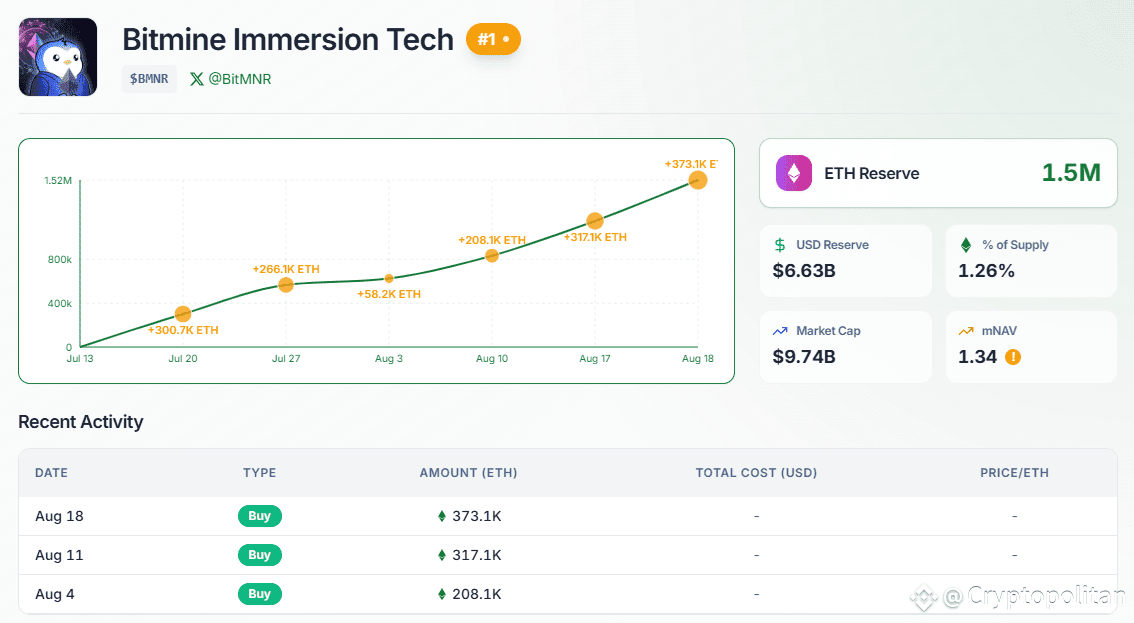

BitMine is now the second-biggest treasury company, outcompeting even BTC holders. The Ethereum treasury is now above $6.6B after additional purchases in the past few days.

BitMine (BMNR) never stopped buying ETH, even through local peaks and corrections. Within just weeks, BitMine turned into the second-biggest crypto treasury company, competing with the ranks of BTC holders. The company’s founder Tom Lee announced the achievement as it aims to buy up 5% of the ETH supply.

Major milestone for @BitMNR $BMNR as the company is now the #2 largest crypto treasury in the World behind only @MicroStrategy $MSTR

👇 https://t.co/mWY9Mn3nlT

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) August 18, 2025

BitMine’s treasury expanded to $6.6B, with a higher potential value if ETH appreciates to a higher range. With those holdings, BitMine outcompetes MARA Holdings, with $5.9B in BTC.

BitMine also bets on the potential of Ethereum as a chain for finance, potentially compatible with inflows from traditional companies. Even now, Ethereum is widely used for RWA tokenization and other on-chain experiments.

BitMine completed one of its largest purchases of ETH as of August 18, expanding the treasury to $6.6B. | Source: Strategic ETH Reserves

BitMine completed one of its largest purchases of ETH as of August 18, expanding the treasury to $6.6B. | Source: Strategic ETH Reserves

“We continue to believe Ethereum is one of the biggest macro trades over the next 10-15 years,” said Lee. “Wall Street and AI moving onto the blockchain should lead to a greater transformation of today’s financial system. And the majority of this is taking place on Ethereum.”

Currently, BitMine still holds its ETH as freely available liquid tokens, though in the future, the company intends to tap the assets for passive income. The ETH reserve envisions wider usage for the network, expanding its main features such as stablecoins and lending.

BitMine holds over 1.52M ETH

BitMine holds 1.52M ETH, up from a recent milestone of 1.2M ETH. At the end of July, Cryptopolitan reported the treasury broke the $2B milestone, and growth has continued at a fast pace ever since. Currently, the company is the most aggressive crypto buyer after Strategy (MSTR).

The BitMine treasury is also an exception, for being publicly visible. A total of 1.17M ETH are held in public-facing wallets, with new purchases coming from Galaxy Digital and other OTC desks. BitMine is deliberately public with its ETH purchases, combined with an extremely bullish message.

BitMine has also not given up on its treasury, retaining 154 BTC in its balance, as reported by aggregated BTC treasuries, though the company’s own sources report 192 BTC.

BitMine retains the biggest weight among ETH treasuries, which currently hold 3.7M tokens. Treasuries still lag behind ETFs with 6.5M ETH, as well as legacy protocols with significant value locked, accrued over the years.

BMNR is among the most widely traded US stocks

BitMine completed a fast rise from a relatively small BTC miner to one of the most actively traded US-based companies.

BMNR shares traded at $55.49, down from their $135 peak when the treasury was first announced. The shares held within the medium range, as BitMine announced a series of purchases within the span of six weeks.

As of August 18, BMNR is within the top 15 most traded US stocks, with a volume of $42.43M, standing just behind MARA. Riot Platforms and TeraWulf are also among the hottest trending stocks, showing the mining and treasury narrative is not forgotten.

BMNR is also growing its treasury more aggressively compared to its competitor, SharpLink Gaming (SBET). SBET recovered to $20.52, stalling as the company has not made new purchases since August 10.

KEY Difference Wire: the secret tool crypto projects use to get guaranteed media coverage