BTCUSD

Structure | Direction | Key Reaction Areas

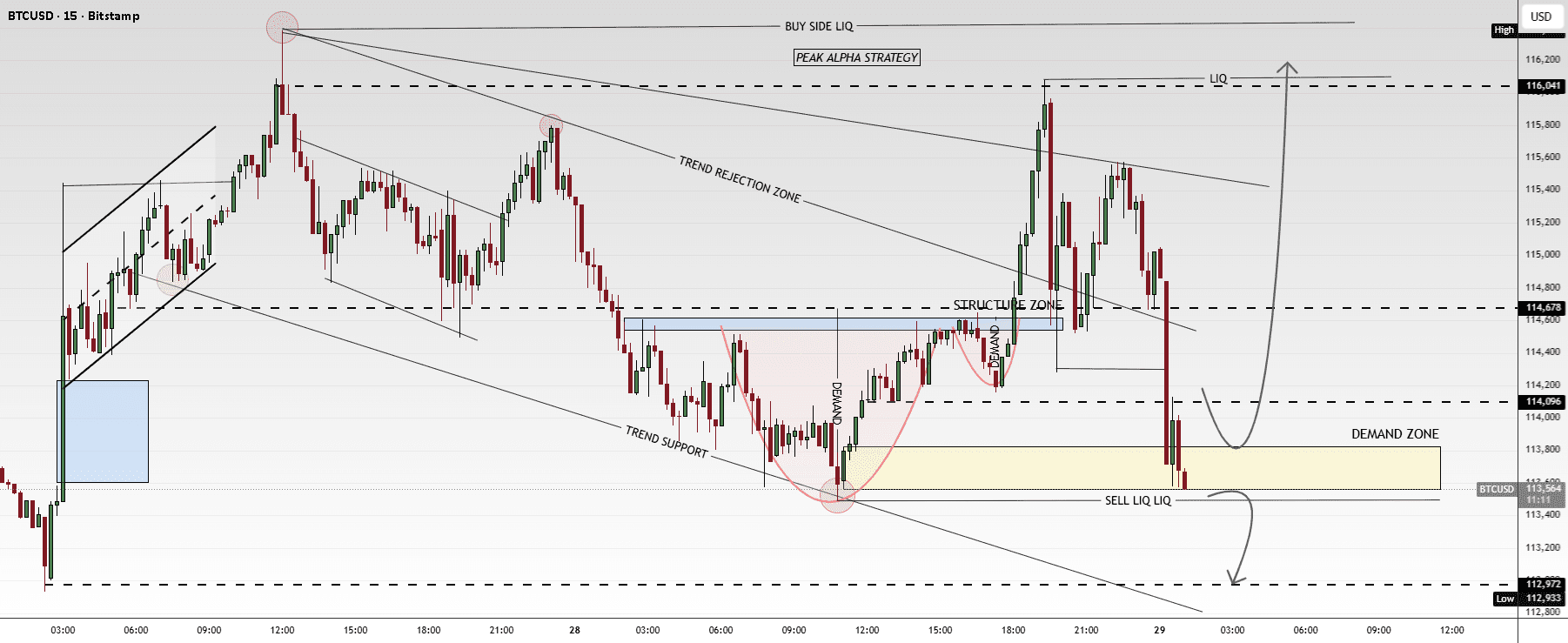

BTC continues to respect the downward channel structure, facing consistent rejection from the directional rejection area while maintaining a clean liquidity behavior at the bottom. Prices have touched the demand area (113,600–114,000) after a strong liquidity pull from the selling side, setting up a potential rebound phase.

Market Overview

After pulling liquidity below 113,700, prices reacted strongly from the demand zone, indicating buyer activity and the potential for a short-term upward correction.

A clean correction above 114,100–114,400 may lead to a new test towards 114,700–115,000, in line with the previous structural area.

However, a breakdown below 113,600 would invalidate the bullish setup, revealing deeper liquidity towards 112,970–112,930.

Main scenarios

✅ Bullish scenario 🚀 → above 114,100

🎯 Target 1: 114,700

🎯 Target 2: 115,200

🎯 Target 3: 116,000

❌ Bearish scenario 📉 → below 113,600

🎯 Target 1: 113,000

🎯 Target 2: 112,930

Current levels to watch

Resistance 🔴: 114,400 – 114,700

Support 🟢: 113,600 – 113,000

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

#WriteToEarnUpgrade #AltcoinETFsLaunch #US-EUTradeAgreement #CPIWatch #bitcoin