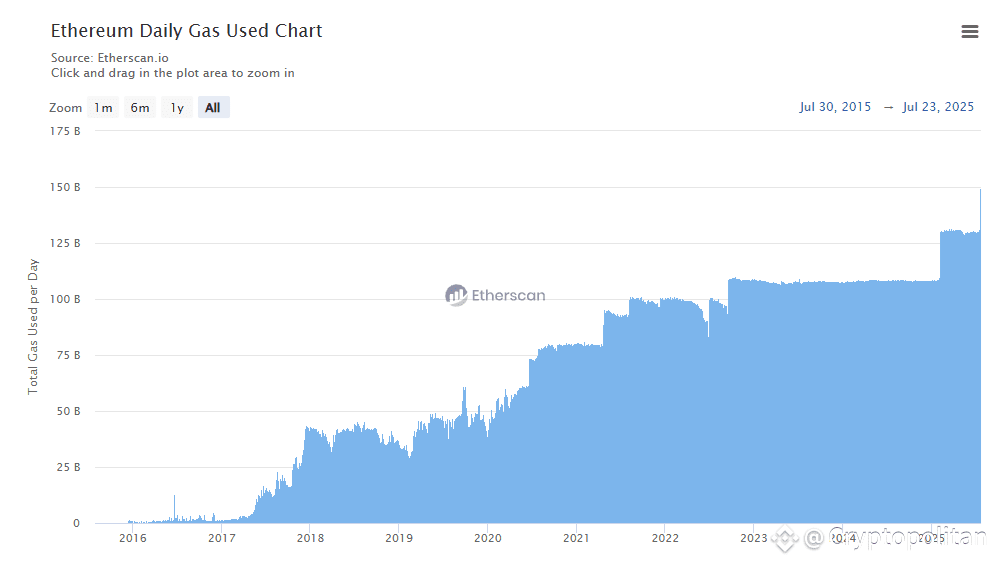

The Ethereum network shows unprecedented demand, recently marking a new record of daily gas used. The metric shows peak on-chain activity, while individual transactions remain relatively cheap.

Activity picked up in the past few days, with daily gas use rising to a record level. The metric reveals Ethereum is key to on-chain activity, and that users are returning during bull markets for multiple apps and use cases.

Ethereum gas usage spiked to a record in the past weeks, on a mix of whale buying, retail demand, and overall hype for the ETH market rally. | Source: Etherscan

Ethereum gas usage spiked to a record in the past weeks, on a mix of whale buying, retail demand, and overall hype for the ETH market rally. | Source: Etherscan

The network carries around 1.6M transactions daily, originating from over 500K daily active wallets. Activity centers around stablecoin transfers for USDT and USDC, as well as raw ETH transfers.

Network activity already spiked to a higher level in early 2025, when ETH traded closer to $4,000. This time around, gas usage rallied to a new range, based not on anomalies but generally elevated on-chain activity. Gas usage is not linked to special events, but reveals the growing DeFi usage and transfers.

ETH returns to 2021 levels, but without the hype

Despite the record usage, regular transactions still cost less than $0.15, and NFT transfers are the most expensive at $2.48. Unlike previous periods of heightened ETH usage, transactions are not prohibitive.

The recent increase in usage raises the question of scaling the network, going beyond the currently existing L2 chains. ETH has shown its combined use cases, both as valuable collateral and as a utility token for active transfers.

The current Ethereum activity and gas usage levels are close to the 2021 activity spike. The previous bull market was linked to peak NFT mania, combined with Web3 games, memes and DeFi.

After a long bear market, on-chain activity is recovering, with better infrastructure and liquidity. The biggest change comes from DeFi, where projects have built tools to avoid cascading liquidations.

The rise of Aave also set the gold standard for lending, unlocking additional liquidity on the network. Aave expanded its value locked to over $29B, while the overall network carried more than $82B in value locked. The chain now carries similar liquidity to early 2022, before the crash triggered by FTX.

Stablecoins boost Ethereum activity

Ethereum still carries over 80% of stablecoin traffic, benefiting from the increased supply in 2025. The chain carries $128.5B in stablecoins, with around 2.5M active addresses specifically dedicated to stablecoin activity.

Ethereum also carries the biggest volume in terms of value transferred, with a significant share originating from whale transactions. In the past three months, stablecoins have been part of the highly active inflow into the network.

Increased usage and liquidity, as well as bridging from unused L2 chains, meant Ethereum added $20B in the past three months. The chain was a leader of inflows, as activity returned to the L1 chain.

Even with the record usage of L2 like Base, in the end some of the earnings were bridged back to Ethereum. Multiple chains showed that bridges were used to lock in gains and revert them to the original ETH ecosystem, due to its connection to DEX and regular exchanges.

Ethereum supplies Arbitrum, Polygon, Unichain and Base with liquidity, while receiving the biggest returns from Base and Arbitrum, based on Artemis data. In the past week, L2 chains sent a net total of $104M to Ethereum, from $1.7B in gross inflows. The constant transfer shows Ethereum remains a key hub for consolidating earnings and especially stablecoins.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now