline is a red flag, it doesn’t mean all is lost for Solana. The long-term bullish case remains alive if key support holds and a breakout above resistance happens. Conversely, if support fails, this could mark the beginning of a deeper correction.

If I were to place a probabilistic view:

40% chance of consolidation / base building

30% chance of breakout to the upside

30% chance of a deeper correction