📊 Market Summary

– Bitcoin trades around $118,009, retreating from its intraday high of $118,330 .

– The recent rally was primarily fueled by $14.8 billion inflows into spot BTC ETFs, lifting BTC to an ATH of $123,000 on July 14

– Profit-taking has triggered a ~3% correction

– Market awaits key CPI/PPI inflation data and regulatory clarity in the US to guide next moves.

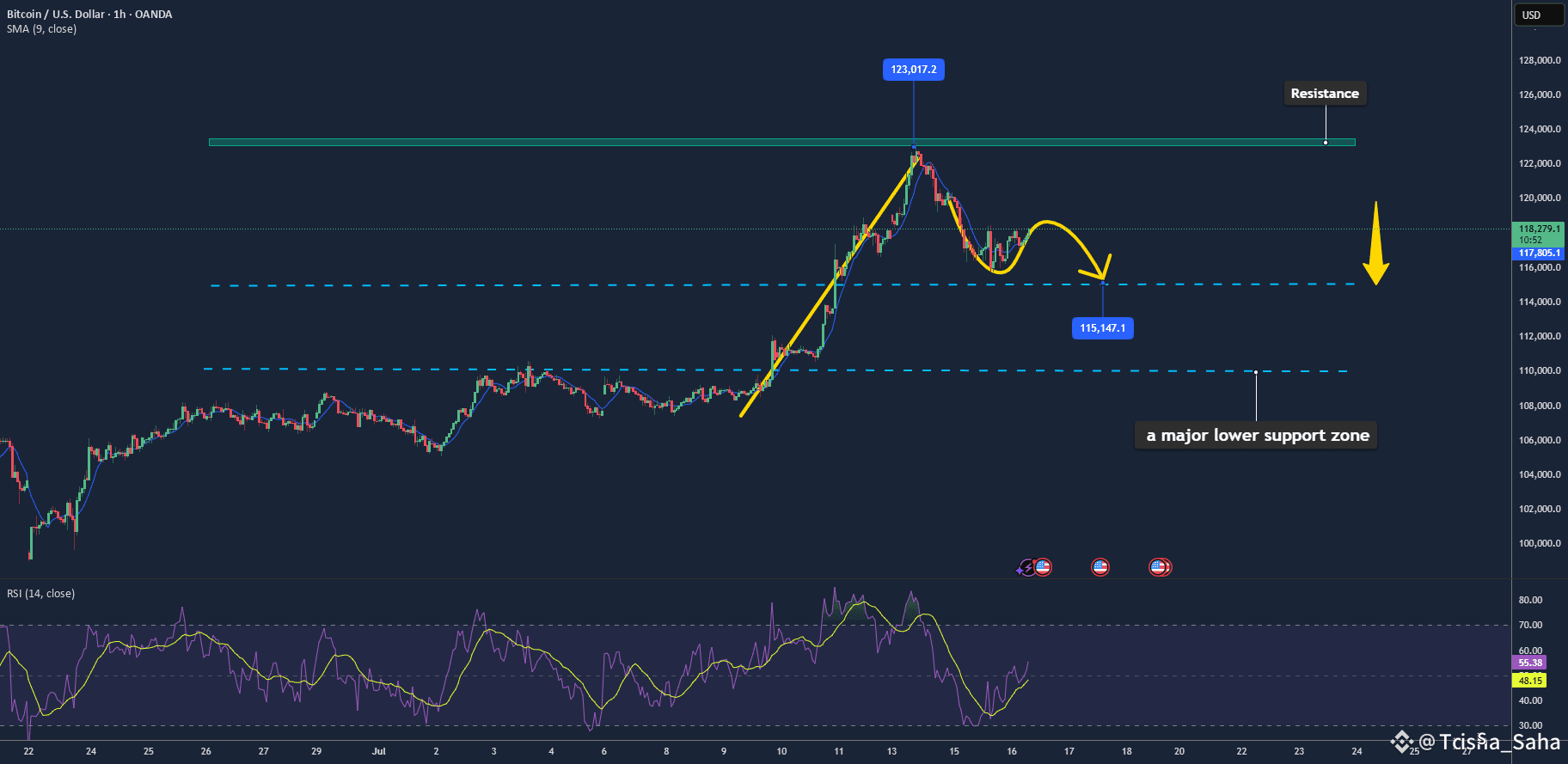

📉 Technical Analysis

• Resistance: $123,000 – $123,100 (all-time high zone, weekly candle top).

• Support: $114,000 – $115,000 (potential retest zone, IH&S neckline, CME gap)

• EMA 9: Price remains above all major EMAs (10/20/50/100/200 day) – bullish short-term trend

• Candles / Volume / Momentum:

• Confirmed inverted head and shoulders breakout above ~$113,000 neckline

• RSI ~74 suggests overbought; short term pullback possible

• MACD bullish but on chain volumes are cooling, reflecting profit taking

📌 Outlook

– Expect a short-term cooldown/pullback toward $114,000–$115,000 for support testing.

– If support holds and ETF inflows continue, BTC could resume rally toward $130,000–$140,000

💡 Trade Strategy

🟣 SELL BTC/USD upon break below $117,000–$118,000 during retrace

🎯 TP: $115,000

❌ SL: $118,500

🟢 BUY BTC/USD at support $114,000–$115,000

🎯 TP: $120,000 – $123,000

❌ SL: $113,000

#CPIWatch #AltcoinSeasonLoading #BTCWhaleTracker #BTC120kVs125kToday #USCryptoWeek