Macro & News Impact

Unemployment Claims (235K vs 226K expected) → Slightly higher = weak labor market = bullish for ETH (more dovish Fed expectations).

Flash Services PMI (55.4 vs 54.2 expected) → Stronger services sector = economic resilience = neutral-to-bearish ETH (less urgent for Fed to cut).

Net Effect → Mixed signals, but ETH remains supported as investors rotate into risk assets.

🔹 Price Action & Technical Zones

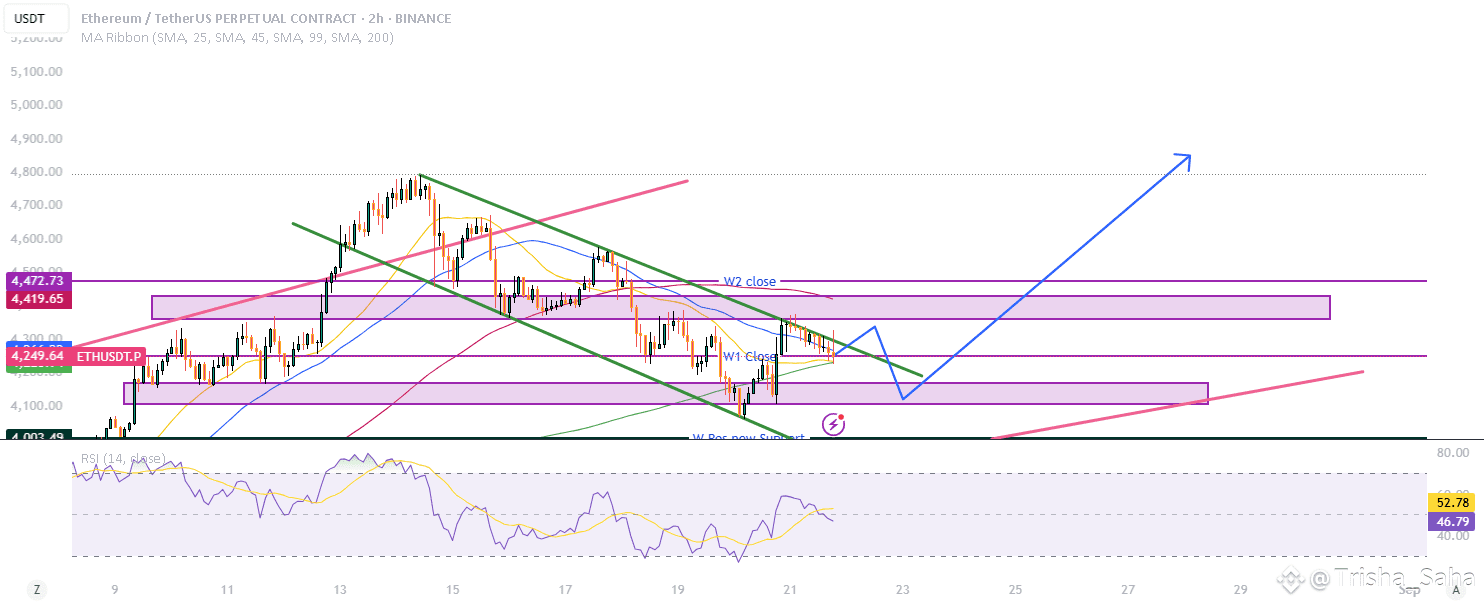

Support: $4,250–$4,300 (strong buyer defense zone).

Immediate Range: $4,300–$4,500 consolidation.

Resistance: $4,600 (short-term), $4,700 (major wall).

Breakout Levels:

Above $4,700 → opens path to $4,900–$5,000.

Below $4,250 → correction risk toward $4,100–$3,950.

🔹 Probability & Swing Trade View

Short-term (weekend) → ETH likely to range $4,300–$4,500.

Next week outlook → 60–70% chance ETH retests $4,700 if support holds.

Bearish risk only if macro shocks push ETH below $4,250.

🔹 Whale Activity & Liquidation Heatmaps

Whale buy walls visible around $4,250–$4,300, suggesting strong demand.

Whale sell walls stacked near $4,650–$4,700, explaining repeated rejections.

Liquidation clusters:

Long liquidations trigger below $4,250 → sharp downside possible.

Short liquidations trigger above $4,700 → possible squeeze rally toward $4,900+.

✅ Trading Idea Summary:

ETH/USDT is consolidating but biased bullish. Watch $4,250 (support) and $4,700 (major resistance). A breakout above $4,700 could ignite a strong move to $4,900–$5,000, while a breakdown under $4,250 risks $4,100 or lower. Whale positioning and liquidation heatmap levels reinforce this range.