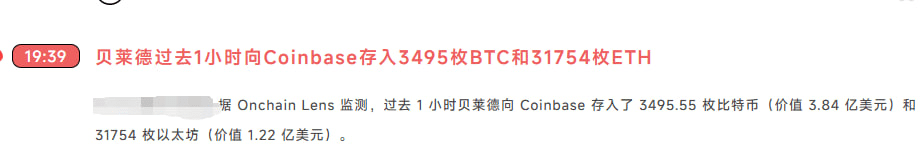

Brothers, the market is like the calm before a storm—BlackRock suddenly dumped nearly $500 million worth of Bitcoin and Ethereum into Coinbase, feeling like an elephant jumping into a small pond, splashing everywhere! Personally, I think this is not a small matter; there might be significant moves behind it from institutions.

Will the market go up or down? It depends on whether retail investors can withstand this wave of impact. I guess today’s market will be as thrilling as a roller coaster, but whether the outcome will be a surprise or a scare depends on whether the key technical positions can hold up!

The suspense has come—now that BlackRock has done this, the market sentiment is definitely going to explode! On the news front, institutions are depositing large amounts of coins into exchanges, which is usually a precursor to selling and can easily trigger panic selling.

In terms of funds, nearly $500 million has moved, like pouring a bucket of cold water on the market; retail investors may be feeling anxious now, thinking 'the big players have all left, what am I still doing here'? Emotionally, I estimate that most retail investors will follow the trend to sell today, fearing being trapped. Therefore, today's direction: retail investors should be cautious, don't rush to bottom fish, first observe the market reaction, and avoid emotional trading.

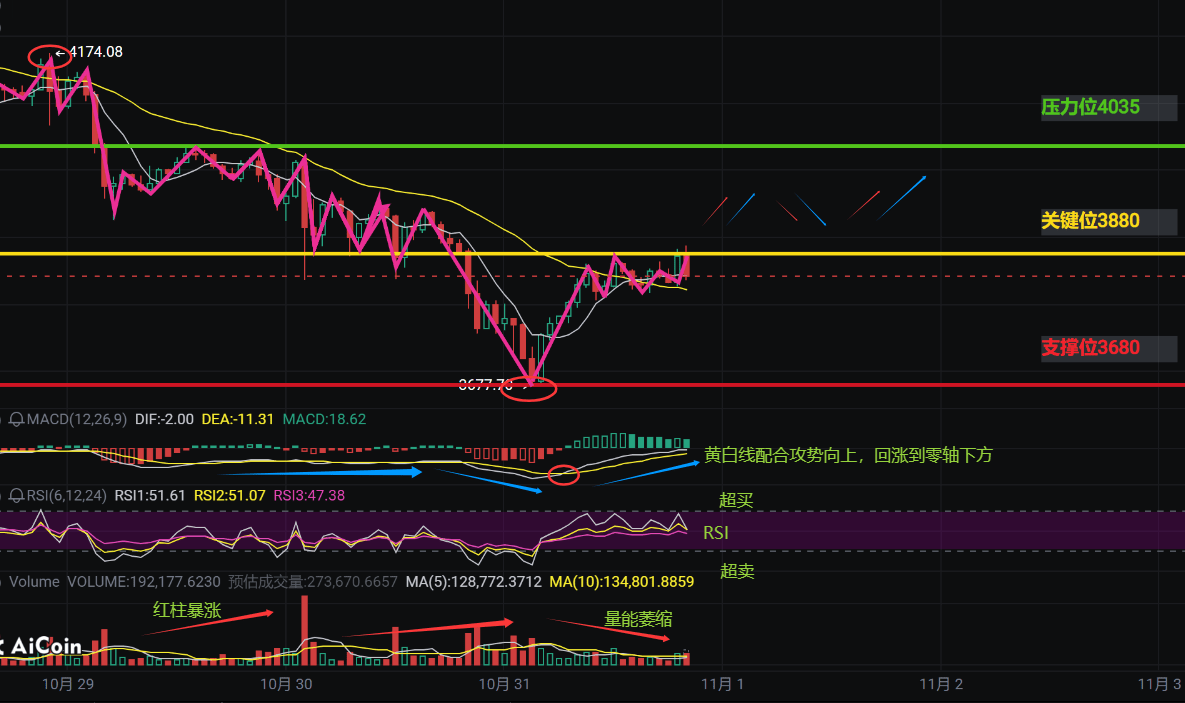

Retail investors' short-term trading strategy: be clear in expression, have support and resistance, water dividing line, and provide practical investment advice and survival skills.

Short-term trading strategy, here are the key points for everyone:

Support level: 3680 (this is the lifeline; if it breaks, don't hold on stubbornly, run quickly).

Resistance level: 4035 (if it pushes up to here, if the volume is not enough, it may be a false breakout).

Water dividing line: 3880 (this position is critical; if it holds, there may be a rebound; if it breaks, a faster decline will follow).

Practical advice:

If the price stays above 3880, you can try a small long position, with a stop loss set below 3680.

If it breaks below 3680, don't hesitate, reduce your position or short, targeting below 3500.

Remember to never go all in, test the waters with small amounts; setting stop-loss orders is as important as wearing a seatbelt; watch more and act less, wait for trend confirmation before taking action. Remember, staying alive is key to making money!

My personal view is very straightforward: the short-term market is suppressed by news, the technicals are also leaning bearish, retail investors should hold on today and not become cannon fodder. But in the long term, the crypto market always has cycles; after a lot of drops, it can actually present opportunities. Brothers, steady and steady, so we can laugh until the end!

Lastly, if you want to receive this kind of valuable analysis every day, remember to follow Anna—he specializes in market confusion and helps you avoid pitfalls to make money! If you find it useful, give a thumbs up and share with more friends, so we can survive together in the cryptocurrency world!#巨鲸动向