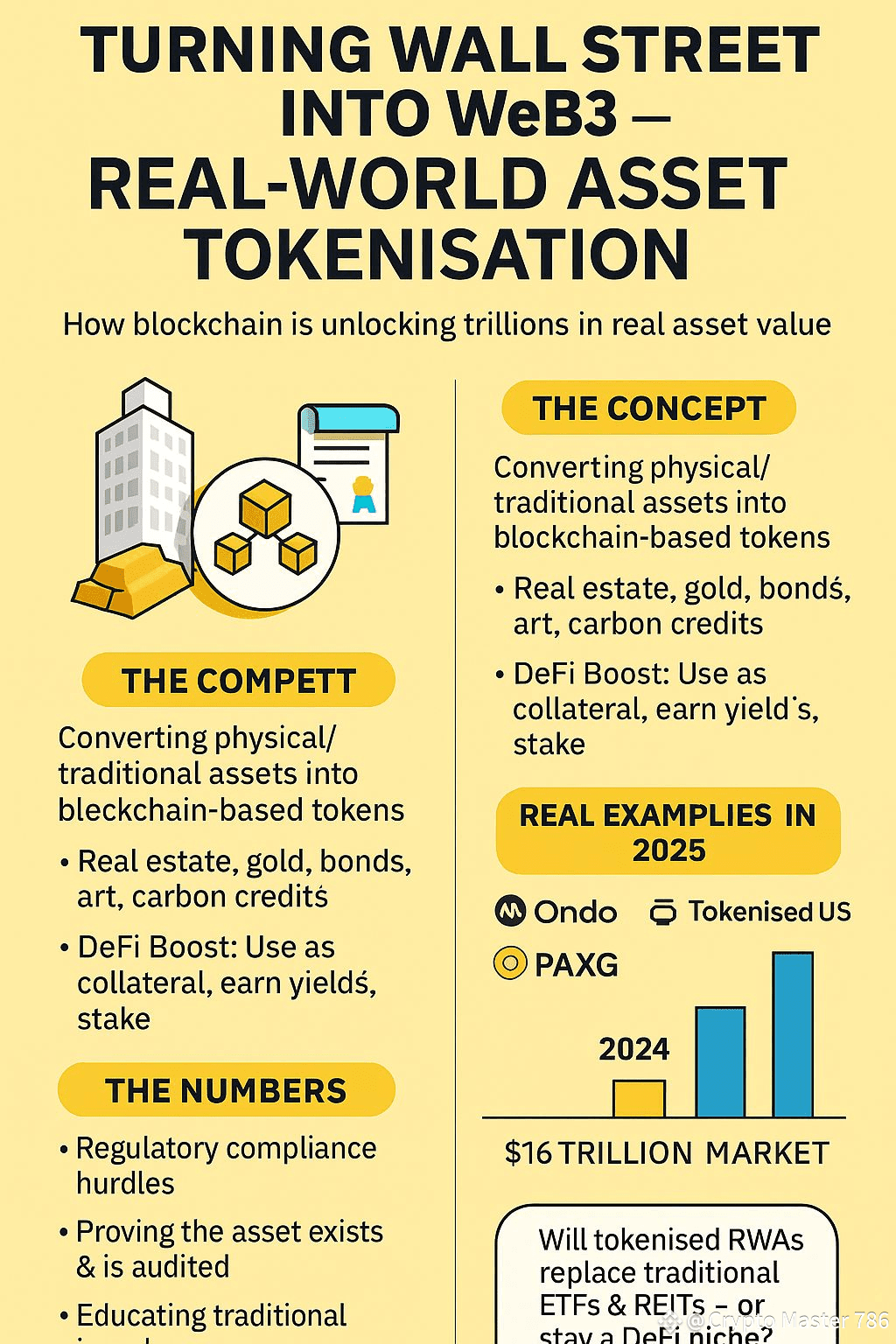

The line between traditional finance (TradFi) and blockchain is blurring fast — and Real-World Asset (RWA) tokenisation is at the center of this shift. In simple terms, it’s the process of converting ownership of real assets — like real estate, bonds, commodities, or even art — into blockchain-based tokens that can be traded, fractionally owned, and integrated into DeFi.

Why It’s a Big Deal in 2025

1️⃣ Unlocking Liquidity – Assets like property or fine art are notoriously illiquid. Tokenisation makes them tradable 24/7 on blockchain markets.

2️⃣ Fractional Ownership – Instead of needing $500K for a property, you could own 0.1% for $500, opening access to smaller investors.

3️⃣ DeFi Integration – Once tokenised, RWAs can be collateralised, staked, or yield-farmed — merging TradFi yields with crypto flexibility.

Current Real-World Examples

• US Treasury Tokenisation – Platforms like Ondo Finance and Maple Finance offer tokenised Treasury Bills, letting stablecoin holders earn 4–5% yields backed by government bonds.

• Real Estate on Blockchain – Companies like RealT sell fractional property shares that pay out rental income in stablecoins.

• Gold-Backed Tokens – PAXG is tied to physical gold reserves, combining traditional stability with blockchain transferability.

The RWA Growth Curve

📈 According to Boston Consulting Group, tokenised assets could reach $16 trillion by 2030 — with bonds, real estate, and commodities leading the way. In 2024 alone, RWA protocols saw over $8B in on-chain value locked — and it’s accelerating as institutions join in.

Challenges Ahead

• Regulatory Compliance – Many RWAs fall under securities laws, requiring strict licensing.

• Custody Verification – Ensuring the physical asset actually exists and matches the token supply.

• Market Education – Bridging the knowledge gap between TradFi and Web3 investors.

Key Takeaway

RWA tokenisation isn’t just another crypto trend — it’s the foundation for bringing trillions of dollars in traditional assets onto blockchain rails. The projects solving legal, custody, and scalability hurdles today could become the BlackRock of Web3 tomorrow.

💬 Your Turn:

Do you think tokenised RWAs will eventually replace traditional ETFs and REITs, or will they remain a niche DeFi product?

#ETH4500Next? #BinanceAlphaAlert #BinanceSquareFamily #CryptoUpdate