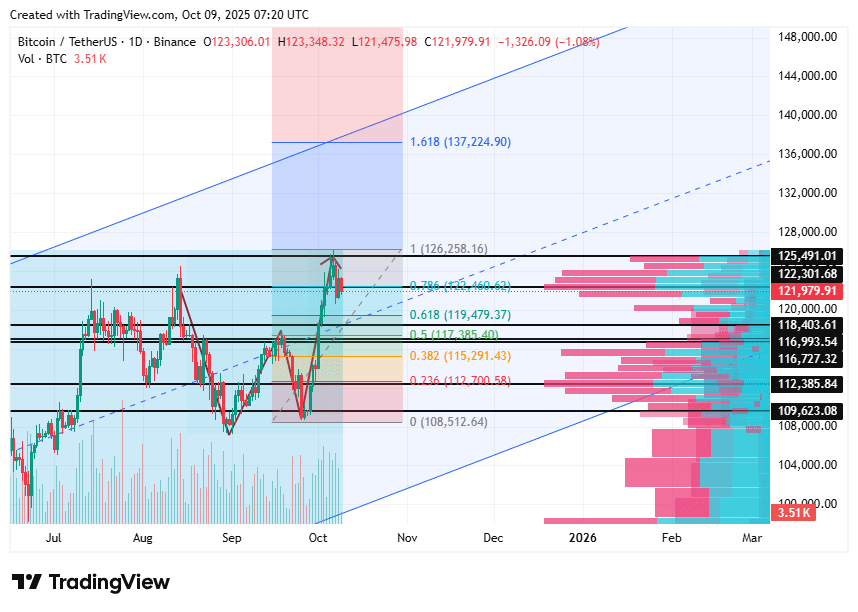

$BTC (Bitcoin)

RSI:

• 15 minutes — 39.4 (neutral zone, closer to oversold)

• 1 hour — 42.7 (weakly oversold)

• 4 hours — 47.5 (balance, market without impulse)

• 24 hours — 60.8 (moderate overbought, market is cooling down)

• 7 days — 62.4 (beginning of moderate overbought, upward trend continues)

RSI summary:

BTC shows stabilization on lower timeframes, but the weekly RSI indicates that the asset remains closer to the overheated zone globally. This is a typical situation for consolidation at the peak of the trend before a decision on a new impulse.

Levels:

• Support: $120,500 — strong buyer zone, retains interest from major players.

• Resistance: $123,500 — the nearest obstacle for bulls; a breakout with volume will open movement to $125,000.

Comment:

BTC is in a sideways movement after a growth phase. Short-term RSIs signal readiness for a local rebound, but the weekly RSI warns of overheating risk with further growth.

Forecast:

• Short-term: movement in the range of $120,500–$123,500.

• Targets when rising: $125,000 and $126,800 upon breaking the upper boundary.

• Risk zones: a drop below $120,000 will increase pressure and open the way to $118,500.

Technical signal: ⚖️ Neutral / Consolidation before directional movement.

________________________________________

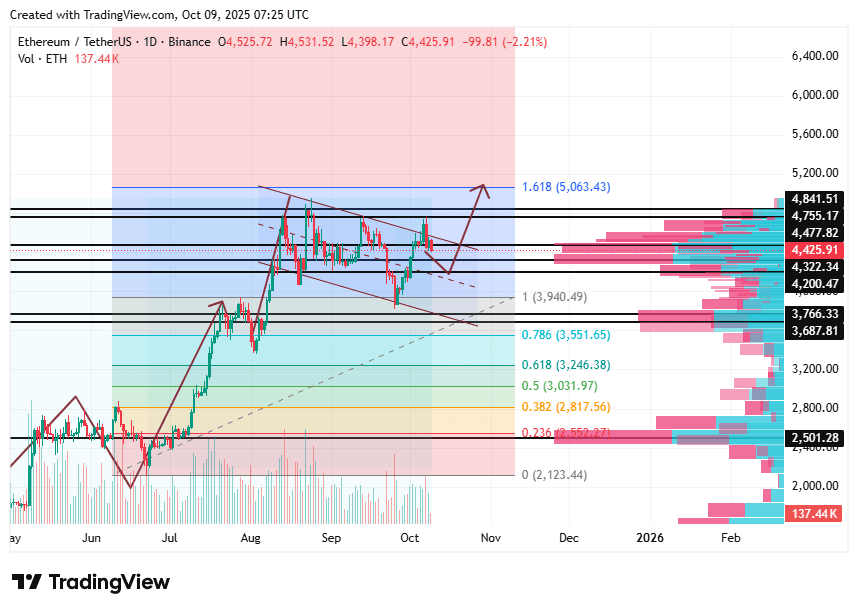

$ETH (Ethereum)

RSI:

• 15 min — 36.9 (approaching oversold)

• 1 hour — 38.9 (weak oversold, decreasing momentum)

• 4 hours — 42.5 (balance, no directional movement)

• 24 hours — 51.7 (neutral, market is balanced)

• 7 days — 62.1 (moderate overbought, growth structure still active)

RSI summary:

ETH is showing a correction within the uptrend. Short timeframes show a weakening of seller pressure, and the weekly RSI confirms that the trend remains upward, but without a pronounced impulse.

Levels:

• Support: $4,350 — key buyer zone, holding is critical for continued growth.

• Resistance: $4,480 — the nearest barrier; a breakout — a signal for acceleration to $4,600.

Comment:

ETH slightly lags behind BTC in dynamics but retains recovery potential. Seller pressure is decreasing, and the asset is close to a turnaround upwards if it manages to hold the $4,350 zone.

Forecast:

• Short-term: rebound from $4,350 to $4,480 with possible profit fixation at $4,600.

• Targets when rising: $4,750 upon breaking $4,600.

• Risk zones: a downward breakout at $4,300 will intensify the correction to $4,150.

Technical signal: ⚠️ Neutral / Potential for recovery if support is held.

________________________________________

General market conclusions:

The RSI on daily and weekly timeframes signals a transition of the market from an overheated phase to a consolidation phase.

• Short-term — a cooling of RSI is observed, indicating readiness for a rebound.

• Long-term (7 days) — the market remains in moderate overbought, meaning there is growth potential, but entering the market should be selective.

Overall sentiment: neutral-optimistic, accumulation phase continues.

________________________________________

Trading strategies:

• 💡 BTC: consider buying only from support at $120,500, targets — $123,500–$125,000.

• 💡 ETH: long position when holding $4,350, partial fixation at $4,480–$4,600.

• ⚠️ Risks: avoid entries when RSI > 65 on the daily or weekly.

• 📈 Tactics: long from support, profit fixation at resistances, building positions at local oversold (RSI 35–40).

🔥 Insights @INVESTIDEAUA : Intraday trading, LONG/SHORT strategies, SPOT, TRAINING, Tarot forecast for cryptocurrencies ✨

#ОбучениеТрейдингу #cryptotrading #tarotrading #CryptoStrategy #CryptoNews