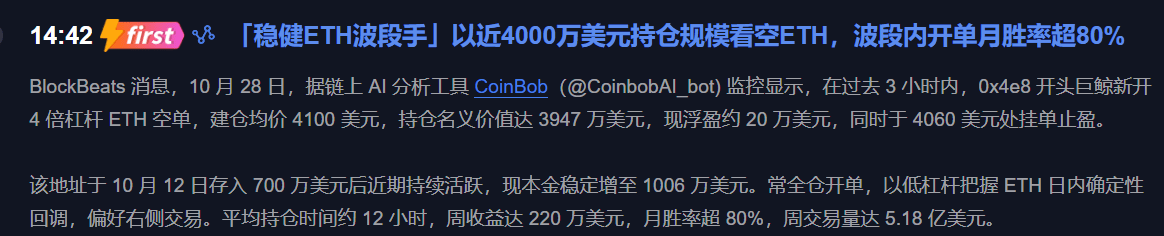

Dear friends, President Fuqi is back to chat again! Today I came across a hot news item, freshly released on October 28, where a mysterious whale (address starting with 0x4e8) made a big move—directly shorting nearly $40 million worth of ETH, using 4x leverage, with an entry price around $4100, and now has an unrealized profit of $200,000, and has placed a take-profit order at $4060. Is this operation fierce or what?

What's even more impressive is that this guy deposited 7 million in principal on October 12 and, with a series of bold operations, the principal rose to 10.06 million, with a monthly win rate exceeding 80%. He made $2.2 million in just one week, with a trading volume reaching $518 million! Even I, the president, was amazed by the sophistication. Now let's talk plainly about what this means and how it relates to our crypto circle.

Firstly, this whale is not acting randomly; they play with a 'steady swing trader' style, fully opening positions but with low leverage, specifically targeting ETH's intraday pullbacks, preferring right-side trading, which means waiting for clear trends before taking action, with an average holding period of about 12 hours. This kind of high win rate operation suggests that the whale may have sensed a signal of short-term market correction.

Isn't ETH recently fluctuating at a high level? With such a big whale opening a short position, it might make some follow-up traders nervous, causing small fluctuations, but don’t panic! This is not a doomsday signal, but rather a market norm—large funds always like to test the waters at key points, and we small retail investors should just enjoy the show and learn some strategies.

Secondly, related to the overall market, such whale behavior often acts like a 'weather vane.' A win rate exceeding 80% is not just talk; it indicates that whales have a precise grasp of timing, possibly based on on-chain data or AI analysis. If more players follow suit later, ETH may face short-term pressure, testing the $4000 support.

But in the long run, the fundamentals of ETH remain stable, and whale operations are more about short-term games, which do not affect the overall trend. Remember, dear friends, don't rush to cut losses as soon as you see a short position; there are always opportunities in the market, and the key is to have your own strategy.

Finally, President Fuqi reminds us that this kind of news is a double-edged sword—on one hand, the successful cases of whales can remind us that swing trading can be low leverage and fast-paced, and with a high win rate, it can really make money; on the other hand, don't blindly imitate, as whales have large capital and many resources, we small retail investors must act according to our capabilities and do our homework. In short, the market direction still depends on macro factors, such as policies and technological updates. Stay alert, but don't scare yourself!

If you want to delve deep into the crypto circle but can't find a clue, and want to quickly get started and understand information gaps, click on my profile and follow me to gain firsthand information and in-depth analysis!#巨鲸动向