Guaranteed profits in the cryptocurrency contract market? First, master these 8 trading systems! Experts are using them, and you can understand it all at a glance without falling into pitfalls

In the cryptocurrency contract market, money earned by luck will eventually be lost through skill. Countless newcomers fall into the pit of 'trading by intuition', while true contract masters have a solid set of 'trading skills'—the classic eight trading systems. These are their core weapons for judging bullish or bearish trends and responding to market conditions. Whether you are bullish or bearish, you cannot do without the dual support of technical and theoretical aspects.

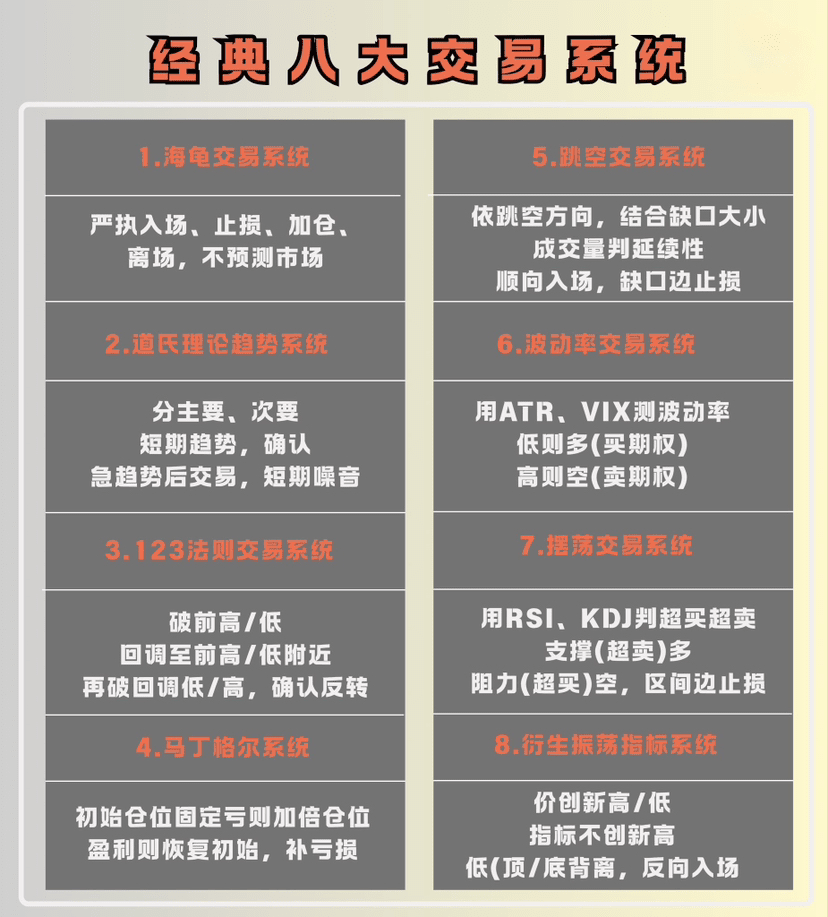

1. Turtle Trading System: A 'laying down profit' tool for trend followers

As a classic representative of trend following, the Turtle Trading System relies on 'fixed rules' for its success. It does not guess tops or bottoms but quietly waits for medium to long-term price trends to appear, just like a turtle lurking. Once a signal is triggered, it decisively enters the market, allowing profits to 'run automatically' with the trend, which is especially suitable for trend traders who do not have time to monitor the market.

2. Dow Theory Trend System: The 'compass' for market direction

Want to understand whether cryptocurrency prices are rising or falling? The Dow Theory Trend System is the foundation of foundations. It helps you see the market's major trends, minor trends, and short-term fluctuations through analysis, avoiding the pitfalls of 'chasing up and killing down' in choppy markets, ensuring that every trade goes 'with the trend'.

3. 123 Rule Trading System: The 'alarm' for trend reversals

Worried about buying at the top and selling at the bottom? The 123 Rule Trading System is specifically designed to address this issue. It accurately confirms trend reversal points through a three-step pattern of 'price breaking through previous highs/lows, retracing without making new highs/lows, and breaking through key levels again,' allowing you to get on or off the bus in time during trend reversals, keeping pace with market rhythms.

4. Martingale System: A 'double-edged sword' of risk and opportunity

The Martingale System is centered on 'doubling the bet', continuously increasing positions after losses in an attempt to cover all previous losses with a single profit. However, be cautious, as it is like a double-edged sword — it may quickly recover in choppy markets, but encountering a one-sided large trend could lead to instant liquidation. New users must set stop losses carefully.

5. Gap Trading System: The 'money-grabbing' code for gap markets

In the cryptocurrency market, there are often 'gaps' from high opens or low opens. Many view this as a risk, but experts see it as an opportunity. The Gap Trading System analyzes the type of gap (breakout gap, continuation gap, exhaustion gap) along with market trends to determine whether the gap is a 'continuation signal' or a 'reversal signal', allowing you to quickly seize short-term profit opportunities when gaps appear.

6. Volatility Trading System: The 'profit tool' for high-volatility markets

The cryptocurrency market is highly volatile; some people fear volatility while others profit from it. The Volatility Trading System assesses the market's volatility (such as the ATR indicator) to determine whether current volatility is 'too high' or 'too low'. It seeks breakout opportunities during spikes in volatility and waits for market explosions during low volatility, making volatility your 'profit assistant'.

7. Swing Trading System: The 'arbitrage expert' in choppy markets

When encountering sideways fluctuations, many people fall into the dilemma of being 'cut back and forth', while the Swing Trading System can navigate these conditions with ease. It uses indicators like RSI and KDJ to determine the 'overbought and oversold' zones of cryptocurrency prices, shorting when overbought and going long when oversold, specifically capturing 'swing profits' in choppy markets, allowing for stable profits during sideways periods.

8. Derivative Oscillator Indicator System: The 'microscope' for short-term fluctuations

If you want to engage in short-term T+0 trading, the Derivative Oscillator Indicator System is essential. It optimizes traditional oscillator indicators to more accurately capture 'small trends' in short-term price fluctuations, such as through MACD golden crosses and dead crosses, and DMA divergence signals, helping you clearly see market changes from a few minutes to a few hours, significantly increasing the win rate of short-term trades.

These eight trading systems are not meant for you to master all of them, but to help you find your own 'unique skills'. There is no myth of 'guaranteed profit' in cryptocurrency contracts, but mastering the correct theories and systems can help you avoid detours in rising and falling markets, transforming you from a 'follower' into a 'rational trader'.#加密市场反弹 #加密市场观察